Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

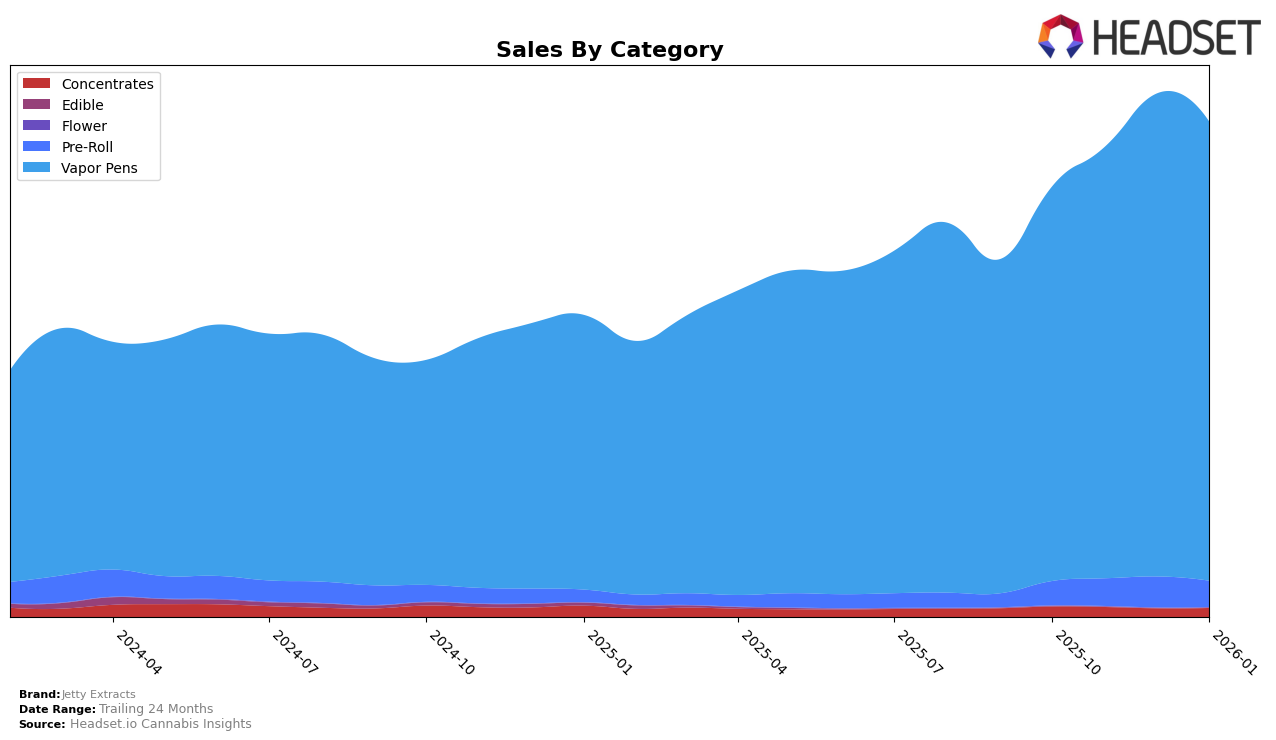

Jetty Extracts has shown a varied performance across different categories and states, with significant movements in rankings. In California, the brand has maintained a steady presence in the vapor pen category, holding the third position consistently from November 2025 through January 2026. This stability indicates a strong foothold in a competitive market. However, in the pre-roll category, Jetty Extracts barely made it into the top 30 by January 2026, suggesting potential challenges or opportunities for growth in that segment. Their pre-roll sales in California peaked in December 2025 but saw a slight decline in January 2026, which could be an area of concern or a target for strategic improvement.

In Colorado, Jetty Extracts has demonstrated upward momentum in the vapor pen category, moving from ninth place in October 2025 to a commendable fifth place by January 2026. This upward trend is indicative of growing brand recognition and consumer preference in the state. Conversely, in New York, the brand experienced some fluctuations, peaking at the 12th position in December 2025 before dropping to 14th in January 2026. This suggests a volatile market presence that may require targeted marketing or product adjustments to stabilize and improve their ranking. The absence of Jetty Extracts in the top 30 for other categories or states could either highlight areas where the brand is not yet competitive or where there is potential for future expansion.

Competitive Landscape

In the competitive landscape of vapor pens in California, Jetty Extracts has demonstrated a strong and consistent performance, maintaining its rank at 3rd place from November 2025 through January 2026. This stability in rank is notable, especially when compared to Plug Play, which slipped from 3rd to 4th place in November 2025 and remained there through January 2026. Despite STIIIZY and Raw Garden consistently holding the top two positions, Jetty Extracts has shown a positive sales trajectory, with sales peaking in December 2025. This upward trend in sales, alongside maintaining a top-three rank, suggests a growing consumer preference and brand strength in a competitive market. Meanwhile, CAKE she hits different remains in 5th place, indicating a clear stratification among the top five brands. Jetty Extracts' ability to hold its ground against these competitors highlights its robust market presence and potential for future growth.

Notable Products

In January 2026, the top-performing product for Jetty Extracts was the Pineapple Express Live Resin Cartridge (1g) in the Vapor Pens category, maintaining its number one rank consistently from October 2025 through January 2026, with sales reaching 11,004 units. The Blue Dream Unrefined Live Resin Cartridge (1g) also held steady in second place throughout the same period. The Northern Lights #5 High THC Distillate Cartridge (1g) climbed to third place in November 2025 and has remained there since. Meanwhile, the Maui Wowie Distillate Cartridge (1g) improved its position to fourth in January 2026, having started at fifth place in October 2025. The Granddaddy Purple Distillate Cartridge (1g) saw a slight decline, dropping to fifth place in January 2026 after peaking at third in October 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.