Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

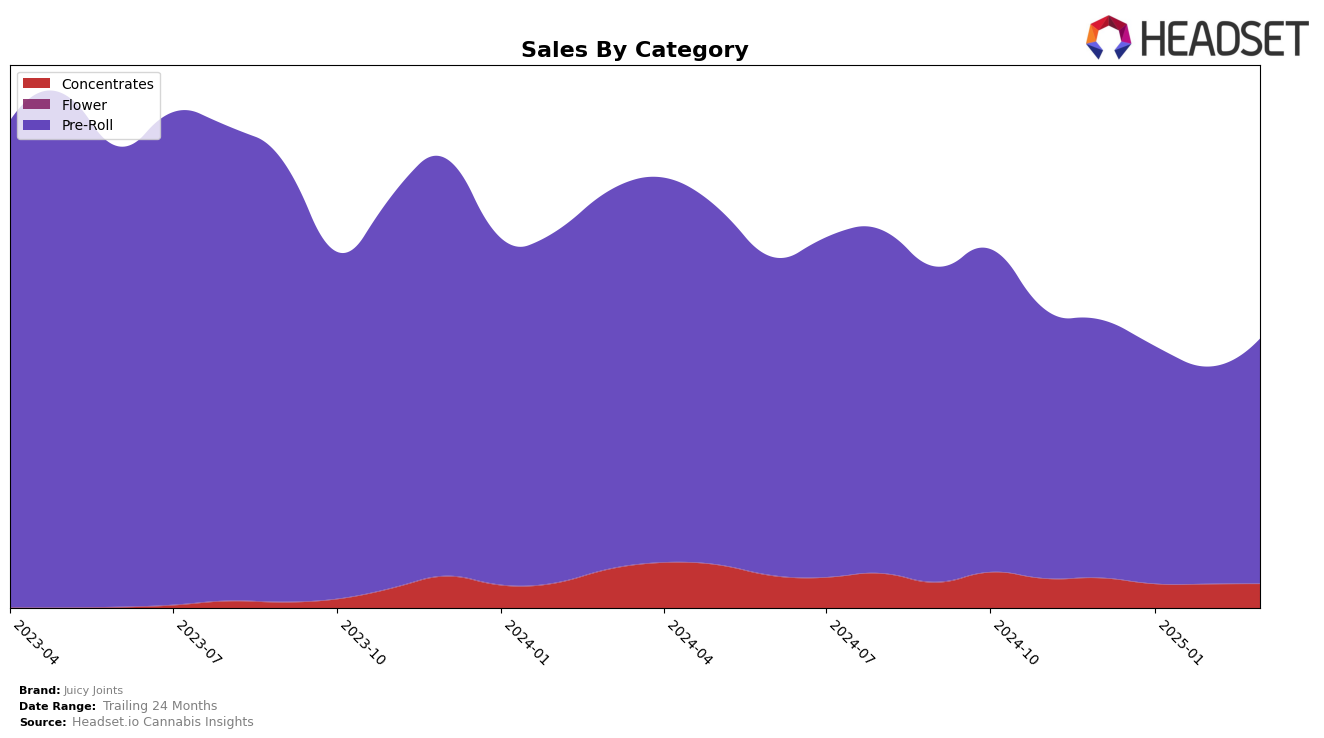

Juicy Joints' performance in the Washington market shows varied results across different product categories. In the Concentrates category, Juicy Joints did not make it into the top 30 brands, with rankings fluctuating slightly from 66th in December 2024 to 68th in March 2025. This consistent positioning outside the top tier suggests challenges in gaining traction or maintaining a competitive edge in this segment. However, the sales figures remained relatively stable, indicating a steady, albeit limited, customer base. This performance might reflect either a niche appeal or the need for strategic adjustments to climb higher in the rankings.

In contrast, Juicy Joints exhibits a stronger presence in the Pre-Roll category within Washington. The brand maintained a solid position within the top 15, ranking 13th in December 2024 and slightly dropping to 15th by March 2025. Despite this minor decline in ranking, the sales figures reveal a recovery in March after a dip in February, suggesting resilience and potential for growth. This trend indicates that Juicy Joints has a more robust foothold in the Pre-Roll market, which could be leveraged to further enhance their market position and explore opportunities for expansion.

Competitive Landscape

In the competitive landscape of the Washington pre-roll category, Juicy Joints has experienced fluctuating ranks, moving from 13th in December 2024 to 15th by March 2025. This shift is indicative of a dynamic market where brands like Captain Yeti have shown notable improvement, climbing from 19th to 14th place over the same period. Meanwhile, Legit (WA) maintained a stronger position, although it slipped slightly from 11th to 13th. Juicy Joints' sales figures reveal a slight dip in early 2025, but a recovery by March, aligning with its rank stabilization. The presence of Forbidden Farms and 1988 in the rankings further highlights the competitive pressure Juicy Joints faces, as these brands consistently hover around the mid-teens. As Juicy Joints navigates this competitive environment, understanding these trends and their impact on market positioning is crucial for strategic planning and growth.

Notable Products

In March 2025, the top-performing product from Juicy Joints was Seattle Berry Infused Pre-Roll (0.8g) in the Pre-Roll category, maintaining its number one rank for four consecutive months with sales of 5803 units. Blue Raspberry Flavored Infused Pre-Roll (0.8g) held steady in second place, showing consistent performance from the previous month. Mango Infused Pre-Roll (0.8g) retained its third position, following a rise from fifth place in January. Blueberry Creamsicle Infused Pre-Roll (0.8g) experienced a slight improvement, climbing to fourth place after dropping to fifth in February. The Grape Infused Pre-Roll (0.8g) entered the rankings in March at fifth place, marking its first appearance in the top five this year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.