Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

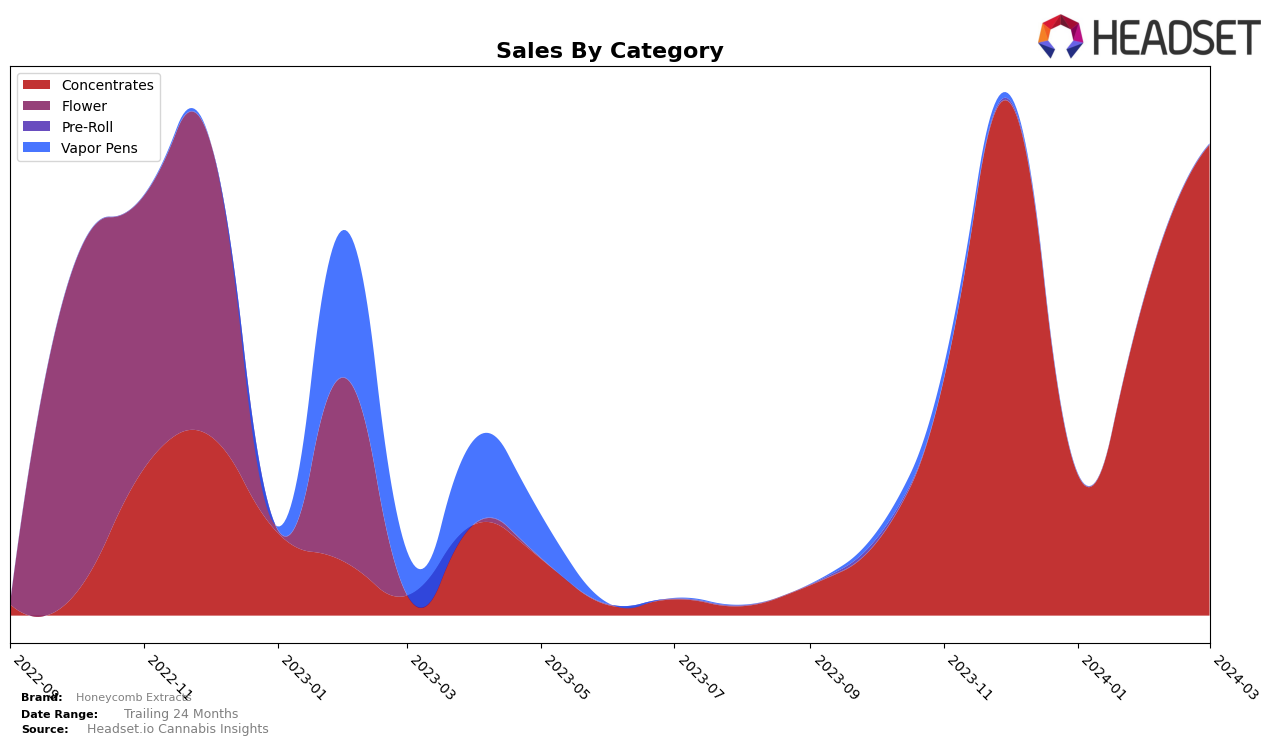

In the competitive cannabis concentrates category in Michigan, Honeycomb Extracts has experienced a notable fluctuation in its rankings over the recent months. Starting at a strong position of 23rd in December 2023, the brand faced a significant drop to 64th place in January 2024, which is a clear indicator of either a strategic misstep or an operational challenge, as they were not within the top 30 brands for that month. However, this setback was followed by a positive trend with an improvement to 37th in February and further to 29th in March 2024. This recovery suggests a resilience in Honeycomb Extracts' market strategy or perhaps an adjustment in their product offerings or marketing efforts. Their sales in December 2023 were notably higher at $196,329, which might have contributed to their initial strong ranking, but the drastic fall in January to $53,705 indicates a significant market challenge that they seem to be overcoming gradually.

While the detailed performance of Honeycomb Extracts in other states or categories is not provided, the data from Michigan's concentrates market offers valuable insights into the brand's market dynamics. The initial high ranking and subsequent drop, followed by a recovery, could imply several underlying factors such as inventory issues, pricing strategies, consumer preferences shifts, or increased competition. For stakeholders and potential investors, these movements highlight the importance of agility and responsiveness in the cannabis industry. Although Honeycomb Extracts faced a tough period in January 2024, their ability to climb back up in the rankings demonstrates potential resilience and adaptability. Such trends are crucial for understanding the brand's position and strategy in the competitive cannabis market, yet they only scratch the surface of the brand's overall performance and strategic direction.

Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Honeycomb Extracts has experienced notable fluctuations in its market position. Initially not ranking within the top 20 in December 2023, Honeycomb Extracts saw a significant drop in rank by January 2024 but managed to improve its standing in the following months, reaching 29th by March 2024. Competitors such as Element and Big Gas Extracts have shown more stability and, in some cases, improvement in their rankings, with Big Gas Extracts notably entering the rankings directly at 27th place by March 2024. Rollganic and Distro 10 also demonstrate significant competitive movements, with Distro 10 achieving a higher rank in February 2024 before dropping slightly. These dynamics suggest a highly competitive market where Honeycomb Extracts faces challenges in maintaining a consistent upward trajectory amidst fluctuating sales and the aggressive positioning of its competitors.

Notable Products

In March 2024, Honeycomb Extracts saw Georgia Melonz Cured Resin (1g) leading the sales chart among their concentrates with an impressive figure of 3963 units sold, marking it as the top-performing product. Following closely, Zack's Cake Live Resin (1g) secured the second position with a sales volume just shy of the leader, demonstrating strong consumer demand. The third spot was claimed by Super Buff Cherry #26 Cured Resin (1g), which was previously the top seller in February 2024, indicating a slight dip in its popularity. Purple Johnson Live Resin (1g) and Jealous Live Resin (1g) rounded out the top five, showing a consistent preference for live resin products among consumers. This ranking highlights a dynamic shift in consumer preferences within Honeycomb Extracts' product lineup, showcasing the competitive nature of the concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.