Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

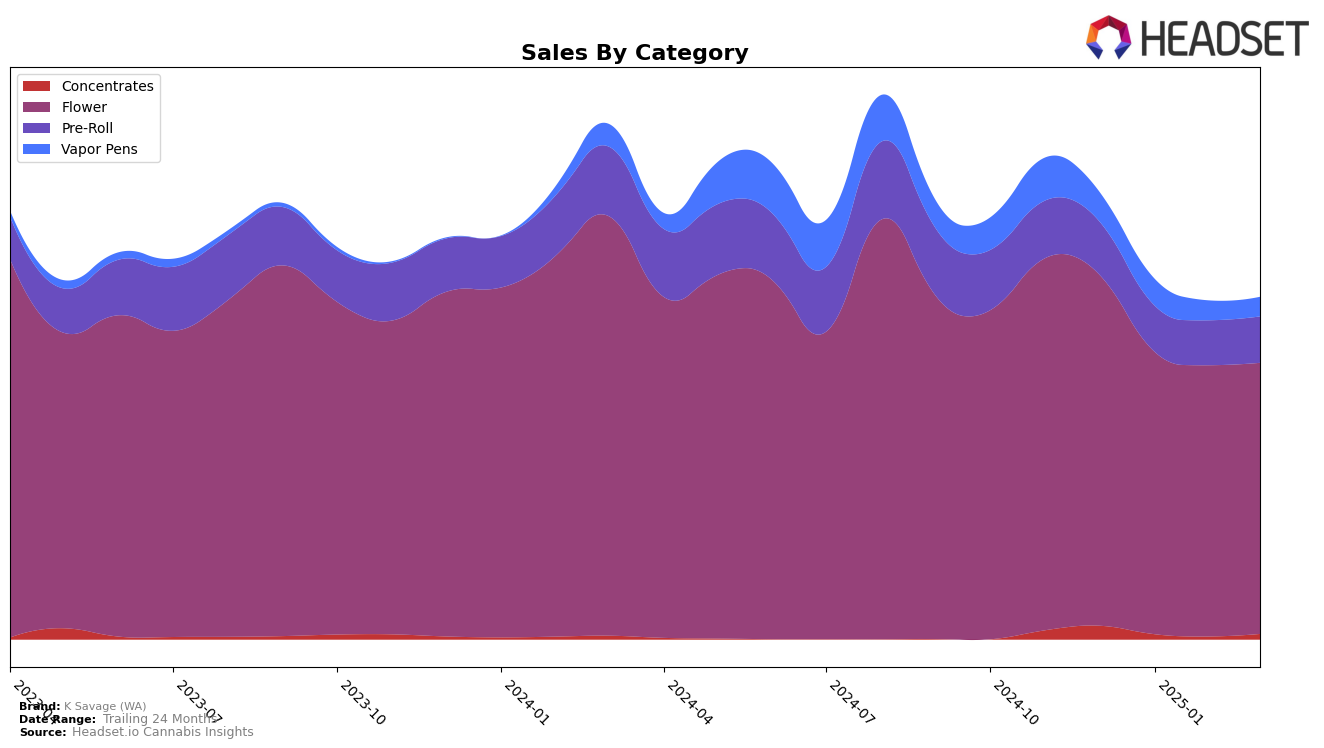

K Savage (WA) has shown a consistent performance in the Washington market, particularly within the Flower category where it has maintained a steady ranking of 10th place from January through March 2025. This stability suggests a solid consumer base and reliable product appeal in this category, despite a slight decrease in sales from December 2024 to March 2025. In contrast, the brand's presence in the Concentrates category did not make it to the top 30 rankings during the same period, indicating potential challenges in market penetration or competition in this segment. This could be a critical area for K Savage (WA) to explore for strategic improvements.

In the Pre-Roll category, K Savage (WA) experienced some fluctuations, with rankings ranging from 47th to 53rd place between December 2024 and March 2025. This variability suggests a dynamic market environment where the brand might need to enhance its competitive strategies. Meanwhile, the Vapor Pens category saw K Savage (WA) steadily declining in rank, dropping from 88th in December 2024 to 100th by March 2025, highlighting a potential need for innovation or marketing efforts to regain traction. Overall, while K Savage (WA) holds a strong position in the Flower category, other segments present opportunities for growth and require strategic focus to improve their market standings.

Competitive Landscape

In the competitive landscape of the Washington flower category, K Savage (WA) has experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked 8th in December 2024, K Savage (WA) saw a decline to 10th place by January 2025, maintaining this position through March 2025. This change in rank is significant as it reflects a decrease in sales performance, contrasting with competitors such as Viking Cannabis, which improved its rank from 11th to 8th over the same period, and EZ Flower, which climbed from 29th to 12th. Despite these challenges, K Savage (WA) remains a key player, but the upward momentum of brands like Fifty Fold and EZ Puff suggests an increasingly competitive environment, emphasizing the need for strategic adjustments to regain higher rankings and sales growth.

Notable Products

In March 2025, the top-performing product for K Savage (WA) was the GMO Pre-Roll 2-Pack (1g), which climbed to the number one rank with sales reaching 2003 units. Lilac Wine (3.5g) maintained its strong performance, ranking second, consistent with its position in February 2025. GMO (3.5g) saw a decline, moving from first place in February to third in March. The Lilac Wine Pre-Roll 2-Pack (1g) improved its ranking to fourth place after being absent from the January list. Lastly, the Rumble Strip Pre-Roll 2-Pack (1g) entered the top five for the first time, securing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.