Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

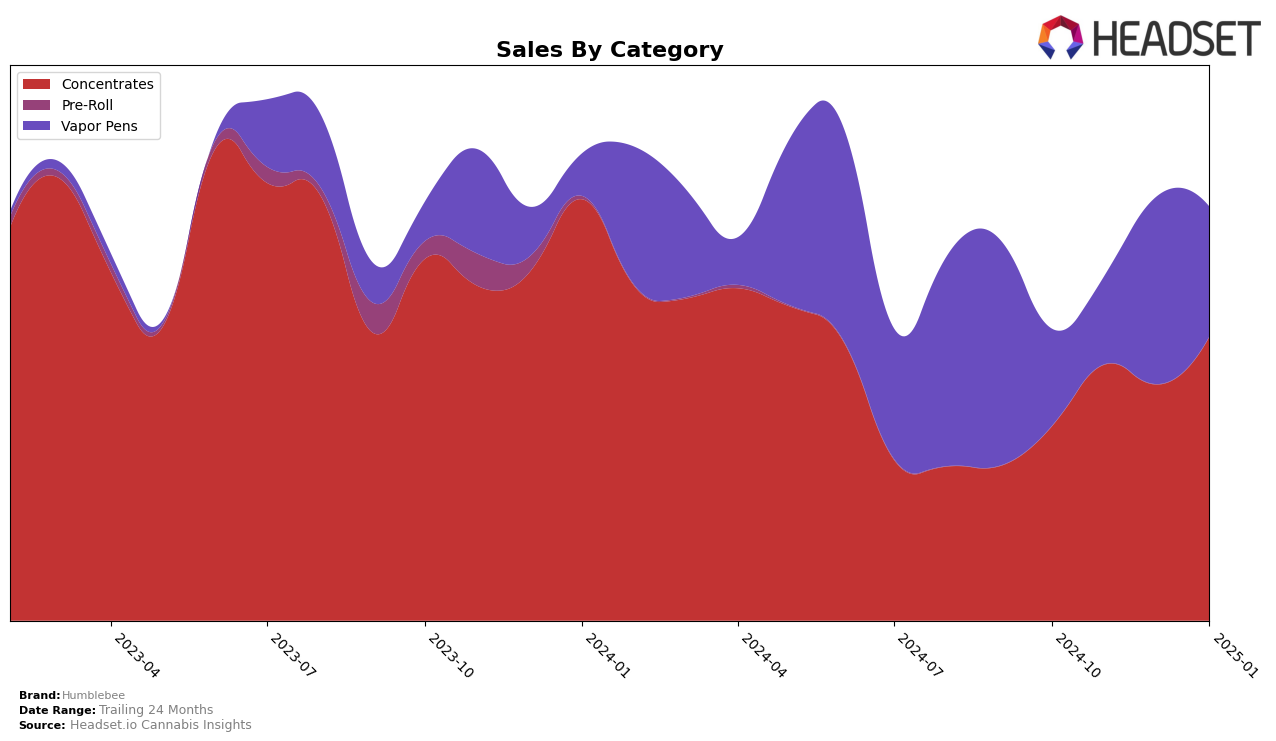

Humblebee has shown significant progress in the Michigan concentrates category over recent months. Beginning in October 2024, Humblebee was ranked 35th, but by January 2025, they had climbed to the 23rd position. This upward trajectory is indicative of their growing presence and popularity in the concentrates market, supported by a steady increase in sales from $129,192 in October to $189,010 in January. The consistent improvement in rankings suggests that Humblebee is making strategic moves to enhance their market share in this category, although they were not initially in the top 30, highlighting the significance of their recent progress.

In contrast, Humblebee's performance in the vapor pens category in Michigan has been more volatile. Despite a jump from 96th place in October 2024 to 62nd in December, the brand experienced a slight decline to 72nd by January 2025. This fluctuation in rankings, coupled with the sales trend, which peaked in December, indicates challenges in maintaining a stable foothold within the top tiers of this category. The brand was not in the top 30 rankings at any point during this period, which signals potential areas for growth and improvement. Understanding the dynamics behind these shifts could provide valuable insights into market demands and consumer preferences.

Competitive Landscape

In the Michigan concentrates market, Humblebee has shown a notable upward trajectory in its rankings from October 2024 to January 2025, improving from 35th to 23rd place. This positive trend in rank is mirrored by a consistent increase in sales, culminating in January 2025 where Humblebee surpassed Cloud Cover (C3) and Gas Station, both of which have experienced more volatile rankings and sales figures. Meanwhile, GreenCo Ventures maintains a strong position, consistently ranking higher than Humblebee, though its sales have shown a slight decline from November to January. Canna Bee Extracts presents a close competition, with a similar rank trajectory but slightly higher sales in January. Humblebee's ability to climb the ranks amidst such competitive brands indicates a strengthening market presence and suggests potential for further growth in the Michigan concentrates category.

Notable Products

In January 2025, Golosa Live Resin (1g) emerged as the top-performing product for Humblebee, leading the Concentrates category with a notable sales figure of 988 units. Critical Sensi Star Live Resin (1g), Death Trap Live Resin (1g), Ghost Train Haze Live Resin (1g), and Shiskaberry Live Resin (1g) all shared the second rank, each recording sales of 957 units. These rankings demonstrate a consistent performance in the Concentrates category, as these products were not ranked in previous months, indicating a significant surge in popularity or availability. The strong showing of Golosa Live Resin (1g) highlights a clear preference among consumers, possibly driven by a unique product feature or a successful marketing strategy. Overall, the January 2025 sales data reveals a concentrated demand for Humblebee's live resin offerings, with little variation in sales figures among the top contenders.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.