Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

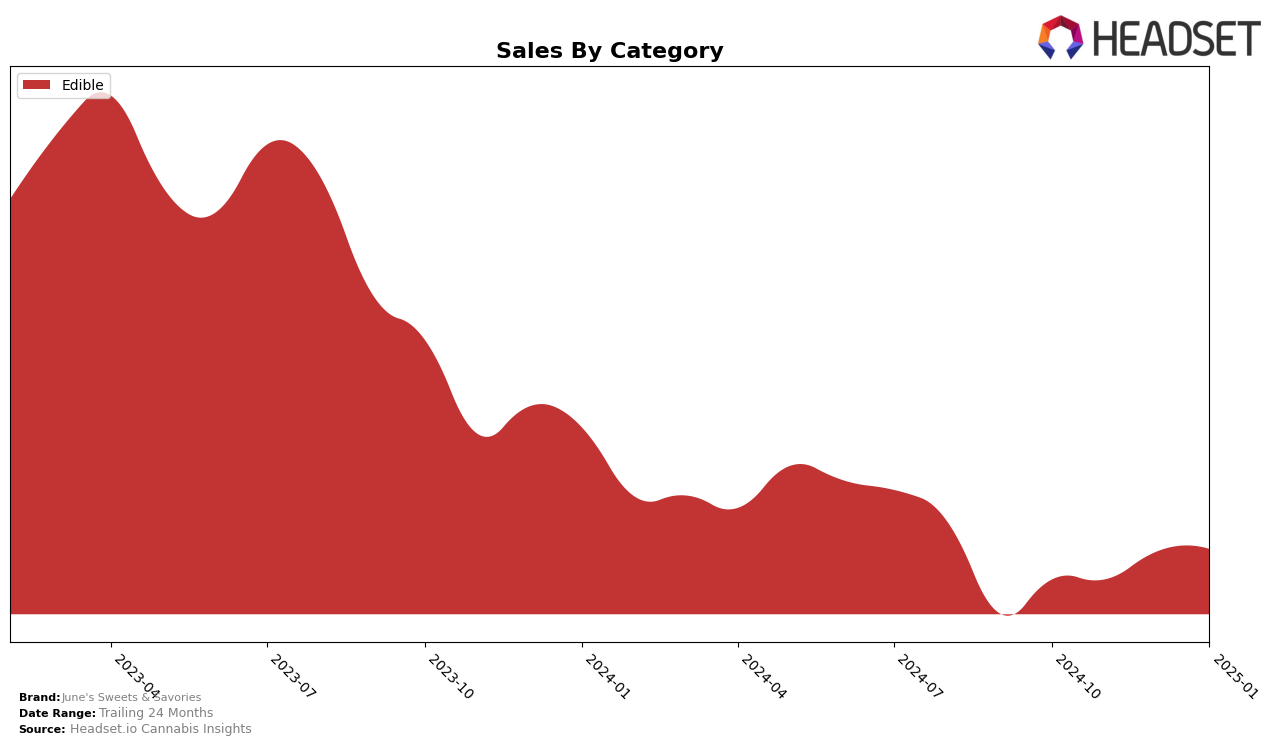

June's Sweets & Savories has shown a consistent upward trajectory in the Edible category within Washington. Starting in October 2024, the brand was ranked 27th, and by January 2025, it had climbed to the 24th position. This steady improvement indicates a growing market presence and consumer preference for their products in this state. The sales figures also reflect this positive trend, with a noticeable increase from October to January, suggesting that the brand's efforts in product development or marketing may be paying off. Such a consistent rise in rankings and sales is a positive indicator of the brand's potential to further solidify its position in the Washington Edible market.

However, it's important to note that June's Sweets & Savories did not make it into the top 30 brands in other states or provinces during this period, which could be seen as a missed opportunity for market expansion. The absence from the top rankings in other regions suggests that the brand might be facing challenges in scaling its operations or adapting its offerings to meet diverse consumer preferences outside of Washington. This discrepancy highlights the need for strategic planning and targeted efforts to replicate their success in Washington across other markets. Understanding the nuances of each market and consumer behavior could be key to unlocking further growth for June's Sweets & Savories.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Washington, June's Sweets & Savories has demonstrated a positive trajectory in terms of rank and sales over the past few months. Starting from a rank of 27 in October 2024, the brand improved to 24 by January 2025, showcasing a steady climb amidst a competitive market. This upward movement is particularly notable when compared to brands like Agro Couture and Hi-Burst, which have seen fluctuations and declines in their rankings, with both dropping to 26 and 27, respectively, by January 2025. Meanwhile, Binske and Koko Gemz have maintained relatively stable positions, yet they have not exhibited the same upward momentum as June's Sweets & Savories. This trend suggests that June's Sweets & Savories is effectively capturing market share and resonating with consumers, potentially due to strategic marketing or product innovation, setting a promising stage for future growth in the Washington edible market.

Notable Products

In January 2025, the top-performing product from June's Sweets & Savories was the Sour Blue Raspberry Fruit Jellies 10-Pack (100mg), which claimed the number one rank with sales reaching 716 units. This product improved from its consistent second position in the previous three months. The Sweet Blood Orange Fruit Jellies 10-Pack (100mg THC, 2.7oz) slipped to second place despite maintaining the top rank from October to December 2024. Sweet Strawberry Pineapple Fruit Jellies 10-Pack (100mg) held steady in the third position, showing a slight decrease in sales compared to December. Notably, the CBD/THC 1:1 Sour Watermelon Fruit Jellies 10-Pack (100mg CBD, 100mg THC) climbed to fourth place, demonstrating an upward trend since its introduction in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.