Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

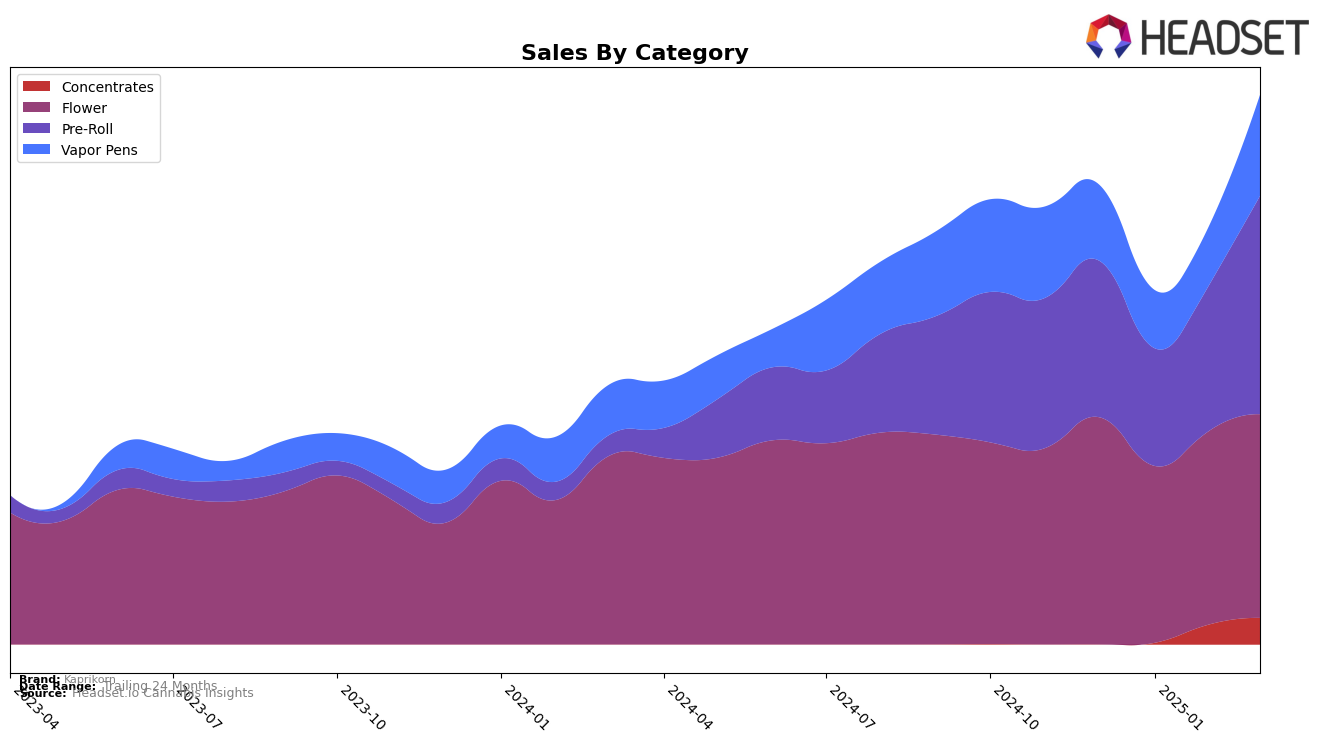

Kaprikorn has demonstrated notable movements across different product categories in Oregon. In the Concentrates category, the brand made its entry into the top 30 in February 2025, ranking 29th, and improved slightly to 27th by March 2025. This suggests a positive trajectory in consumer interest or market penetration for Kaprikorn's concentrates. However, their performance in the Vapor Pens category indicates challenges, as they were not in the top 30 for December 2024 and January 2025, only breaking into the rankings in February and improving to 26th by March. This could point to increasing competition or a slower adoption rate for their vapor pen products in the state.

Focusing on the Flower and Pre-Roll categories, Kaprikorn has maintained a strong presence in Oregon. Flower saw a dip from 5th place in December 2024 to 11th in January 2025, before recovering to 7th and then 9th by March. This fluctuation might indicate seasonal demand variations or shifts in consumer preferences. Meanwhile, the Pre-Roll category has shown consistent strength, with Kaprikorn holding steady at 4th place in February and March after a slight drop from 5th in December to 7th in January. This stable performance in Pre-Rolls suggests a loyal customer base or effective product positioning. These dynamics highlight the brand's competitive positioning and potential areas for strategic focus in the Oregon market.

Competitive Landscape

In the competitive landscape of Oregon's Pre-Roll category, Kaprikorn has demonstrated notable resilience and adaptability over the first quarter of 2025. Starting from a rank of 5th in December 2024, Kaprikorn experienced a dip to 7th in January 2025, before rebounding to 4th place in both February and March 2025. This upward trend is significant, especially when considering the consistent performance of top competitors like Hellavated, which maintained a steady 2nd place ranking throughout the same period. Meanwhile, STiCKS showed a strong upward trajectory, climbing from 9th to 5th, matching Kaprikorn's rank in March. Despite these competitive pressures, Kaprikorn's sales saw a substantial increase from February to March, indicating a successful strategy in regaining market share. The brand's ability to climb the ranks amidst fierce competition from Fire Dept. Cannabis and Killa Beez underscores its potential for continued growth in the Oregon market.

Notable Products

In March 2025, Kaprikorn's top-performing product was Amaretto Sour Bulk in the Flower category, achieving the number one rank with sales reaching 4,106 units. Mule Fuel Pre-Roll 2-Pack 1.5g climbed to the second position from a previous absence in the rankings, showing a significant increase in popularity. Mule Fuel Bulk, also in the Flower category, maintained a strong presence, securing the third spot, though it dropped from its January 2025 leading position. The Cap Junky x Pink RNTZ Pre-Roll 10-Pack 5g debuted in the rankings at fourth, indicating a growing interest. Chicken & Waffles Bulk rounded out the top five, entering the list for the first time and highlighting a diverse product preference among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.