Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

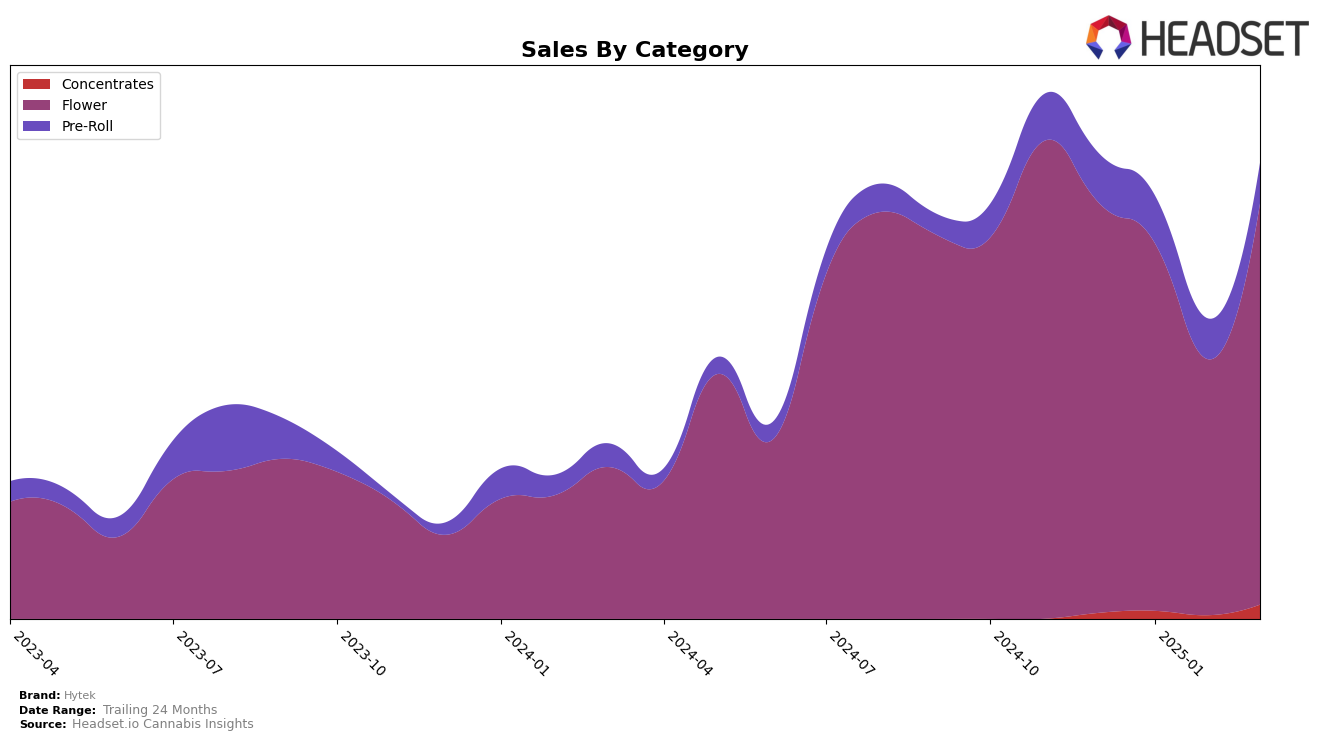

Hytek's performance in the Michigan market demonstrates a varied trajectory across different product categories. In the flower category, Hytek consistently maintained a presence within the top 30 brands, though its ranking fluctuated slightly. Starting at 18th in December 2024, it dipped to 30th by February 2025 before rebounding to 19th in March 2025, showcasing resilience and adaptability in a competitive market. In contrast, Hytek's absence from the top 30 in the concentrates category suggests a potential area for growth or a need for strategic reevaluation, as it did not rank in this segment during the first quarter of 2025.

In the pre-roll category within Michigan, Hytek's ranking experienced minor fluctuations, starting at 56th in December 2024, improving to 49th in January 2025, and then seeing a decline to 60th by March 2025. This indicates a challenging competitive landscape, where maintaining a stable position requires continuous innovation and market engagement. Despite these challenges, the brand's ability to remain within the top 60 suggests a level of market penetration that could be leveraged for future growth. The sales trends across these categories provide a nuanced picture of Hytek's market positioning and potential opportunities for strategic adjustments.

Competitive Landscape

In the competitive landscape of the Michigan flower market, Hytek has experienced notable fluctuations in its rank and sales over the past few months. Starting from December 2024, Hytek was ranked 18th, but it saw a dip to 30th in February 2025 before recovering to 19th in March 2025. This volatility suggests challenges in maintaining consistent market presence, possibly due to competitive pressures or market dynamics. In contrast, Six Labs improved its position from being outside the top 20 to securing the 17th spot by February 2025, indicating a positive sales trajectory. Meanwhile, Glorious Cannabis Co. experienced a gradual decline, moving from 15th to 20th, which might have opened opportunities for Hytek's slight recovery in March. Additionally, Everyday Cannabis (MI) and Galactic have shown varying trends, with Galactic dropping from 10th to 21st by March, which could further influence Hytek's competitive strategies. Overall, Hytek's fluctuating rank highlights the need for strategic adjustments to stabilize and enhance its market position amidst dynamic competition.

Notable Products

In March 2025, Los Muertos #10 (Bulk) from the Flower category claimed the top spot among Hytek products. Motor Breath 15 Pre-Roll (1g) significantly improved its standing, rising from fourth place in February to second place in March, with a notable sales figure of 4264 units. Flawlezz Pre-Roll (1g) secured the third position, maintaining its debut rank. Waffle Cone (3.5g) remained consistent, holding the fourth rank as it did in January. Black Sherblato Pre-Roll (1g) saw a decline, dropping from third place in February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.