Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

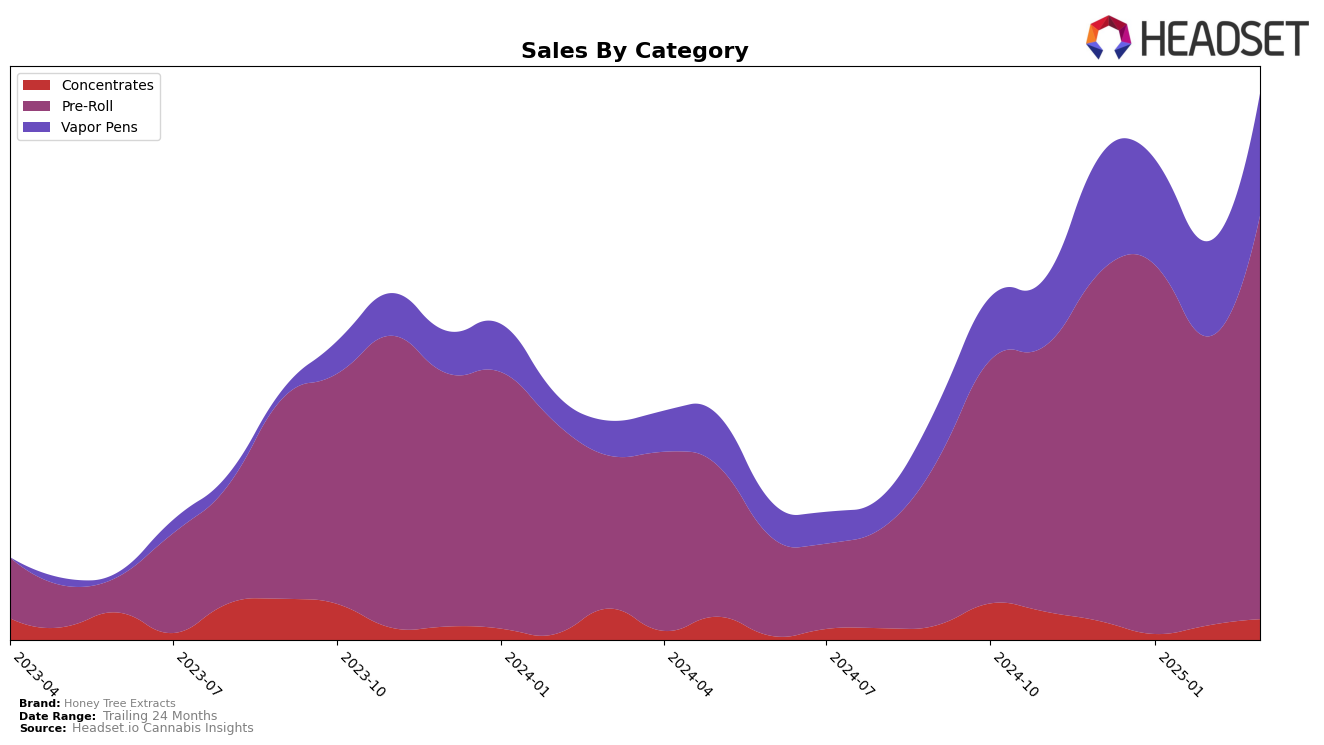

Honey Tree Extracts has shown varied performance across different product categories in Washington. In the Concentrates category, the brand has not yet broken into the top 30, with rankings hovering around the 80s and 90s, indicating room for growth. However, the Pre-Roll category tells a different story, with Honey Tree Extracts consistently ranking in the top 30, peaking at 22nd in March 2025. This suggests a stronger foothold in the Pre-Roll market compared to Concentrates. The Vapor Pens category also shows promise, with a steady climb from 75th in January 2025 to 69th in March 2025, indicating a slow but positive trend.

The sales figures for Honey Tree Extracts in Washington further highlight these trends. While Concentrates sales have fluctuated, they show an upward trend from January to March 2025. Pre-Roll sales, on the other hand, have consistently been strong, with a notable increase in March 2025, suggesting successful market penetration and consumer preference. Vapor Pens have also seen a rise in sales, particularly in March 2025, which is reflected in their improved rankings. The brand's varied performance across categories suggests strategic opportunities for growth in Concentrates and further consolidation in the Pre-Roll and Vapor Pens markets.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll market, Honey Tree Extracts has experienced notable fluctuations in its rank over the past few months, reflecting a dynamic market position. Starting from December 2024, Honey Tree Extracts was ranked 28th, improving to 23rd in January 2025, then dropping to 30th in February, before climbing back to 22nd in March. This variability indicates a competitive market where brands like Artizen Cannabis and Redbird (formerly The Virginia Company) have maintained more stable positions, with Redbird consistently ranking in the top 20. Despite these fluctuations, Honey Tree Extracts' sales have shown resilience, with a significant increase in March, suggesting a potential recovery or strategic adjustment. Meanwhile, Falcanna and Seattle's Private Reserve have also been strong contenders, with Falcanna generally maintaining a higher rank. These insights highlight the competitive pressures and opportunities for Honey Tree Extracts to leverage its recent sales momentum to improve its market position further.

Notable Products

In March 2025, Honey Tree Extracts' top-performing product was Honey Stixx - Purple Planet x Grape Ape Crystal Infused Pre-Roll 2-Pack (1g), which ascended to the number one rank with sales of $1,531. Honey Stixx - Golden Pineapple Infused Pre-Roll (0.75g) maintained its position at rank two, showing consistent performance from February. Honey Stixx - Pineapple Express x Maui Wowie Infused Pre-Roll 2-Pack (1g) held steady at rank three, indicating stable demand. Grape Krush Infused Pre-Roll (0.75g) emerged at rank four, while Huckleberry OG Infused Pre-Roll (0.75g) dropped slightly to rank five from its previous fourth position. The rankings reveal a strong preference for infused pre-rolls, with notable improvements in sales figures compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.