Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

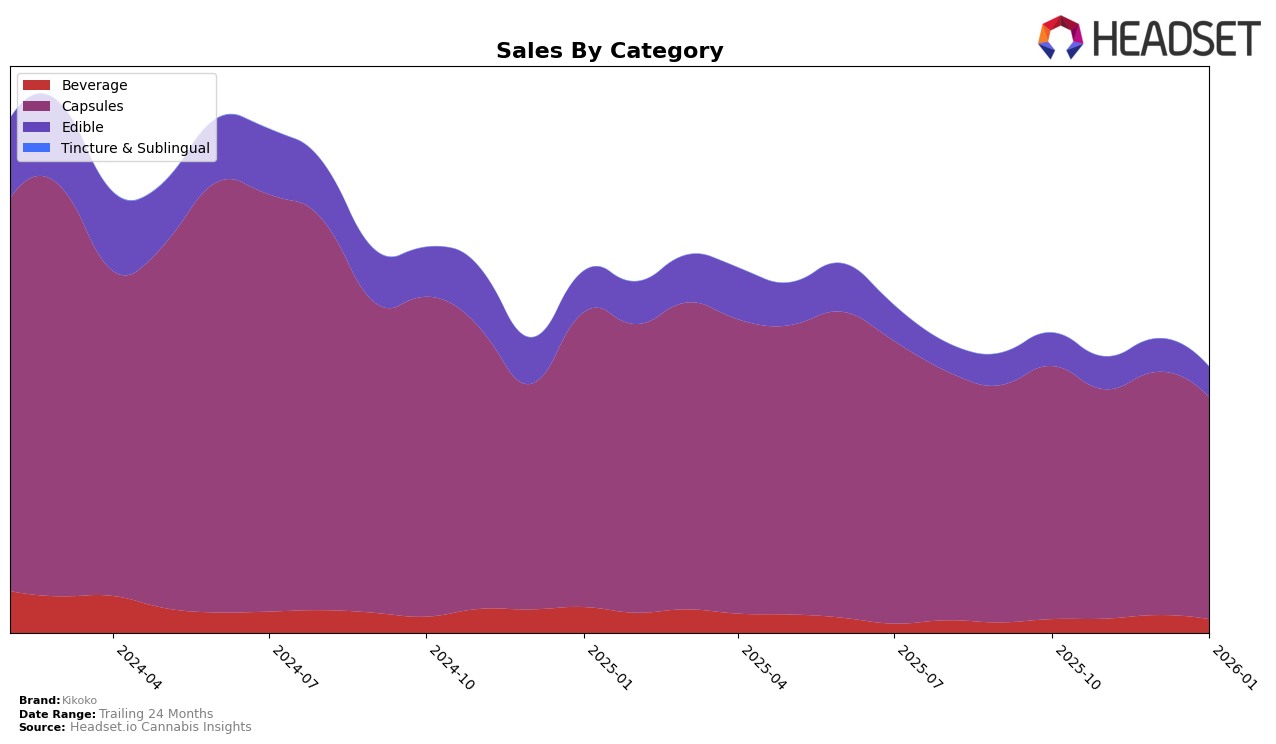

Kikoko's performance in the California market presents an intriguing landscape across different product categories. In the Beverage category, Kikoko maintained a steady presence, fluctuating slightly between 13th and 15th place from October 2025 to January 2026. This stability suggests a consistent consumer base, though there was a noticeable peak in sales during December 2025. In contrast, the Edible category saw Kikoko consistently ranked outside the top 30, indicating potential challenges in gaining a foothold in this segment. This could be a point of concern for the brand as it suggests limited visibility or consumer preference in the Edible market.

