Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

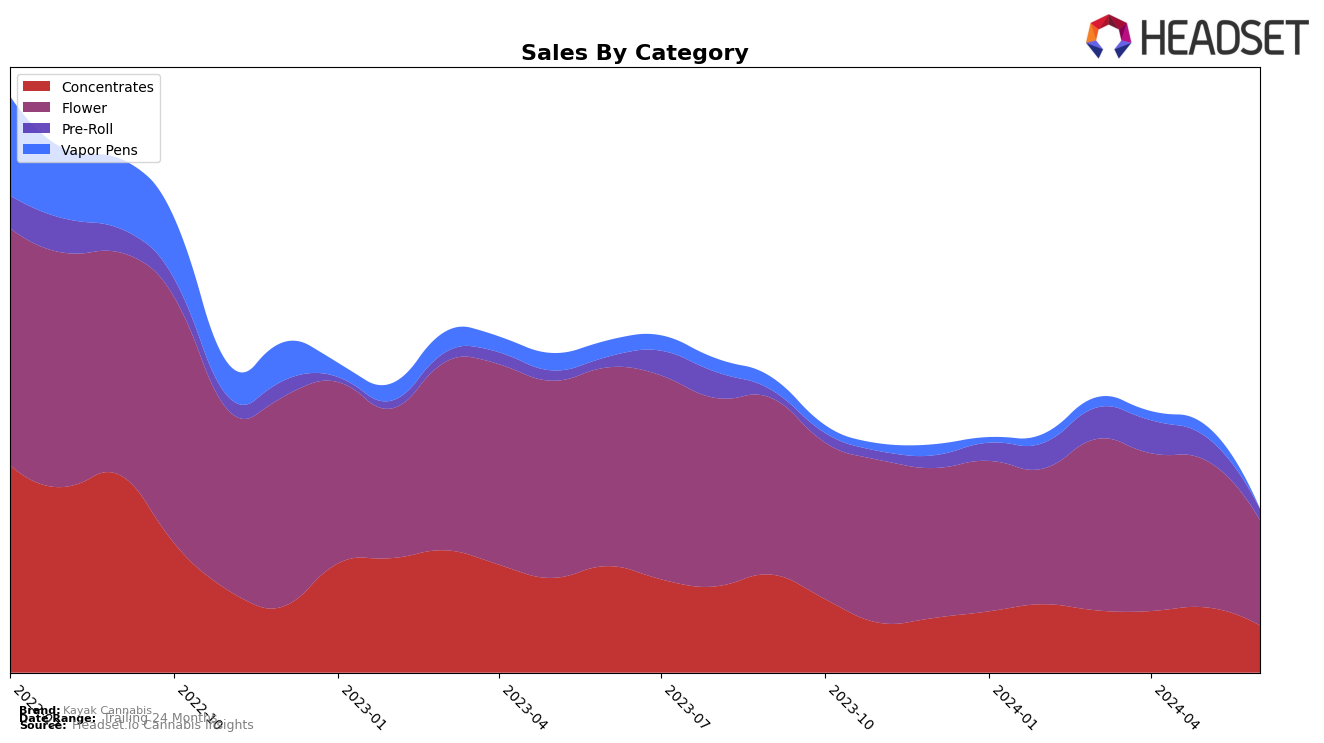

Kayak Cannabis has shown varied performance across different product categories in Colorado. In the Concentrates category, the brand has seen a steady improvement in rankings, moving from the 30th position in March 2024 to 25th in June 2024. This upward trend is noteworthy despite a dip in sales in June. Conversely, the Flower category has been a struggle, with rankings fluctuating around the 30s and not breaking into the top 30. This indicates potential challenges in maintaining a competitive edge in this highly contested category.

The Pre-Roll category has also been challenging for Kayak Cannabis, with rankings consistently outside the top 40 and dropping to 53rd in June 2024. This downward trend could be a cause for concern. The Vapor Pens category has been particularly tough, as the brand did not rank within the top 30 in any of the months analyzed, and even dropped out of the rankings entirely by June. This suggests that Kayak Cannabis might need to re-evaluate its strategy in this segment to regain market share.

Competitive Landscape

In the competitive landscape of the Colorado Flower category, Kayak Cannabis has shown notable fluctuations in its rank and sales over the past few months. Despite a consistent presence in the top 35, Kayak Cannabis experienced a drop from 33rd in April 2024 to 35th in June 2024. This decline contrasts with the upward trajectory of competitors like Super Farm, which improved its rank from 47th in April to 32nd in June, and Kind Love, which jumped from 54th in April to 37th in June. Additionally, Sunshine Extracts also showed a positive trend, moving from 49th in April to 34th in June. These shifts indicate a dynamic market where Kayak Cannabis must strategize to regain its competitive edge and stabilize its sales, which saw a significant drop from $250,848 in April to $168,634 in June. The data suggests that while Kayak Cannabis remains a strong player, it faces increasing competition and must adapt to maintain its market position.

Notable Products

In June 2024, the top-performing product for Kayak Cannabis was Hybrid Caviar Pre-Roll (1g) in the Pre-Roll category, achieving the first rank with notable sales of 3558 units. Sativa For The People Wax (4g) in the Concentrates category surged to the second rank from fourth in May, indicating a significant increase in popularity. Indica Caviar Pre-Roll (1g), also in the Pre-Roll category, dropped to the third rank from its top position in May. Indica Wax (1g) entered the rankings for the first time at fourth place. Lastly, Glueball Pre-Roll (1g) made its debut at fifth place, showcasing its initial market entry success.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.