Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

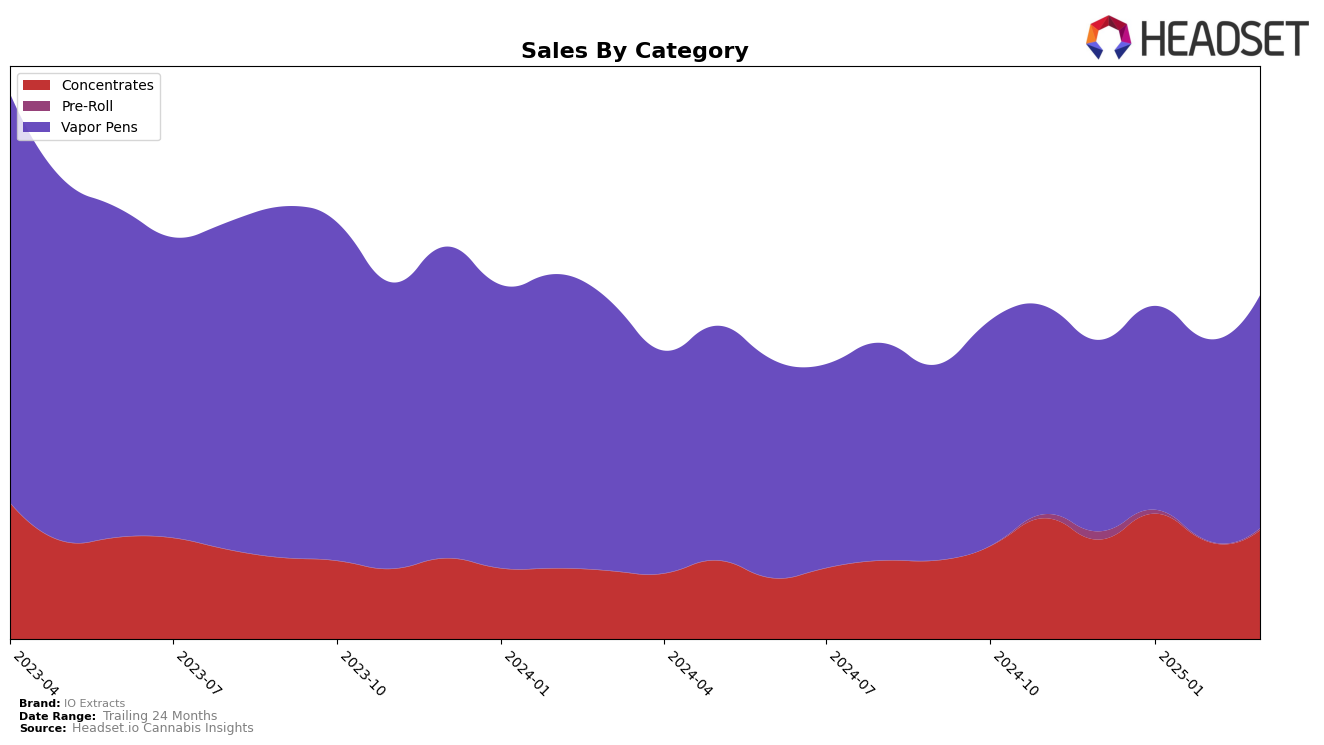

IO Extracts has shown notable performance in the Arizona market, particularly in the Concentrates category. Starting with a rank of 6 in December 2024, the brand improved to rank 3 by January 2025, before experiencing a slight dip to rank 5 in February and regaining some ground to rank 4 in March 2025. This fluctuation suggests a competitive landscape in the Concentrates category, yet IO Extracts remains a significant player. In contrast, their presence in the Pre-Roll category did not make it into the top 30, which could indicate an area for potential growth or a strategic shift in focus. The Vapor Pens category has been relatively stable, with IO Extracts maintaining a top 10 position throughout the analyzed months, highlighting consistent consumer interest and market strength.

While IO Extracts has maintained a strong position in the Concentrates and Vapor Pens categories in Arizona, their absence from the top 30 in the Pre-Roll category is noteworthy. This absence might reflect either a strategic decision to prioritize other categories or a need to enhance their competitive strategies in this segment. The increase in sales from February to March in the Vapor Pens category suggests a positive trend, possibly driven by new product offerings or marketing strategies. As the brand continues to navigate the competitive landscape, these insights could inform future decisions to optimize their market presence across different categories.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, IO Extracts has shown resilience and steady performance despite fierce competition. Over the months from December 2024 to March 2025, IO Extracts maintained a consistent presence, ranking between 10th and 11th place. This stability is notable given the dynamic shifts seen among competitors. For instance, Jeeter consistently outperformed IO Extracts, holding a rank between 7th and 8th, with a significant sales surge in January 2025. Meanwhile, iLava maintained a steady 9th place, indicating a strong foothold in the market. Canamo showed more volatility, fluctuating between 10th and 12th place, suggesting a less stable market position compared to IO Extracts. Despite these challenges, IO Extracts' ability to maintain its rank and increase sales from $525,068 in December 2024 to $639,374 in March 2025 highlights its competitive edge and potential for growth in the Arizona vapor pen market.

Notable Products

In March 2025, IO Extracts saw its Pineapple Express Distillate Cartridge (1g) reclaim the top spot in the Vapor Pens category, with impressive sales reaching 1748 units. The Granddaddy Purple Distillate Cartridge (1g) made a significant leap to second place, up from fifth in both January and February. The Exotic Orange Apricot Distillate Disposable (1g) maintained a steady position at third place, showing consistent demand. Sour Diesel Distillate Cartridge (1g) experienced a drop from second place in February to fourth in March, indicating a shift in consumer preference. Platinum OG Distillate Cartridge (1g) entered the rankings for the first time in March, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.