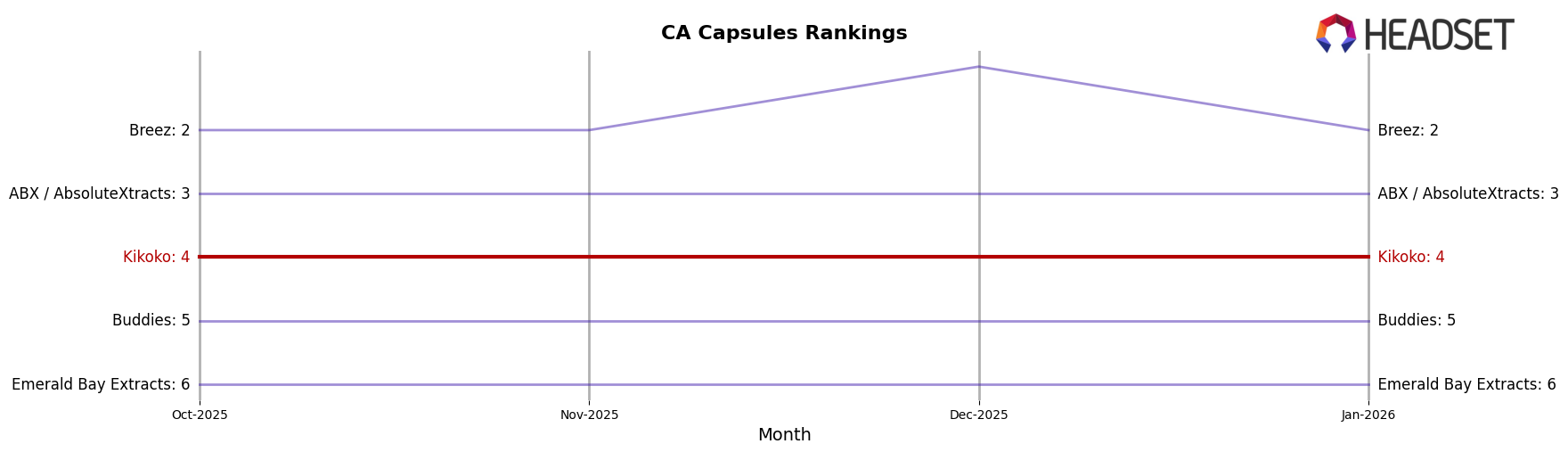

The Capsules category, however, stands out as a strong performer for Kikoko in California. The brand consistently held the 4th position from October 2025 through January 2026, showcasing its dominance and consumer loyalty in this segment. Despite a slight dip in sales from November to January, the ranking stability indicates that Kikoko has successfully established itself as a key player in the Capsules category. This consistent performance in Capsules juxtaposed with the challenges in Edibles highlights the varying levels of brand strength across different product lines. Such insights could be pivotal for strategic decisions moving forward, especially in terms of resource allocation and marketing efforts.

Competitive Landscape

In the competitive landscape of the California capsules market, Kikoko consistently held the 4th rank from October 2025 to January 2026, indicating a stable position amidst fluctuating sales. Despite a slight decline in sales from $431,191 in October 2025 to $377,802 in January 2026, Kikoko maintained its rank, suggesting a loyal customer base or effective brand strategies that counterbalance sales volatility. In contrast, Breez demonstrated a strong performance, climbing to the top rank in December 2025, although its sales dipped in January 2026. Meanwhile, ABX / AbsoluteXtracts consistently held the 3rd position, with a steady increase in sales, which may pose a competitive threat to Kikoko if this trend continues. Buddies and Emerald Bay Extracts remained in the 5th and 6th positions, respectively, with Buddies showing a slight sales increase, while Emerald Bay Extracts experienced a decrease, indicating potential shifts in consumer preferences that Kikoko could capitalize on.

Notable Products

In January 2026, Kikoko's top-performing product was the XTabs Sativa High Dose Tablets 20-Pack, maintaining its first-place ranking from December 2025 with sales of 3152 units. The XTabs Indica High Dose Tablets 20-Pack followed closely in second place, holding steady from the previous month despite a decrease in sales. The XTabs Hybrid High Dose Tablets remained consistently in third place over the past four months, although sales have steadily declined. Little Helpers CBN/THC/Melatonin 3:2 Sleep Mints also maintained its fourth-place position, with a notable increase in sales to 1285 units. The XTabs THC/CBN/CBD Sleep Tablets returned to the rankings in fifth place, showing a slight recovery from its absence in December 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.