Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

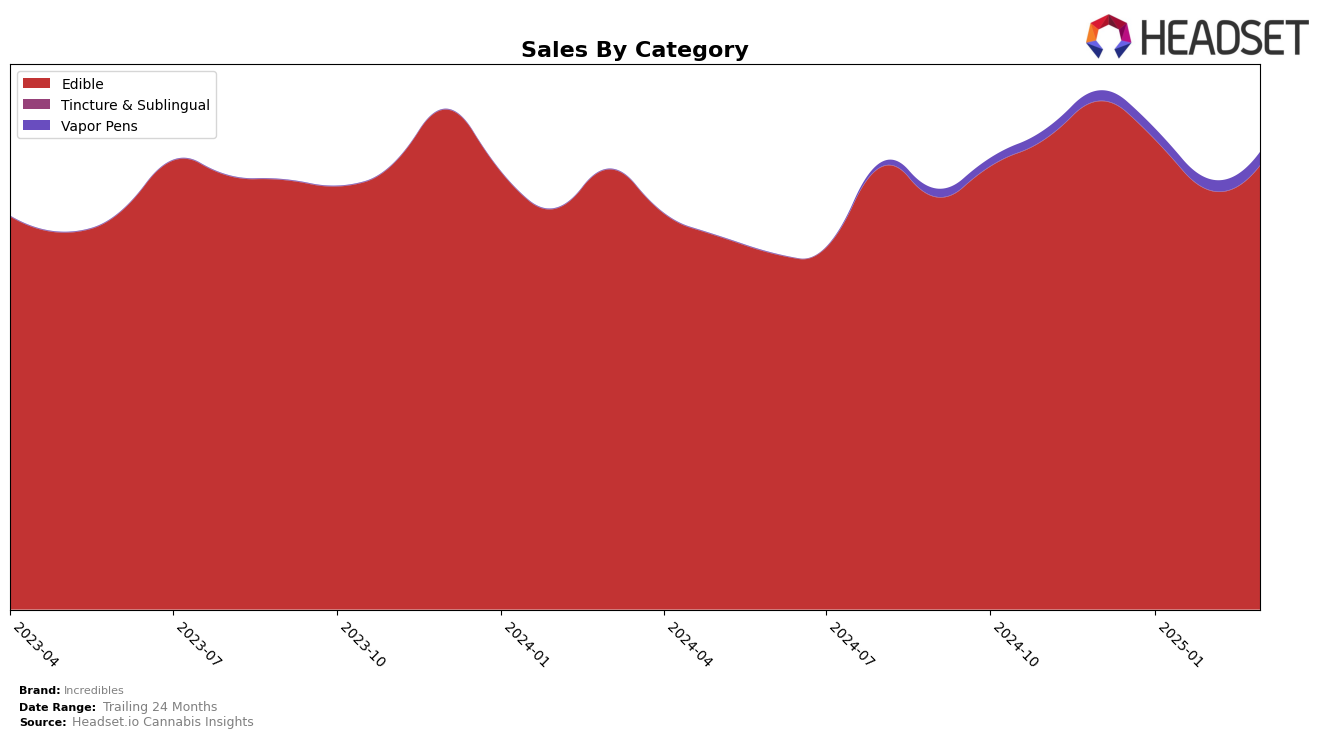

In the competitive landscape of cannabis edibles, Incredibles has maintained a strong presence in several key markets. Notably, in Illinois, the brand has consistently held the top position in the edibles category from December 2024 through March 2025, despite a noticeable decline in sales over this period. Similarly, in Ohio, Incredibles has also secured the number one rank in edibles, indicating a strong market hold. However, in New Jersey, the brand experienced a slight decline, dropping from the 8th position in December 2024 to the 11th by March 2025, which could suggest increasing competition or shifting consumer preferences in that state.

Incredibles has also been active in the vapor pens category, though with less dominance compared to edibles. In Massachusetts, the brand has shown a gradual improvement in its ranking, moving from 40th place in December 2024 to 34th by March 2025. This upward trend, coupled with increasing sales figures, indicates a growing acceptance and potential for expansion in the vapor pens market. Meanwhile, in Colorado, Incredibles maintained a steady position in the edibles category, though it slipped slightly from 8th to 9th place by March 2025, suggesting a need for strategic adjustments to regain its earlier standing. These movements highlight the dynamic nature of the cannabis market and the importance of adaptability for sustained success.

Competitive Landscape

In the competitive landscape of the Illinois edible cannabis market, Incredibles has consistently maintained its top position from December 2024 through March 2025, showcasing its strong brand presence and customer loyalty. Despite a decline in sales over this period, Incredibles has managed to hold its rank, indicating a robust market strategy and product appeal. In contrast, Wana and Wyld have been vying for the second and third positions, with Wana regaining the second spot in March 2025 after a brief dip to third place in January and February. This dynamic suggests that while Incredibles leads, competitors are actively challenging its dominance, potentially influencing future sales strategies and product innovations. The consistent ranking of Incredibles amidst fluctuating sales highlights its resilience and the importance of strategic brand positioning in maintaining market leadership.

Notable Products

In March 2025, the top-performing product for Incredibles was the CBN/CBG/THC 1:1:2 Snoozzzierberry Gummies 10-Pack, which maintained its leading rank from the previous three months, with notable sales of $35,059. The THC/CBN 5:1 Snoozzzeberry Gummies 10-Pack consistently held the second position across the same period. Summer Peach Gummies rose to the third rank, improving from fourth in both December 2024 and February 2025. Greener Apple Gummies slightly dropped to fourth place after being third in January 2025. Mon Cherry Gummies experienced a decline, moving from third in December 2024 to fifth in March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.