Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

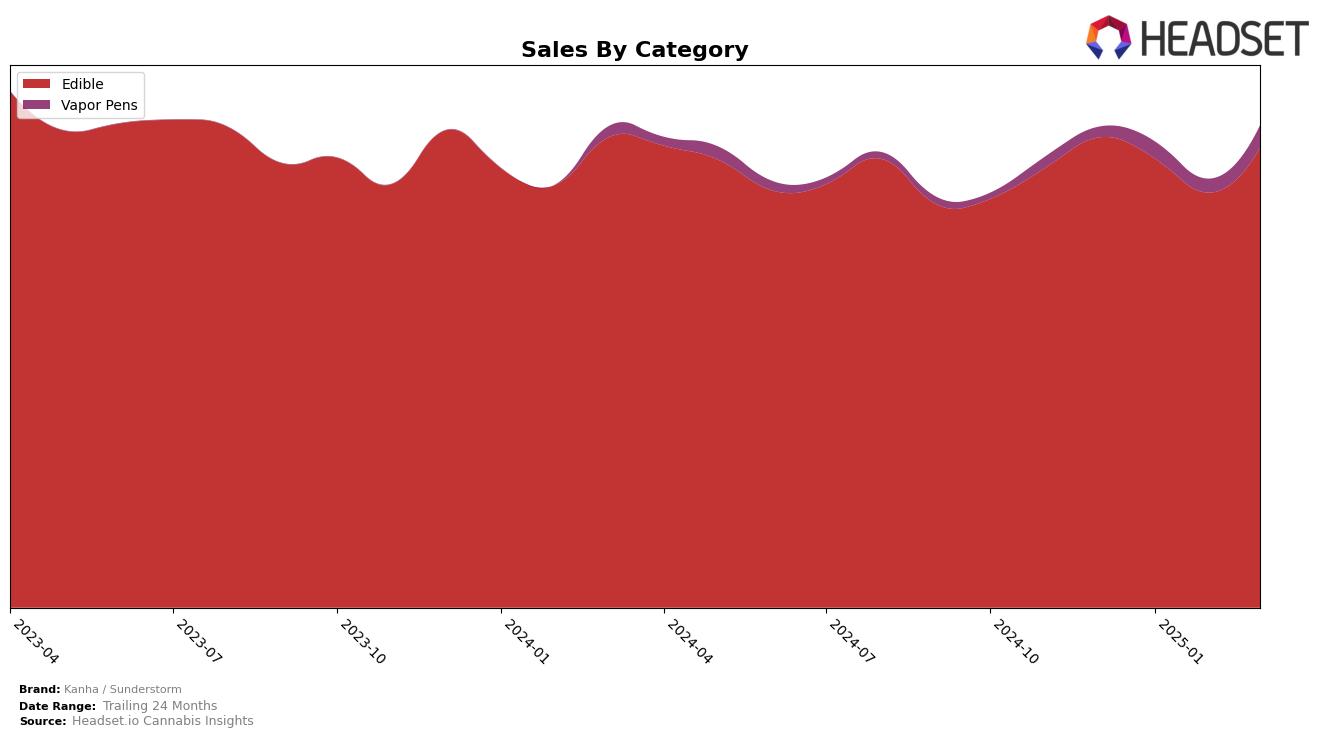

Kanha / Sunderstorm has maintained a strong presence in the California market, consistently holding the third rank in the Edible category from December 2024 through March 2025. This stability in ranking suggests a solid foothold in one of the largest cannabis markets. However, the sales figures reveal a slight dip in January and February 2025, before rebounding in March, indicating potential seasonal or market-driven fluctuations. In contrast, their performance in the Illinois Edible market shows a positive trajectory, climbing from 37th to 27th place over the same period, suggesting increasing brand recognition and consumer acceptance in this state. Despite not being in the top 30 in December 2024, their continuous climb in rank highlights a growing presence in Illinois.

In the Massachusetts Edible category, Kanha / Sunderstorm has shown a slight decline, moving from second to third place by March 2025. Although still a top contender, this drop might indicate increased competition or shifting consumer preferences. Meanwhile, in Nevada, their position has remained relatively stable, fluctuating between 11th and 12th place in the Edible category, which suggests consistent performance but also potential challenges in breaking into the top ten. Notably, their presence in the Illinois Vapor Pens category, though outside the top 30 in December, has seen improvement, reaching the 38th position by March 2025. This upward trend in multiple categories across different states underscores Kanha / Sunderstorm's strategic efforts to expand its market footprint.

Competitive Landscape

In the competitive landscape of the California edible market, Kanha / Sunderstorm consistently holds the third position from December 2024 through March 2025, indicating a stable presence amidst fluctuating sales figures. Despite a slight dip in sales from January to February 2025, Kanha / Sunderstorm's ability to maintain its rank suggests resilience and a loyal customer base. The brand trails behind Wyld, which dominates the market at the top rank, and Camino, which holds the second position. Both competitors have significantly higher sales figures, highlighting potential areas for Kanha / Sunderstorm to explore in terms of market expansion or product innovation. Meanwhile, Lost Farm and Froot remain steady in fourth and fifth positions, respectively, with sales figures that are notably lower than Kanha / Sunderstorm's, reinforcing its stronghold in the market.

Notable Products

In March 2025, the top-performing product for Kanha / Sunderstorm was the CBN/CBD/THC 3:2:1 Sleep Marionberry Plum Gummies 10-Pack, maintaining its number one rank from previous months and achieving sales of 34,433. The CBD/THC/CBN 1:1:1 Blue Raspberry Tranquility Gummies 10-Pack consistently held the second position, with sales showing a positive increase from February 2025. Classic- Sativa Cherry Gummies 10-Pack remained steady at the third rank across the months, with a slight uptick in sales in March. Nano - Indica Galactic Grape Gummies 10-Pack improved its rank from fifth to fourth, indicating a resurgence in popularity. Classic- Hybrid Watermelon Gummies 10-Pack re-entered the rankings at fifth place, demonstrating a notable comeback after previously being absent from the list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.