Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

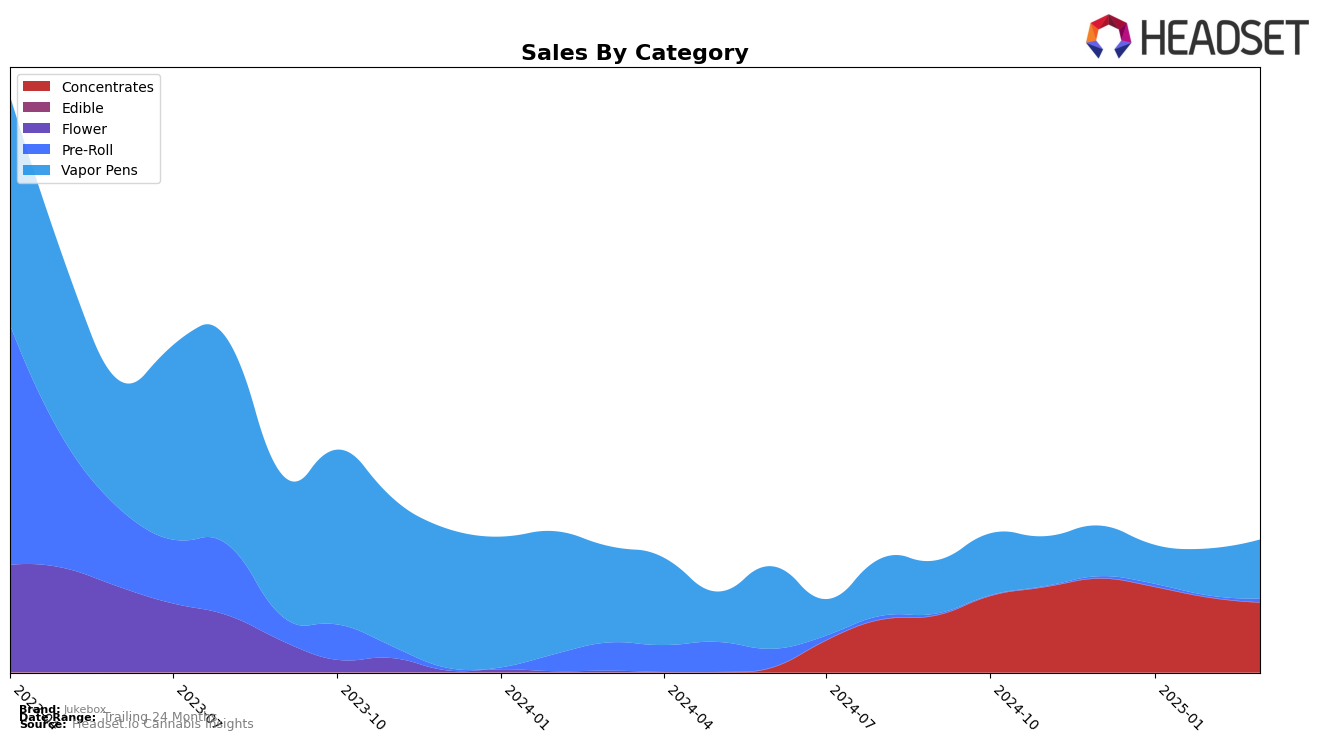

In the Arizona market, Jukebox has shown a consistent presence in the Concentrates category, maintaining a position within the top 10 brands from December 2024 to March 2025. Specifically, Jukebox held the 8th rank in both December and February, slipping slightly to 9th in January and March. This stability in ranking suggests a steady demand for their concentrates, although there is a noticeable decline in sales over these months, with March sales dropping to $145,943 from $196,094 in December. This trend might indicate increased competition or shifting consumer preferences in the Arizona concentrates market.

Conversely, Jukebox's performance in the Vapor Pens category in Arizona has been more volatile. The brand did not make it into the top 30 in December, but managed to climb to the 34th position by February, before slipping slightly to 37th in March. Despite these fluctuations, there was a notable increase in sales from January to March, with March sales reaching $122,627, suggesting potential growth and increasing consumer interest in their vapor pen products. This upward sales trend, despite not breaking into the top 30 consistently, could be a positive indicator of future performance in this category.

Competitive Landscape

In the competitive landscape of concentrates in Arizona, Jukebox has experienced some fluctuations in its ranking over the past few months. Starting from December 2024, Jukebox held the 8th position, but it slipped to 9th in January 2025, only to regain the 8th spot in February, before dropping back to 9th in March. This pattern indicates a competitive struggle, particularly against brands like Mr. Honey Extracts, which consistently outperformed Jukebox, even achieving a peak rank of 4th in February. Additionally, iLava showed a steady upward trend, moving from 11th to 8th place, which could pose a future threat to Jukebox's market position. Despite these challenges, Jukebox's sales remained relatively robust, although they did see a decline from December to March, which might suggest the need for strategic adjustments to maintain competitiveness in this dynamic market.

Notable Products

In March 2025, the top-performing product for Jukebox was the Pink Certz Pre-Roll (1g), which secured the number one rank with sales of 1710 units. The Papaya Badder (1g) showed significant improvement, climbing to the second position from fifth in February 2025. The Super Boof Badder (1g) maintained its third-place ranking from the previous month, despite a slight dip in sales. The Beaver Cookies Shatter (1g) emerged in the fourth position for the first time, marking its entry into the top ranks. Meanwhile, the Milano Cookies Badder (1g) dropped from second in February to fifth in March, indicating a shift in consumer preference within the concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.