Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

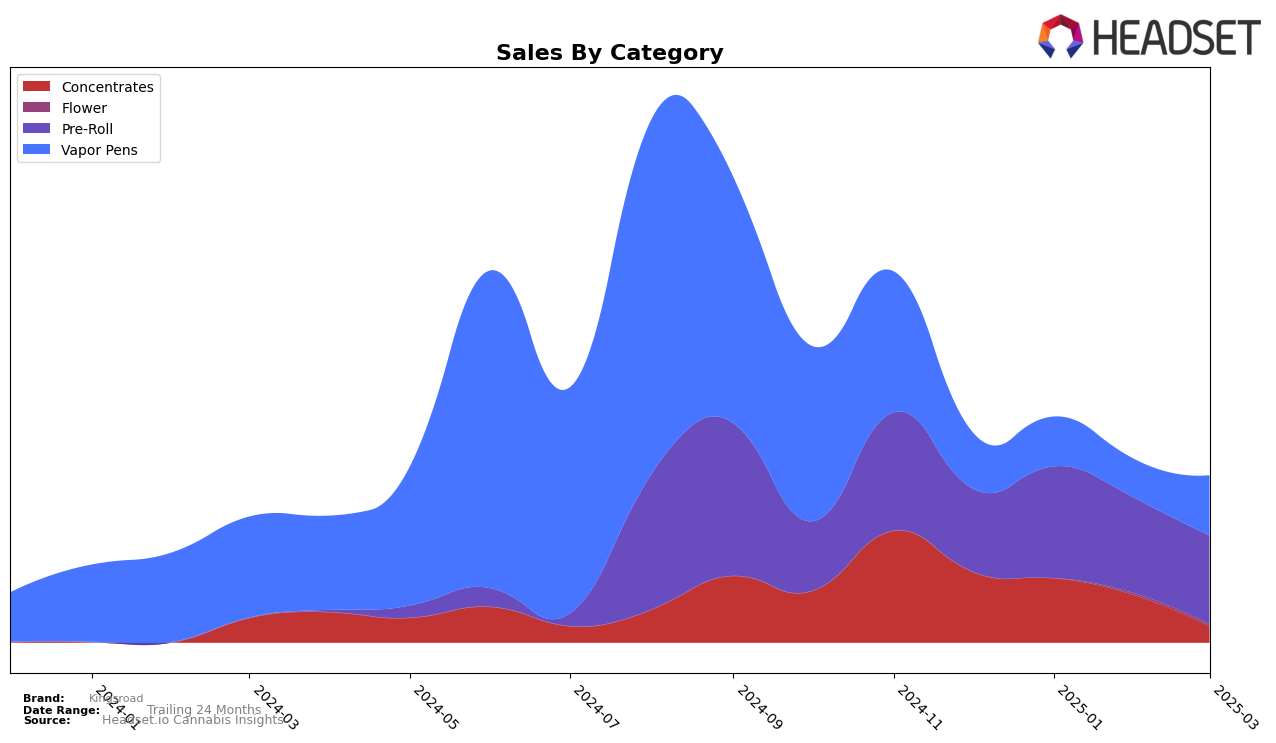

Kingsroad's performance in the New York cannabis market has shown varied results across different product categories. In the Concentrates category, Kingsroad maintained a steady ranking of 14th place from December 2024 through February 2025, before experiencing a significant drop to 25th place by March 2025. This decline coincides with a notable decrease in sales over the same period, suggesting challenges in maintaining market share. On the other hand, Kingsroad's position in the Pre-Roll category has seen fluctuations, with their rank moving from 56th in December 2024 to as high as 41st in January 2025, before settling at 52nd in March 2025. This movement indicates a competitive struggle to break into the top tier, although the brand did manage to increase sales in January, which may hint at potential growth opportunities if the right strategies are implemented.

In the Vapor Pens category, Kingsroad has consistently hovered around the lower tier of the rankings, with positions ranging from 56th to 51st between December 2024 and March 2025. Despite the relatively stable rankings, there was a notable increase in sales from February to March 2025, which could suggest improving consumer interest or successful marketing efforts in this category. However, the absence of Kingsroad in the top 30 brands for both Pre-Roll and Vapor Pens throughout this period highlights the competitive nature of the New York market and the challenges Kingsroad faces in gaining a stronger foothold. Overall, while there are pockets of positive movement, Kingsroad's performance across these categories suggests that there is considerable room for improvement to enhance their market presence in New York.

