Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

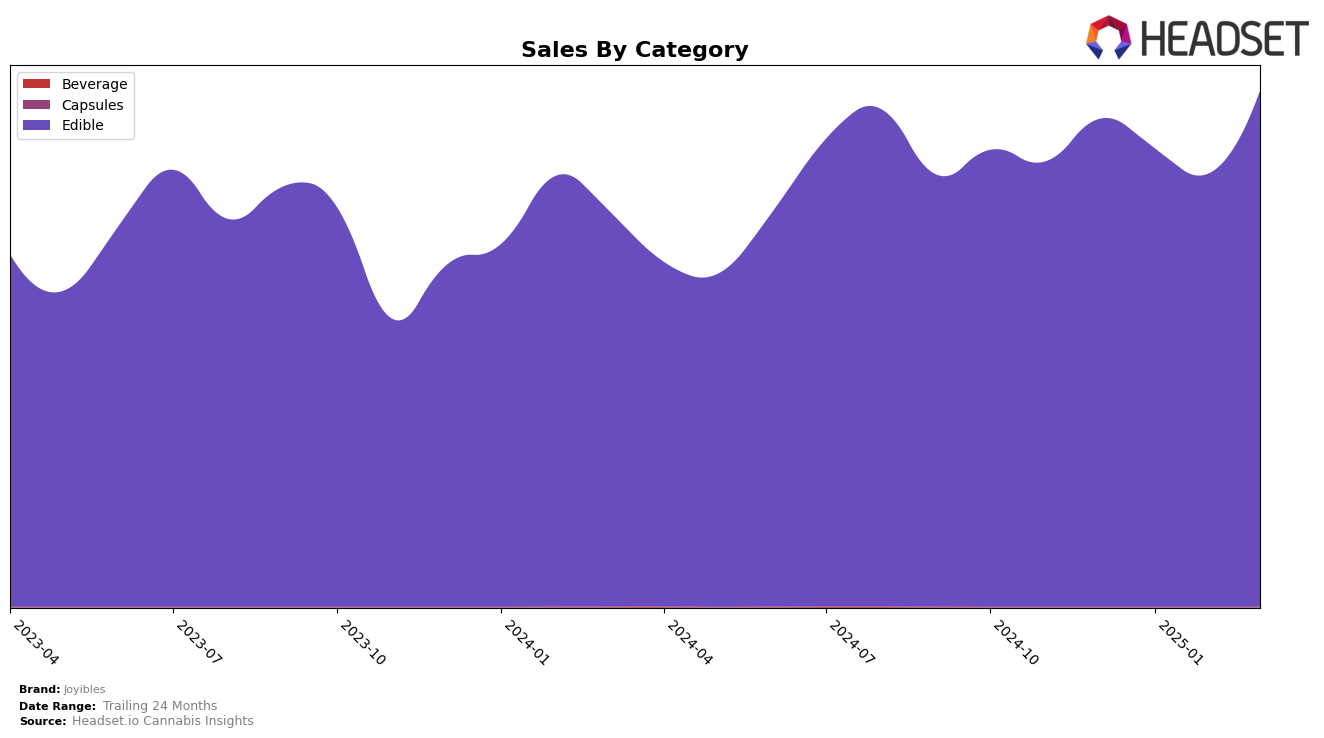

Joyibles has shown a consistent performance in the Colorado edible market, maintaining a steady rank of 7th place from December 2024 through March 2025. This stability is noteworthy, especially considering the fluctuations in sales figures, which peaked at $508,494 in March 2025. In contrast, in Massachusetts, Joyibles has seen slight movements within the lower ranks, shifting between 22nd and 23rd positions over the same period. While the sales figures in Massachusetts are significantly lower than in Colorado, the brand's ability to remain within the top 30 suggests a consistent, albeit modest, presence in the market.

The performance in Oregon paints a different picture, with Joyibles hovering near the bottom of the top 30 edibles brands. Despite a dip to 29th place in January 2025, the brand managed to regain its 26th position by February and maintain it through March. This indicates some resilience in a competitive market, although the sales figures remain relatively low compared to other states. Notably, any absence from the top 30 rankings in any given month would highlight a significant challenge for Joyibles, but their presence in Oregon's rankings suggests they are holding their ground despite the competitive pressures.

Competitive Landscape

In the competitive landscape of the Colorado edibles market, Joyibles has maintained a consistent rank of 7th from December 2024 through March 2025, showcasing stability amidst fluctuating sales figures. While Joyibles' sales saw a notable increase in March 2025, rising to 508,494, it still trails behind competitors such as Tastebudz and Good Tide, which have consistently ranked higher. Good Tide in particular has shown impressive sales growth, leading the category with a steady 5th place rank and a significant sales boost from January to March 2025. Meanwhile, Incredibles and Revel (CO) have experienced rank fluctuations, with Revel (CO) improving its position to 8th in March 2025. This competitive environment suggests that while Joyibles maintains a solid presence, there is potential for growth by analyzing the strategies of higher-ranking brands like Good Tide and Tastebudz.

Notable Products

In March 2025, Joyibles' top-performing product was Joy Bombs - Original Fruit Chews 40-Pack (100mg), maintaining its position as the leading product since December 2024, with impressive sales of 12,392 units. Joybombs - Sour Fruit Chews 40-Pack (100mg) also held steady in second place, showcasing a significant increase in sales compared to February 2025. The Joybomb - CBD/THC 1:1 Sour Cherry Berry Blend Chew 40-Pack (100mg CBD, 100mg THC) remained consistent in third place, with a notable sales rise from the previous month. Joybombs - Tropical Haze Fruit Chews 40-Pack (100mg) continued to secure the fourth position, despite a slight sales increase. The Joybomb - CBN:THC 1:1 Dream Blend Chew 40-Pack (100mg CBN, 100mg THC) stayed in fifth place, with sales figures showing a minor fluctuation over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.