Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

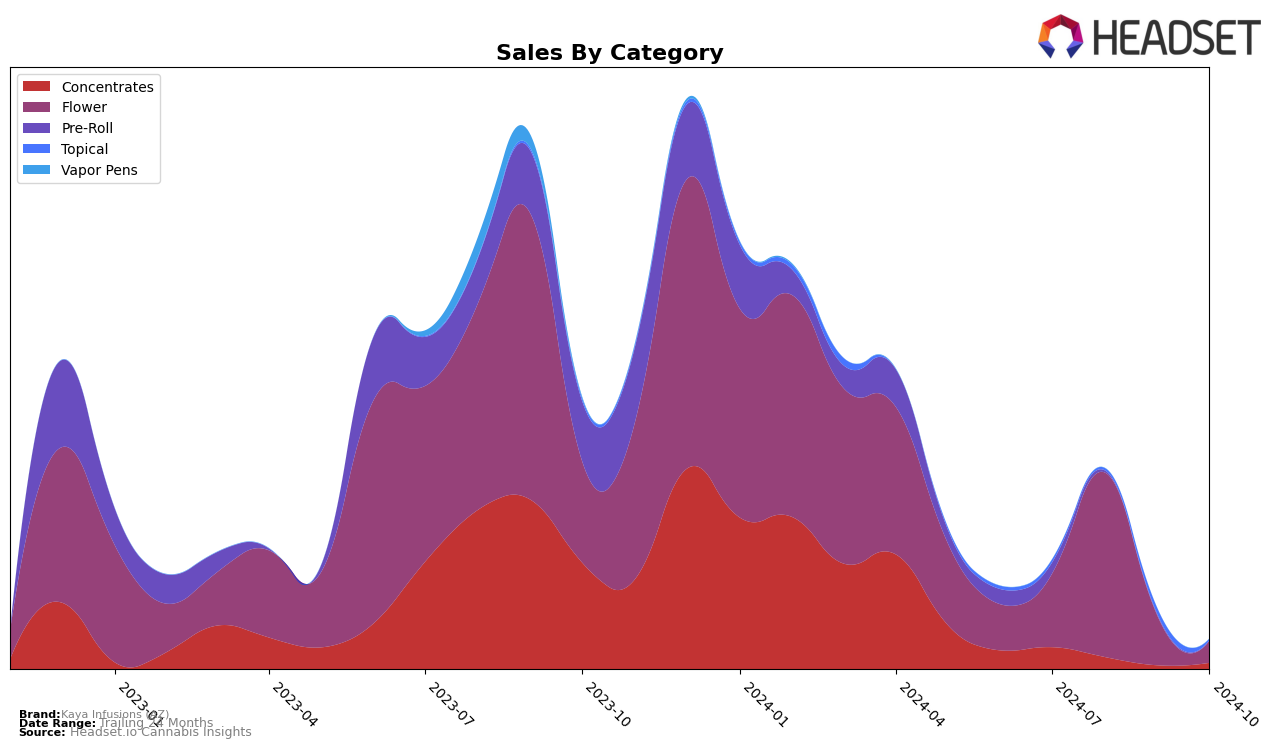

Kaya Infusions (AZ) has shown a notable performance trajectory in the state of Arizona, particularly within the Flower category. Despite not being in the top 30 brands during July and August 2024, the brand experienced a significant improvement, moving up from a rank of 77 in July to 67 in August. This upward movement indicates a positive trend, suggesting that Kaya Infusions is gaining traction and possibly expanding its market share in Arizona's competitive cannabis market. The substantial increase in sales from July to August further underscores this growth, highlighting the brand's potential to break into the top 30 in the near future.

However, Kaya Infusions (AZ) did not maintain its presence in the rankings for September and October 2024, which could be a point of concern or an indication of seasonal fluctuations. The absence from the top 30 in these months might suggest challenges in sustaining the growth momentum or increased competition from other brands in Arizona. This fluctuation in rankings and sales performance provides a mixed picture of the brand's position in the market, emphasizing the need for strategic initiatives to capitalize on the gains made earlier in the year. Observing how Kaya Infusions navigates these dynamics in the coming months will be crucial for understanding its long-term positioning in the Arizona cannabis market.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Kaya Infusions (AZ) has shown a promising upward trajectory in recent months. While the brand was not ranked in the top 20 in September and October 2024, it made significant strides earlier, climbing from 77th in July to 67th in August. This upward movement indicates a positive trend in consumer interest and market penetration. In contrast, Khalifa Kush and Amber have experienced fluctuating ranks, with Khalifa Kush dropping out of the top 20 by October and Amber showing inconsistent presence. These dynamics suggest that while Kaya Infusions (AZ) is gaining ground, competitors are facing challenges in maintaining consistent sales and rank, presenting an opportunity for Kaya Infusions (AZ) to capitalize on its momentum and potentially capture a larger market share in the Arizona flower category.

Notable Products

In October 2024, the top-performing product for Kaya Infusions (AZ) was Dosi (3.5g) in the Flower category, achieving the number one rank. Double Cup (3.5g), also in the Flower category, improved its position to second place from fourth in September, with notable sales of 35 units. Moby Dick Cured Resin Batter (1g) in the Concentrates category secured the third spot, marking its entry into the top rankings. Locktite Cured Resin Sugar (1g) followed closely in fourth place. Strawberry Banana (3.5g), which was previously ranked first in July, slipped to fifth position in October, indicating a downward trend over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.