Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

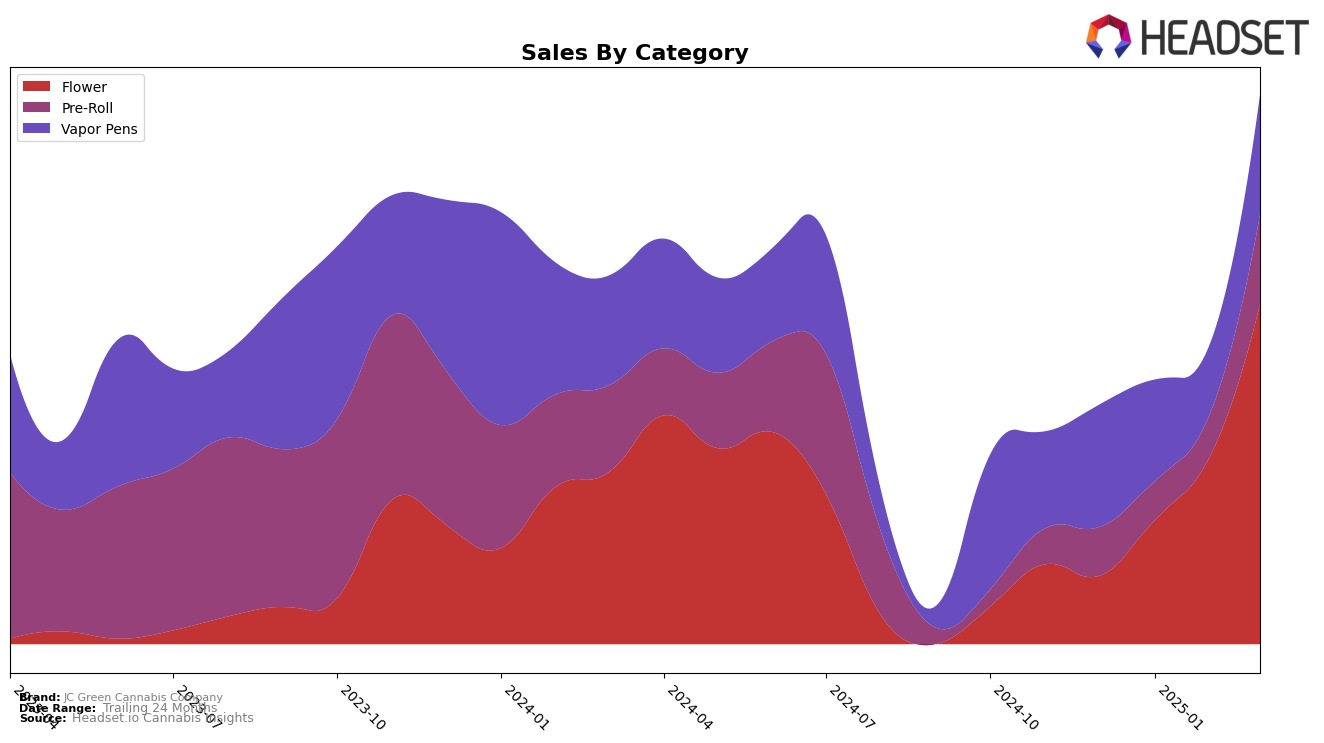

In the province of Saskatchewan, JC Green Cannabis Company has shown a noteworthy upward trajectory in the Flower category. Starting outside the top 30 in December 2024, the brand made a significant leap to rank 22nd in February 2025 and further improved to 9th by March 2025. This impressive climb highlights the brand's growing popularity and market penetration in the Flower category. In contrast, the Pre-Roll category has seen more modest progress, with the brand maintaining a steady presence just outside the top 30, improving from 49th in December 2024 to 37th by March 2025. This suggests a consistent, albeit slower, growth in consumer preference for JC Green's Pre-Roll offerings.

Meanwhile, JC Green Cannabis Company has maintained a stable position in the Vapor Pens category within Saskatchewan. The brand consistently ranked around the 21st and 22nd positions from December 2024 to March 2025, indicating a steady demand for their vapor pen products. Despite the lack of dramatic movement, this consistent ranking suggests a reliable consumer base for JC Green in this category. The sales figures, particularly in the Flower category, hint at a strong upward trend, but the specific details of these sales movements across other categories and potential strategies for sustaining growth remain areas to explore further.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, JC Green Cannabis Company has demonstrated a remarkable upward trajectory from being outside the top 20 in December 2024 to securing the 9th position by March 2025. This significant climb in rank highlights a strategic shift or successful marketing efforts that have resonated well with consumers. In contrast, competitors like MTL Cannabis and Big Bag O' Buds have maintained relatively stable positions, with MTL Cannabis consistently ranking in the top 10, although experiencing a slight dip to 9th in February 2025. Meanwhile, Space Race Cannabis saw a notable drop to 19th in February before recovering to 8th in March, indicating potential volatility in their sales performance. Divvy experienced fluctuations, missing the top 20 in January but rebounding to 12th by March. JC Green's rise in rank suggests a positive reception in the market, potentially driven by innovative product offerings or effective consumer engagement strategies, positioning them as a formidable contender in the Saskatchewan Flower market.

Notable Products

In March 2025, the top-performing product for JC Green Cannabis Company was Cherry Bomb (7g) in the Flower category, which ascended to the number one rank with notable sales of 1535 units. Cherry Bomb (3.5g), also in the Flower category, dropped to the second position after leading in previous months. Reefers - Indiana Bubblegum Pre-Roll 3-Pack (1.5g) made a significant leap to third place from being unranked in February. Cherry Bomb Pre-Roll 10-Pack (5g) entered the rankings at fourth place, indicating growing consumer interest in pre-rolls. Cherry Bomb Distillate Cartridge (1g) in the Vapor Pens category remained consistent, securing the fifth spot, showing a slight increase from February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.