Competitive Landscape

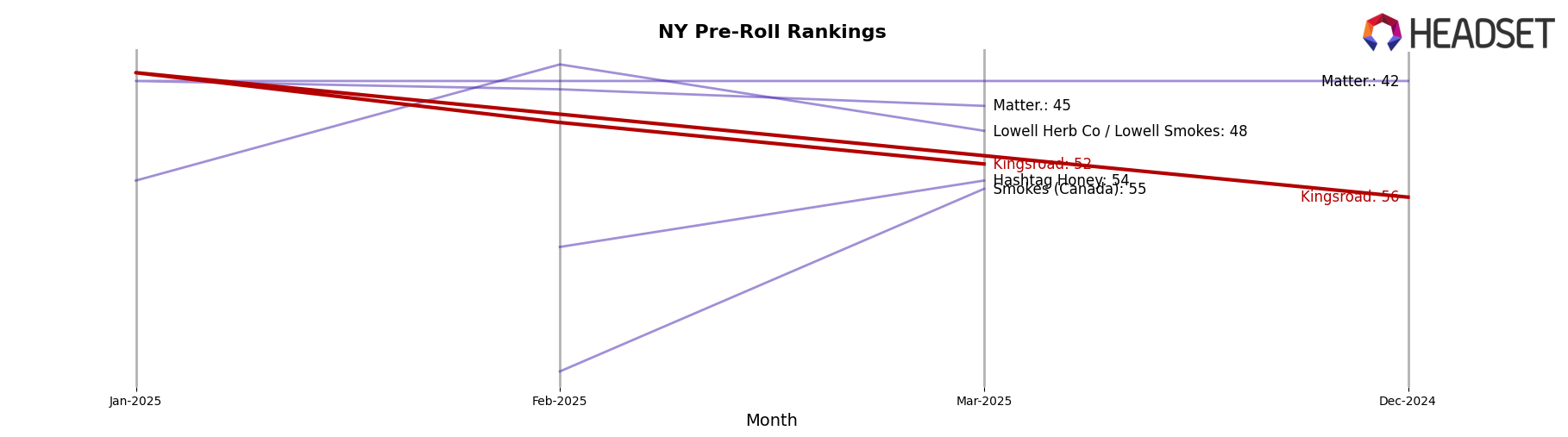

In the competitive landscape of the New York pre-roll category, Kingsroad has experienced fluctuations in its rankings and sales, which highlight both opportunities and challenges. From December 2024 to March 2025, Kingsroad's rank shifted from 56th to 52nd, with a notable peak at 41st in January 2025. This improvement in January coincided with a sales increase, suggesting effective marketing strategies or product offerings during that period. However, by March, Kingsroad's rank dropped to 52nd, indicating increased competition or market saturation. Notably, Matter. maintained a relatively stable position, ranking consistently in the low 40s, which may suggest a loyal customer base or strong brand recognition. Meanwhile, Lowell Herb Co / Lowell Smokes showed a significant improvement from being unranked in December to 48th in February, demonstrating a potential rise in consumer interest. Additionally, Smokes (Canada) and Hashtag Honey also entered the rankings, with Smokes climbing to 55th by March. These dynamics suggest that while Kingsroad has made strides, it faces stiff competition from both established and emerging brands, necessitating strategic adjustments to maintain and improve its market position.

Notable Products

In March 2025, Kingsroad's top-performing product was the Cherry Runtz x Purple Punch Live Resin Infused Pre-Roll 14-Pack, which climbed to the number one rank, up from second place in February. The White Runtz x Lemon Ice Live Resin Infused Pre-Roll 2-Pack dropped to second place after holding the top position for the previous two months, with notable sales of 385 units. The Melon Collie x Gelato Live Resin Infused Pre-Roll 14-Pack maintained a steady rise, securing the third spot after debuting at fourth in February. Early Riser Live Resin Disposable entered the rankings in fourth place, marking a new entry for vapor pens. Blue Lemonade Live Resin Disposable also made its debut in March, taking the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.