Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

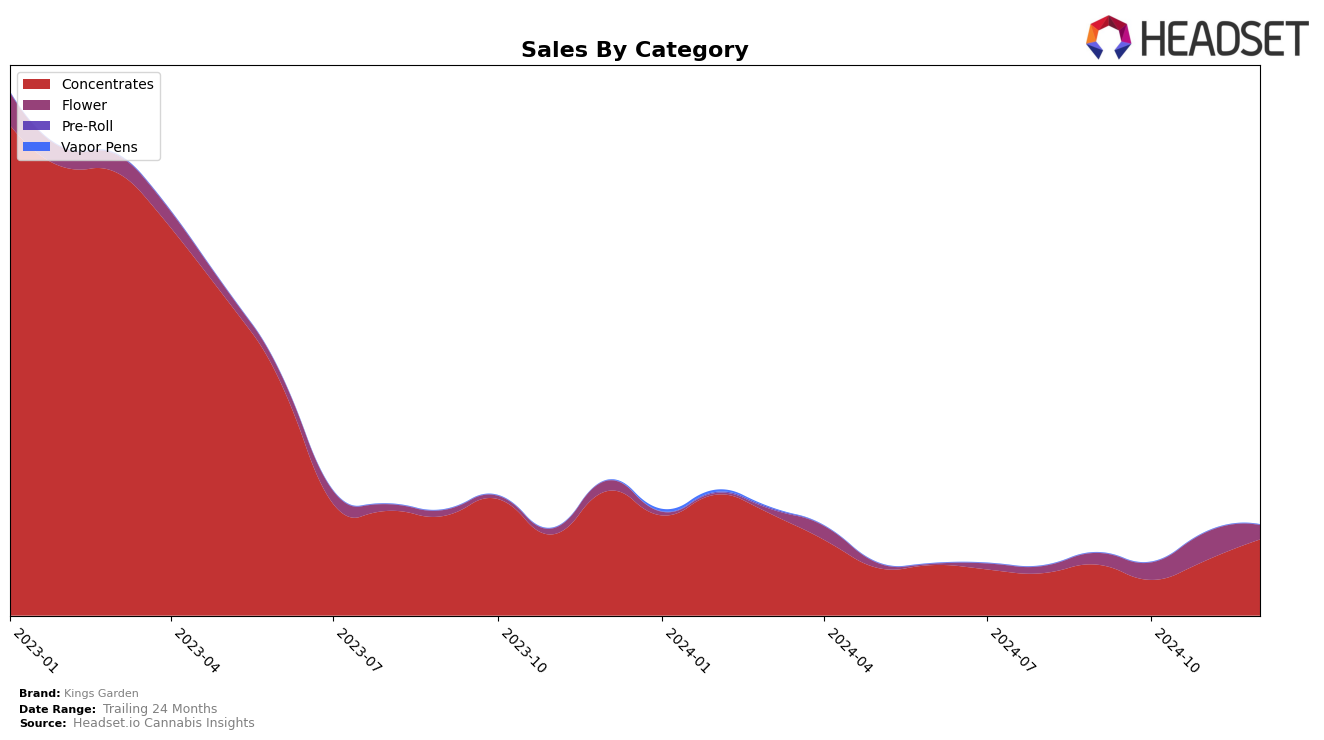

In the state of California, Kings Garden has shown notable performance in the Concentrates category. Despite starting off September 2024 ranked 39th, the brand experienced fluctuations, dropping to 56th place in October. However, it quickly rebounded to 39th in November and made a significant leap to 27th by December. This upward trend suggests a strong recovery and increasing consumer preference for Kings Garden products in the Concentrates category. Notably, the sales figures reflect this positive movement, with December sales reaching a peak, indicating a successful end to the year for Kings Garden in California.

It is important to highlight that Kings Garden's rank in October was outside the top 30, which might have been concerning for stakeholders at the time. However, their ability to climb back into the top 30 by December speaks volumes about their resilience and market strategy. The brand's performance in other states and categories remains an area of interest, as understanding their strategy in California could provide insights into their overall market approach. Observing how Kings Garden navigates these fluctuations could be crucial for predicting future trends and potential market expansions.

Competitive Landscape

In the competitive landscape of California's concentrates category, Kings Garden has shown a dynamic performance over the last few months. Despite a dip in October 2024, where it fell to 56th place, Kings Garden rebounded to 27th by December 2024. This fluctuation highlights the brand's resilience and ability to recover in a competitive market. Notably, Greenline Organics and Buddies have maintained relatively stable positions, with Buddies even matching Kings Garden's December rank of 25th. Meanwhile, Sun Smoke consistently outperformed Kings Garden, maintaining a top 30 position throughout the period. The competition from 5G (530 Grower) also intensified as they climbed from 43rd in September to 29th in December. These shifts indicate a highly competitive environment where Kings Garden must continue to innovate and strategize to maintain and improve its market position.

Notable Products

In December 2024, the top-performing product for Kings Garden was Runtz Shatter (1g) in the Concentrates category, maintaining its first-place rank from November with sales reaching 4,652 units. Gas Face Sugar (1g) emerged as the second top product, having not appeared in the top ranks in previous months. Karen Sugar (1g) secured the third spot, also making its debut in the rankings for December. Cereal Runtz Batter (1g) and Runtz Sugar Wax (1g) both tied for the fourth position, with the former dropping from a third-place finish in November. The consistency and emergence of these products highlight a strong performance trend for Kings Garden's Concentrates in the final month of the year.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.