Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

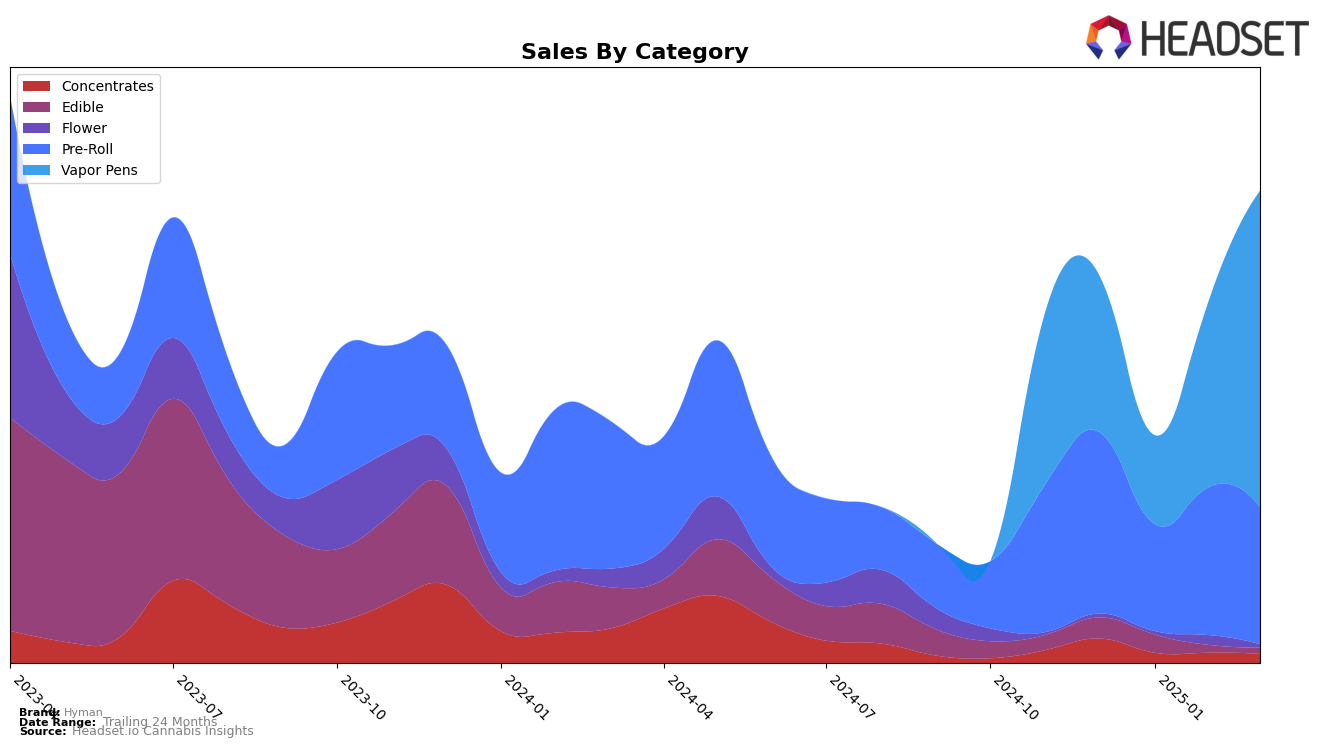

In the state of Michigan, Hyman has shown varied performance across different product categories. Notably, in the Pre-Roll category, Hyman's ranking experienced fluctuations, starting at 51st place in December 2024, dropping to 71st in January 2025, and then climbing back to 49th in February before settling at 57th in March. This volatility indicates potential market challenges or shifts in consumer preferences. Conversely, the Vapor Pens category demonstrated a positive trajectory, with Hyman improving its position from 54th in December to an impressive 28th by March 2025, suggesting strong consumer acceptance or effective marketing strategies in this segment.

In other categories, Hyman's performance in Concentrates and Edibles in Michigan is less prominent. For Concentrates, the absence of a ranking in the top 30 from January onwards may signify a need for strategic adjustments or increased competition in that category. Similarly, in the Edible category, Hyman maintained a position just outside the top 80, with a slight improvement from 87th in December to 86th in January, but not breaking into the top 30 in subsequent months. This could highlight potential growth areas for the brand, as they continue to navigate the competitive landscape of Michigan's cannabis market.

Competitive Landscape

In the competitive landscape of vapor pens in Michigan, Hyman has demonstrated a notable upward trajectory in recent months. Starting from a rank of 54 in December 2024, Hyman surged to an impressive 28 by March 2025, indicating a significant improvement in market position. This upward movement is particularly striking when compared to competitors such as Bloom and North Cannabis Co., both of which have consistently ranked outside the top 20. Although Mac Oils also improved its rank to 27 in March 2025, Hyman's leap from 75 in January to 28 in March suggests a more dynamic growth pattern. Meanwhile, Fly experienced a decline, dropping to 30 in March from a consistent rank of 24 in previous months. Hyman's sales have shown a positive trend, particularly in March 2025, where they surpassed those of Bloom and North Cannabis Co., highlighting Hyman's growing consumer appeal and market share in the Michigan vapor pen category.

Notable Products

In March 2025, the top-performing product from Hyman was the Big League Runtz Live Resin Stylus Disposable (1g) in the Vapor Pens category, reclaiming its top spot from January with a notable sales figure of 1700 units. The Kelly Kapowski Live Resin Disposable (1g) maintained its consistent performance, holding steady at the second rank for two consecutive months. The Sosa Sherb Live Resin Disposable (1g) made a significant leap to third place after being unranked in February. Meanwhile, the Jackknife Live Resin Stylus Disposable (1g) slipped slightly to fourth position after previously ranking first in December 2024. Lastly, the Sosa Sherb x Rainbow Sherb Live Resin Stylus Disposable (1g) entered the rankings in fifth place, indicating a strong debut.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.