Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

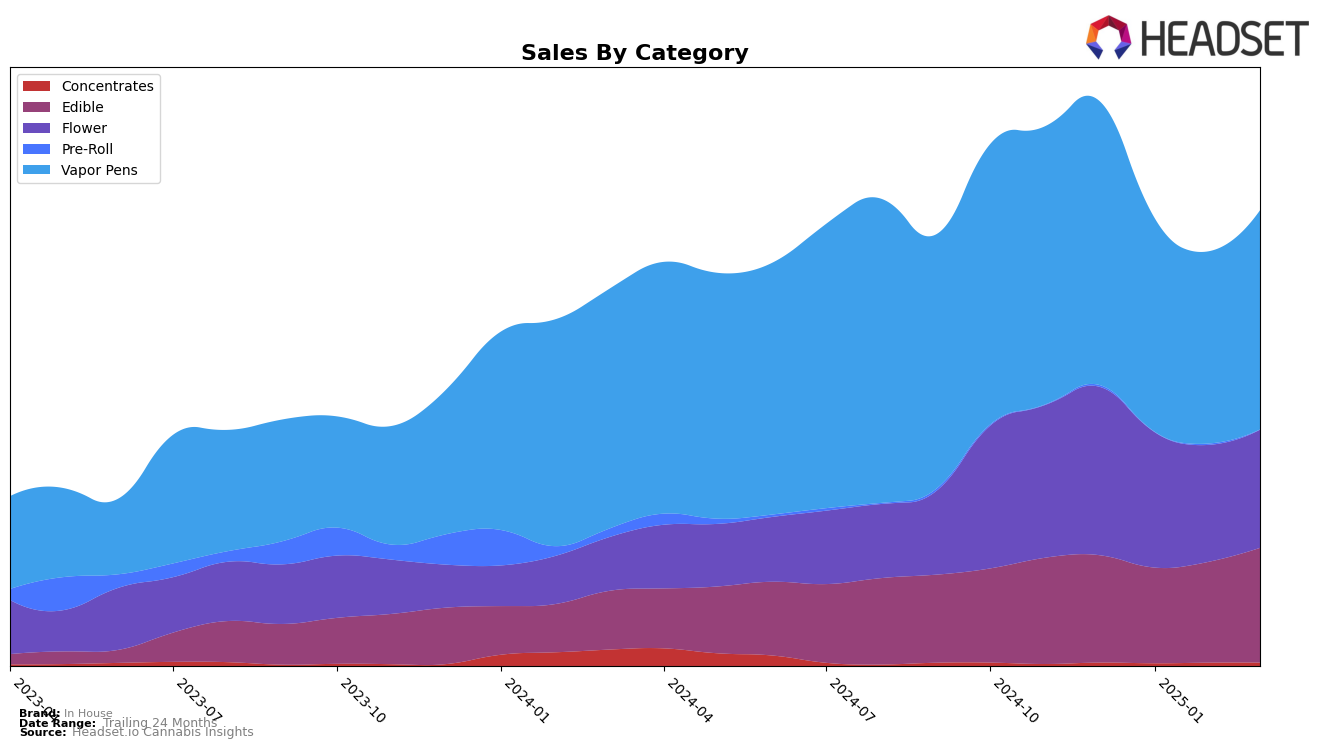

In the state of Illinois, In House has shown varied performance across different product categories. The brand maintained a steady presence in the Vapor Pens category, consistently holding the 11th position from January through March 2025, indicating a stable consumer base for this product. However, in the Edible category, In House saw a slight decline, dropping from the 28th position in February to falling out of the top 30 by March. This could suggest a need for strategic adjustments in their edible offerings. In the Flower category, the brand experienced a notable drop from 20th in December 2024 to 34th by March 2025, highlighting a challenging market environment or increased competition in this segment.

In contrast, In House's performance in Massachusetts presents a more positive trajectory. The brand improved its ranking in the Edible category, moving from 15th in December 2024 to 11th by March 2025, reflecting growing consumer interest. The Flower category saw fluctuations, with a dip to 22nd in February but a recovery to 16th in March, suggesting potential volatility or seasonal preferences affecting sales. Meanwhile, in Maryland, In House maintained strong positions in both Edible and Vapor Pens, consistently ranking in the top 7, which indicates a strong market presence and consumer loyalty. However, their Flower category performance remains outside the top 30, which could be an area for potential growth and strategic focus.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, In House has maintained a consistent rank of 11th from December 2024 to March 2025, indicating a stable position amidst fluctuating market dynamics. Despite a dip in sales from December 2024 to February 2025, In House's sales rebounded in March 2025, suggesting resilience and potential for growth. Competitors such as AiroPro and Midweek Friday have consistently ranked higher, with AiroPro holding ranks between 6th and 9th, and Midweek Friday maintaining the 10th position throughout the same period. Meanwhile, Simply Herb and Savvy have shown slight improvements, with Simply Herb moving from 15th to 13th and Savvy from 14th to 12th. These shifts highlight the competitive pressures In House faces, emphasizing the need for strategic marketing and product differentiation to climb the ranks and increase sales in the Illinois vapor pen market.

Notable Products

In March 2025, Peach Mango Gummies 10-Pack (100mg) maintained its top position as the best-selling product for In House, with a notable sales figure of 11,136 units. CBD/THC 5:1 Blood Orange Gummies 20-Pack (500mg CBD, 100mg THC) also held steady in second place, following closely behind in sales. Strawberry Fast Acting Gummies 10-Pack (100mg CBD, 100mg THC) climbed to third place, showing an improvement from its fifth position in February. Cherry Lemonade Fast Acting Gummies 10-Pack (100mg) experienced a drop to fourth place from its previous third position. Blueberry Dreams Gummies 10-Pack (150mg CBD, 100mg THC, 50mg CBN) remained consistent in fifth place, maintaining its rank from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.