Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

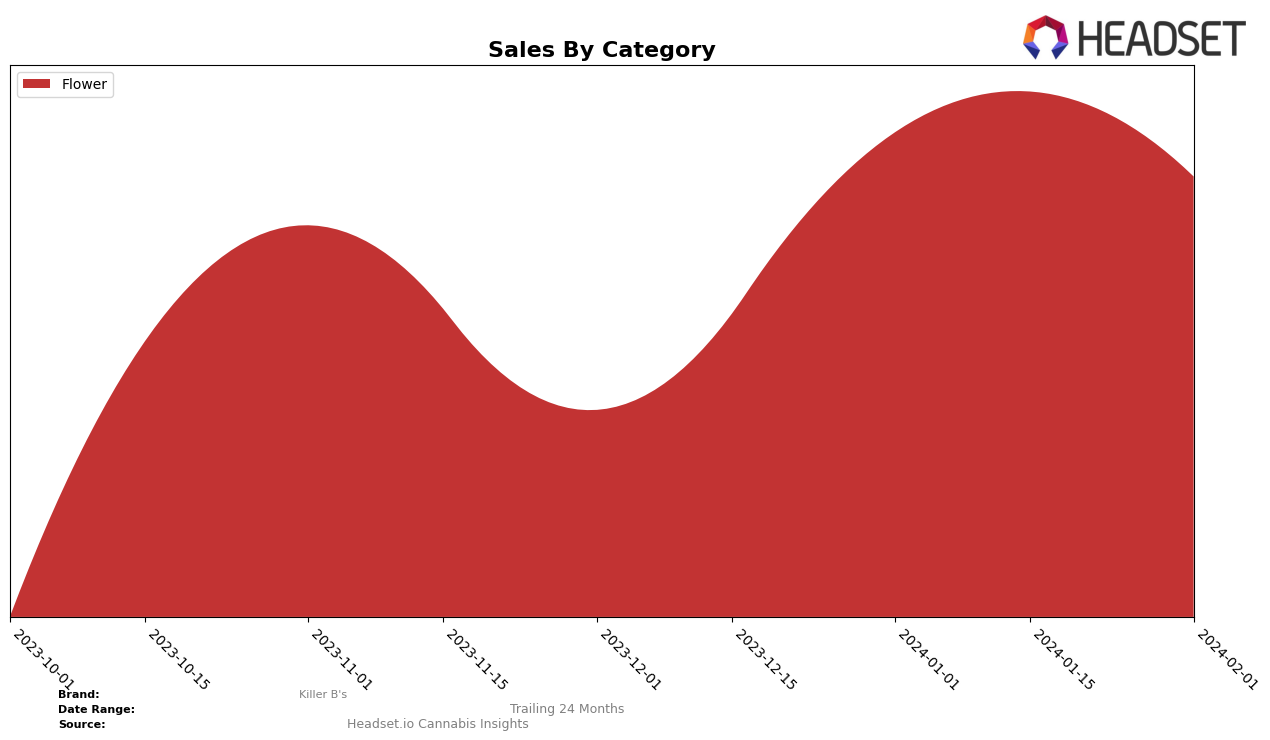

In the competitive cannabis market of Nevada, Killer B's has shown a notable performance in the Flower category, experiencing a fluctuating but overall positive trajectory in its rankings over the recent months. Starting from November 2023, the brand was ranked 18th, which slightly dipped in December to the 22nd position, indicating a temporary setback as it fell out of the top 20 brands for that month. However, Killer B's demonstrated a commendable recovery and upward movement in January 2024, climbing to the 14th rank, and further improving to the 12th position by February 2024. This progression suggests a growing consumer preference and an effective strategy by Killer B's in enhancing its market presence within Nevada's Flower category, despite the December dip.

Financial performance insights reveal that Killer B's experienced a decrease in sales in December 2023 to $339,007, down from $424,499 in November 2023, aligning with its drop in rankings for that month. Yet, the brand managed to rebound significantly in the following months, with sales peaking in January 2024 at $467,686 before slightly decreasing to $447,115 in February 2024. This sales trajectory mirrors the brand's rankings, underscoring the direct impact of market positioning on revenue. While the exact strategies behind Killer B's resurgence remain unshared, the data points towards effective marketing or operational adjustments that have resonated well with the Nevada consumer base. The brand's ability to recover and improve its standing in a competitive category speaks volumes about its potential and adaptability in the ever-evolving cannabis market.

Competitive Landscape

In the competitive landscape of the Nevada flower market, Killer B's has shown a notable trajectory in terms of rank and sales, moving from 18th in November 2023 to 12th by February 2024. This upward movement is significant when compared to its competitors. For instance, Kynd Cannabis Company experienced a fluctuation in rank but ultimately improved from 11th in November to 13th by February, indicating a slightly less positive trajectory than Killer B's. Polaris MMJ saw a more dramatic shift, dropping from 7th in November to 10th by February after a dip to 26th in January, suggesting volatility in its market position. High Heads maintained a more stable presence, hovering around the 9th to 11th ranks, showing consistency but less improvement than Killer B's. Savvy, on the other hand, made a significant leap from 21st in November to 14th by February, marking a notable improvement but still trailing behind Killer B's in terms of rank advancement. This analysis underscores Killer B's positive momentum in the Nevada flower market, outpacing several of its competitors in rank improvement and stability over the observed period.

Notable Products

In February 2024, Killer B's top-performing product was Gummy Buns Nuggets (14g) from the Flower category, securing the first rank with impressive sales of 1243 units. Following closely, Platinum Strawberries Nuggets (14g) also in the Flower category, achieved the second rank. The third place was taken by First Class Funk Nuggets (14g), which showed a significant improvement in its ranking, moving up to third from not being ranked in the previous month. Congo Kashmir (14g) and Blue Bando (14g), both from the Flower category as well, rounded out the top five positions, indicating a strong preference for Flower products among Killer B's offerings. This month's rankings highlight a dynamic shift in consumer preferences, with previously unranked products making a notable entrance into the top tiers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.