Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

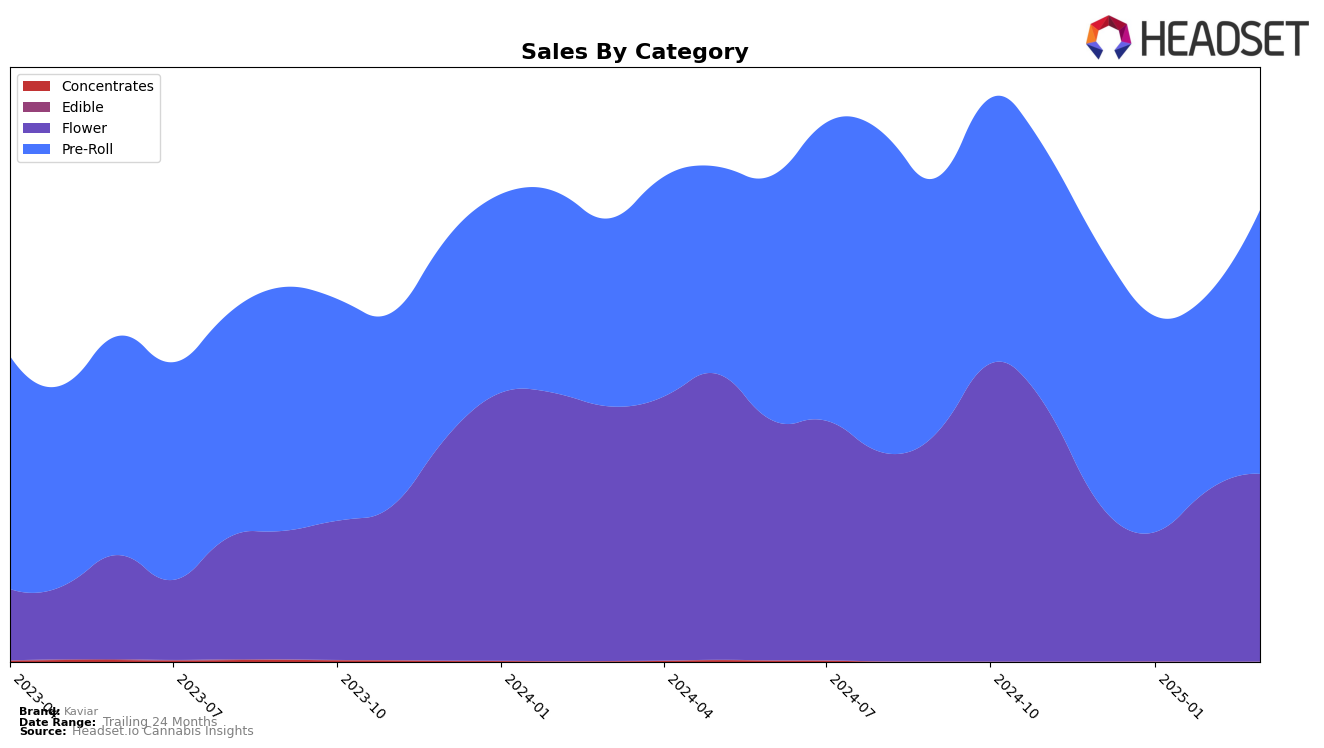

In the Colorado market, Kaviar has shown a significant upward movement in the Pre-Roll category. Starting with a strong position at rank 2.0 from December 2024 through February 2025, Kaviar climbed to the top spot by March 2025. This improvement is underscored by a notable increase in sales, particularly in March 2025, where sales surged to $737,999. This consistent performance in Colorado indicates a robust market presence and consumer preference for Kaviar's Pre-Roll products.

In contrast, Kaviar's performance in Illinois presents a mixed picture. Within the Flower category, Kaviar improved its ranking from 28.0 in December 2024 to 24.0 by March 2025, reflecting a positive trajectory. However, in the Pre-Roll category, Kaviar's rank fluctuated, ending at 25.0 in March 2025, which suggests challenges in maintaining a consistent position within the top 30. Meanwhile, in Maryland, Kaviar's Pre-Roll products experienced slight rank declines but managed to stay within the top 15, indicating a stable but competitive market environment. The situation in Missouri is more concerning, as Kaviar's Pre-Roll category dropped out of the top 30, highlighting potential market penetration issues.

Competitive Landscape

In the competitive landscape of the Illinois flower category, Kaviar has shown a promising upward trajectory in rankings over the first quarter of 2025. Starting from a rank of 28 in December 2024, Kaviar climbed to 24 by March 2025, indicating a positive shift in market presence. This improvement is notable when compared to competitors like Island, which fluctuated slightly but remained consistently higher ranked, and 93 Boyz, which maintained a stable position in the low 20s. Meanwhile, Find. showed a significant rise from being outside the top 20 in December to reaching 26 by February, though it did not sustain this momentum into March. Despite Kaviar's sales dip in January, the brand recovered with a steady increase in sales through February and March, suggesting effective strategies in capturing market share and enhancing brand visibility. This trend positions Kaviar as a brand to watch in the Illinois flower market, as it continues to close the gap with its higher-ranked competitors.

Notable Products

In March 2025, the top-performing product for Kaviar was the Indica Blend Infused Pre-Roll (1.5g), maintaining its position at rank 1 with notable sales of 10,888 units. The Kaviar x Happy Eddie - Zen Wen Infused Pre-Roll (1.5g) followed closely at rank 2, consistent with its ranking from the previous two months. The Kaviar x Happy Eddie - The CEO Hybrid Infused Pre-Roll (1.5g) held steady at rank 3, showing stable performance compared to earlier months. A new entry, Tangie Berry Infused Pre-Roll (1.5g), debuted at rank 4, indicating a positive reception. The Sativa Blend Infused Pre-Roll (1.5g) remained at rank 5, reflecting a slight dip from December 2024 when it was ranked 4.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.