Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

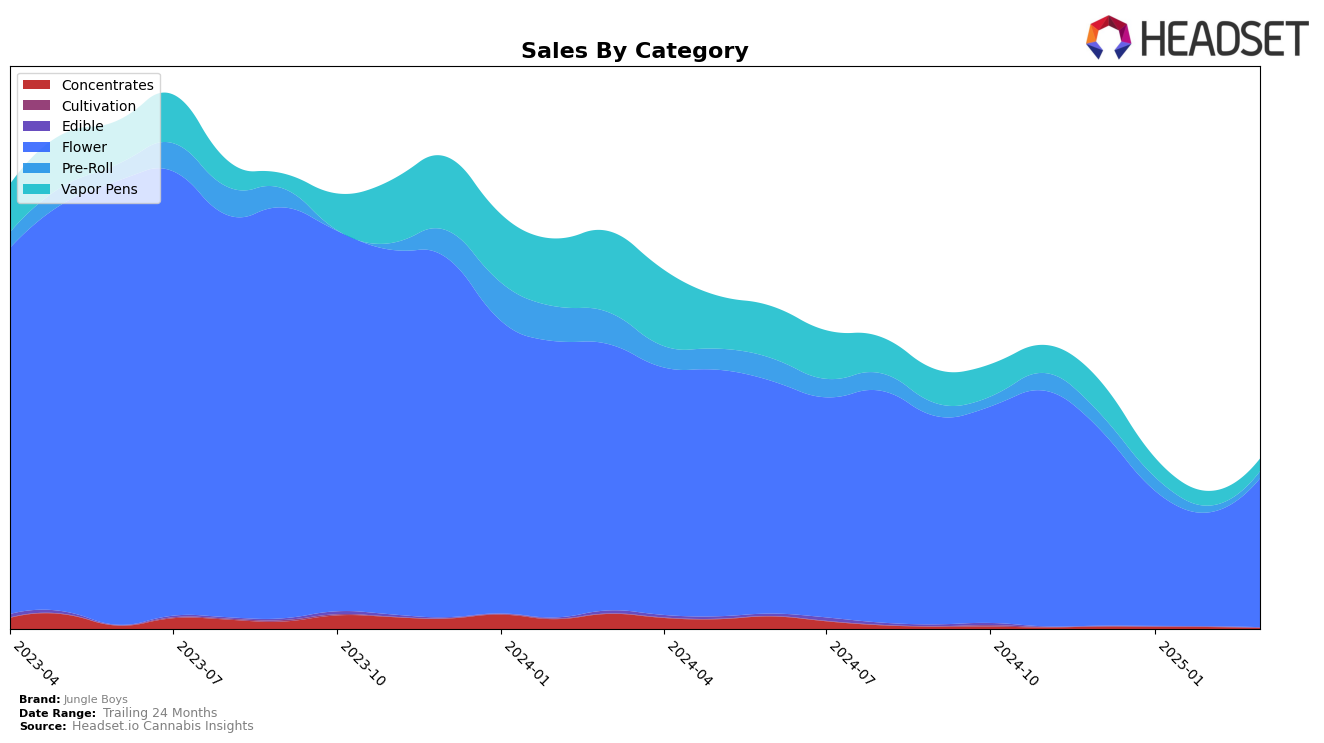

Jungle Boys has shown a varied performance across different categories in California. In the Flower category, they have maintained a presence within the top 30, with rankings fluctuating from 17th in December 2024 to 23rd by March 2025. This suggests a resilient position despite some volatility in sales, where they experienced a dip in February but rebounded in March. On the other hand, their performance in the Pre-Roll category has been less favorable, with rankings in December and January outside the top 80, indicating a significant opportunity for improvement in this segment. The Vapor Pens category reflects a downward trend, as Jungle Boys fell from 62nd place in December to 91st by March, highlighting a challenge in maintaining competitive positioning in this highly dynamic market.

The absence of Jungle Boys from the top 30 rankings in the Pre-Roll category in February and March is notable, as it underscores the competitive pressures faced in California. This could be attributed to shifting consumer preferences or increased competition. Despite these challenges, the Flower category remains a stronghold for Jungle Boys, although the fluctuations in their ranking suggest a need for strategic adjustments to solidify their standing. The Vapor Pens category presents another area for potential growth, but the consistent drop in rankings over the months indicates that Jungle Boys may need to innovate or enhance their offerings to regain traction. These insights can be crucial for stakeholders looking to understand the brand's positioning and areas for potential investment or improvement.

Competitive Landscape

In the competitive California Flower market, Jungle Boys experienced fluctuations in their rank and sales from December 2024 to March 2025. Starting at 17th place in December 2024, Jungle Boys dropped out of the top 20 in January and February 2025, before rebounding to 23rd place in March 2025. This period saw a notable decline in sales, with a significant dip in January and February, before a partial recovery in March. In contrast, Connected Cannabis Co. maintained a relatively stable position, consistently ranking higher than Jungle Boys, despite a slight decline in sales. Meanwhile, Yada Yada and Cruisers showed varying performance, with Cruisers notably climbing to 19th place in February. Originals also showed a positive trend, surpassing Jungle Boys by March. These dynamics suggest that Jungle Boys faces stiff competition and may need strategic adjustments to regain and sustain higher rankings and sales in this competitive landscape.

Notable Products

In March 2025, Gator Breath Smalls (10g) emerged as the top-performing product for Jungle Boys, significantly increasing its sales to 7378 units and climbing from the third position in February. G Ride Smalls (10g) maintained its strong performance, securing the second rank for the month. RS1000 Smalls (10g) made a notable entry into the rankings, achieving the third spot. Gelato #33 Smalls (10g) remained consistent, holding the fourth position for two consecutive months. Kush Sorbet Smalls (10g) entered the top five for the first time, rounding off the list as the fifth best-seller in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.