Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

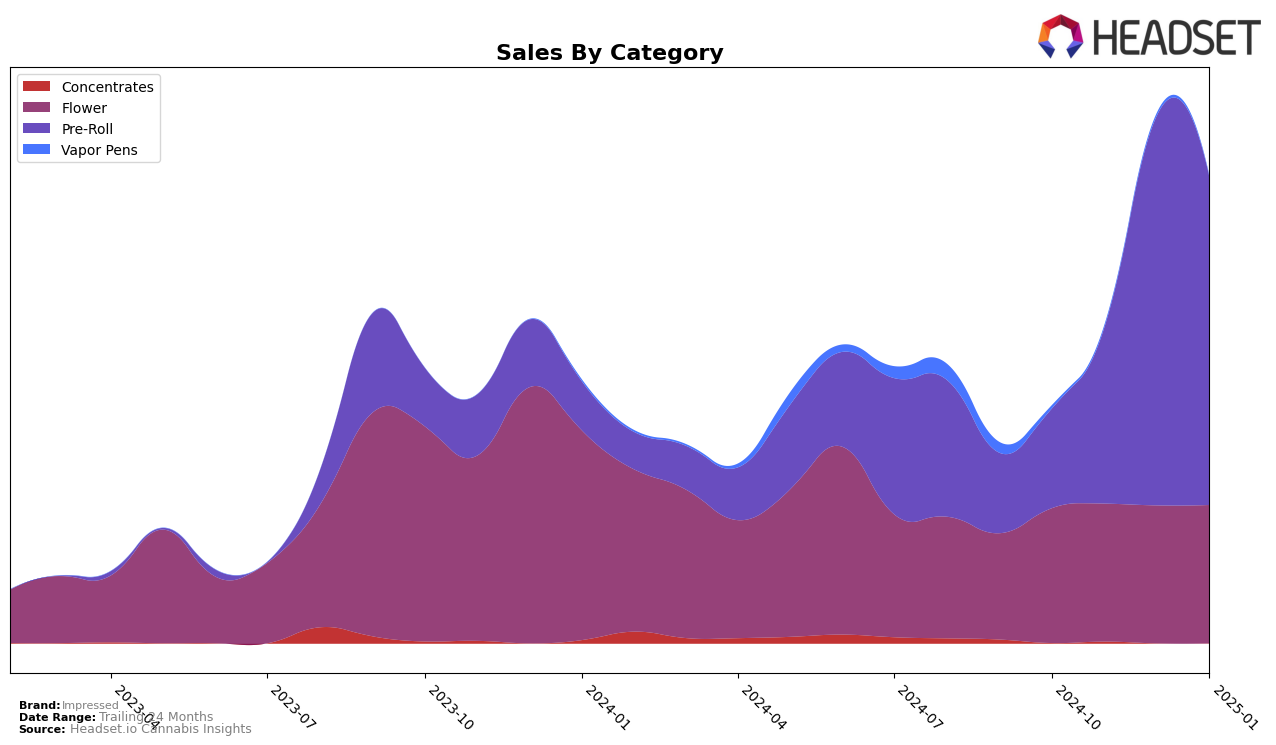

Impressed has shown interesting dynamics in the Massachusetts market, particularly in the Pre-Roll category. Over the span from October 2024 to January 2025, Impressed made a remarkable ascent in the Pre-Roll rankings, moving from 60th to 16th place. This upward trend is indicative of a strong market presence and growing consumer preference. However, in the Flower category, Impressed has not managed to break into the top 30 rankings, consistently hovering in the mid-60s over the same period. This suggests that while Impressed is gaining traction in Pre-Rolls, it faces challenges in the more competitive Flower category in Massachusetts.

The sales figures further highlight these trends, with Pre-Roll sales witnessing a substantial increase, particularly from November to December 2024. Despite this, the Flower category sales have remained relatively stagnant, indicating potential areas for strategic improvement. The lack of top 30 placement in the Flower category could be seen as a missed opportunity, especially given the brand's success in Pre-Rolls. This dichotomy suggests that Impressed may want to explore different strategies or product offerings to enhance its performance in the Flower category within Massachusetts.

Competitive Landscape

In the Massachusetts Pre-Roll category, Impressed has demonstrated a remarkable upward trajectory in brand ranking over the past few months. Starting from a rank of 60 in October 2024, Impressed has climbed to 16 by January 2025, indicating a significant improvement in market presence and consumer preference. This ascent is noteworthy when compared to competitors like Shaka Cannabis Company, which fluctuated between ranks 17 and 21, and Happy Valley, which experienced a decline from rank 7 to 14. Meanwhile, Fathom Cannabis maintained a more stable position, hovering around rank 15. Despite Green Gold Group showing some consistency, Impressed's rapid rise in ranking suggests a strong competitive edge and potential for increased sales momentum in the coming months.

Notable Products

In January 2025, the top-performing product from Impressed was Truffle Cake Pre-Roll (1g), reclaiming its position as the best-seller with notable sales of 13,468 units. Apples & Bananas Pre-Roll (1g) maintained its strong performance, holding steady at the second rank despite a slight decrease in sales compared to December 2024. Zombie Kush Pre-Roll (1g) made a significant leap to the third position, marking its first appearance in the top ranks since October 2024. K Dynamite Pre-Roll (1g) entered the top five for the first time, securing the fourth spot. Ice Cream Cake Pre-Roll (1g), which previously held the top spot in December 2024, fell to fifth place in January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.