Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

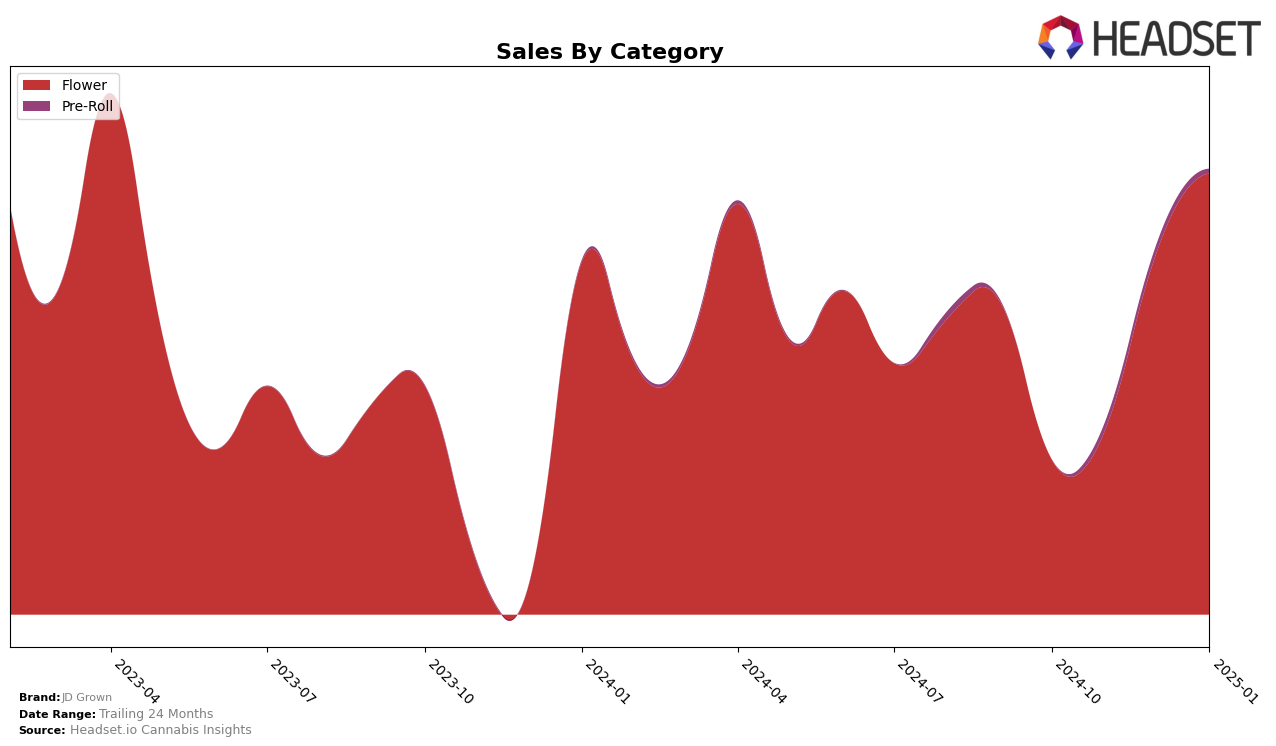

JD Grown has shown a notable upward trajectory in the Oregon market, particularly in the Flower category. Starting from a rank of 89 in October 2024, the brand climbed to the 30th position by January 2025. This significant improvement is indicative of a strong market presence and growing consumer preference. The sales figures corroborate this trend, with a substantial increase from October to January, highlighting effective brand strategies or perhaps a favorable market response to their products. Such a leap in rankings suggests that JD Grown is making strategic moves to capture a larger share of the Flower category in Oregon.

However, it's important to note that JD Grown's performance in other states or categories is not reflected in the top 30 rankings, which might suggest a focused strategy on Oregon or specific challenges in expanding their footprint elsewhere. This absence in other markets could be seen as a potential area for growth or a reflection of competitive pressures in those regions. Understanding the dynamics in Oregon could provide insights into JD Grown's strategies and potential for replication in other markets. Observing how they leverage their strengths in the Flower category could be crucial for their future expansion plans.

Competitive Landscape

In the competitive landscape of the Oregon flower category, JD Grown has demonstrated a notable upward trajectory in its market positioning. Starting from a rank of 89 in October 2024, JD Grown has climbed to 30 by January 2025, indicating a significant improvement in its competitive standing. This upward movement is in contrast to Chalice Farms, which experienced a decline from rank 4 to 37 over the same period, suggesting potential market share opportunities for JD Grown. Meanwhile, Virgin Cannabis and Excolo have shown fluctuating ranks, with Virgin Cannabis improving from 44 to 29, while Excolo moved from 25 to 28, indicating a competitive but volatile market environment. JD Grown's consistent sales growth, especially between December 2024 and January 2025, further underscores its strengthening market presence, making it a brand to watch in the Oregon flower market.

Notable Products

In January 2025, Island Cookies (Bulk) from JD Grown maintained its top position in the Flower category, with impressive sales of 6724 units, marking a consistent rise from its previous rankings in late 2024. Cheetoz (Bulk) emerged as a strong contender, securing second place without prior rankings, showcasing its growing popularity. 8* Bagel (1g) climbed to the third position from fifth in December 2024, indicating a significant increase in consumer interest. Killer Beez (Bulk) experienced a decline, dropping to fourth place from its peak position in November 2024. Lastly, Double Stuffed (Bulk) entered the top five for the first time, taking the fifth spot, reflecting a positive reception in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.