Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

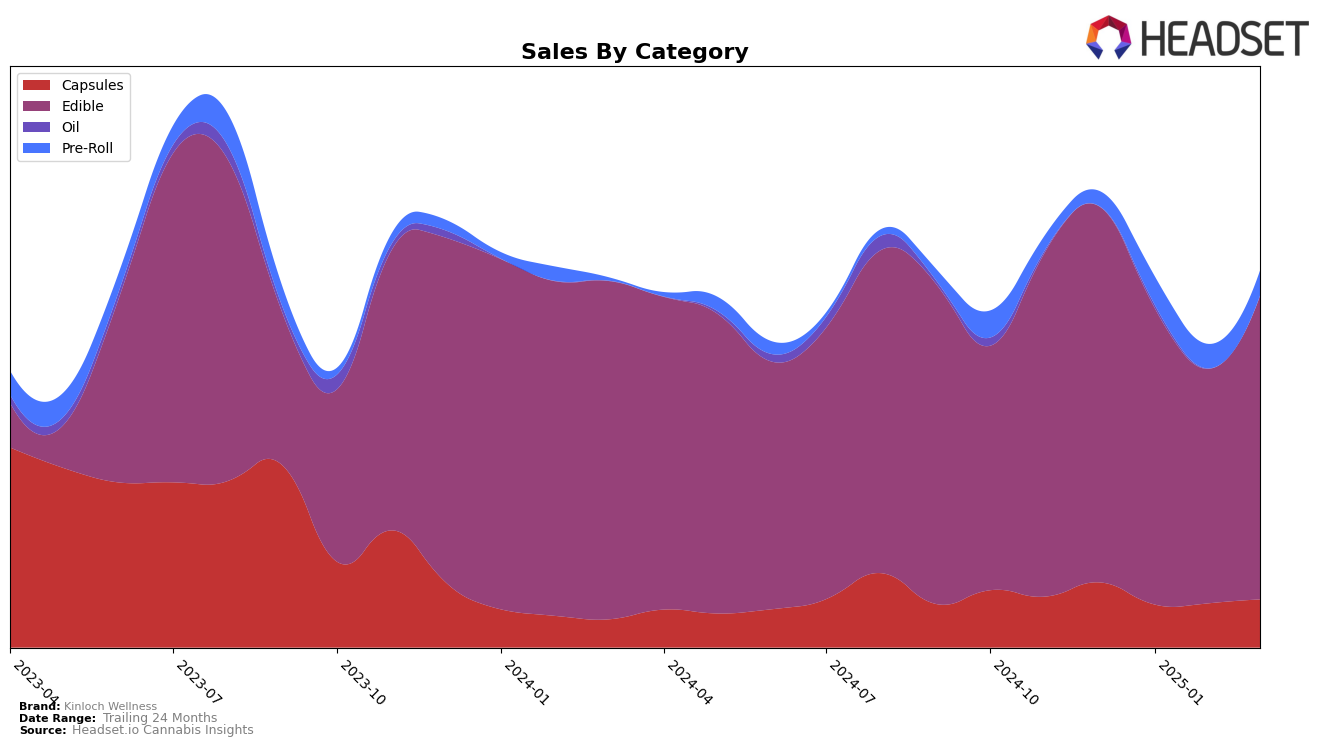

Kinloch Wellness has shown a consistent presence in the Ontario market within the Edible category, maintaining a steady rank around the 21st and 22nd positions from December 2024 to March 2025. Despite a noticeable dip in sales from December 2024 to February 2025, the brand managed to recover some ground by March 2025. This suggests a resilience in consumer demand or perhaps successful adjustments in their marketing or distribution strategies. The fact that Kinloch Wellness remained in the top 30 throughout this period highlights its stable foothold in the Ontario Edible market.

However, the absence of Kinloch Wellness from the top 30 rankings in other states and categories indicates potential areas for growth or challenges in market penetration. This could be seen as a limitation in their current market strategy or an opportunity for expansion into new regions or product lines. The consistent rankings in Ontario suggest a strong brand presence there, but the lack of similar performance elsewhere might point to regional preferences or competitive pressures that the brand has yet to overcome. Understanding these dynamics can provide insights into where Kinloch Wellness might focus its efforts to achieve broader market success.

Competitive Landscape

In the competitive landscape of the Edible category in Ontario, Kinloch Wellness has experienced fluctuations in its ranking, moving between 21st and 22nd place from December 2024 to March 2025. This indicates a relatively stable position amidst a competitive market. Notably, Lord Jones consistently held the 20th rank, suggesting a stronger market presence with sales figures notably higher than Kinloch Wellness. Meanwhile, San Rafael '71 maintained its 18th rank, reflecting a robust performance with sales significantly surpassing those of Kinloch Wellness. On the other hand, Vacay and Spot showed similar ranking patterns to Kinloch Wellness, with Vacay occasionally dropping to 22nd, indicating potential opportunities for Kinloch Wellness to capitalize on any market shifts. The data suggests that while Kinloch Wellness is holding its ground, there is room for strategic initiatives to enhance its market position and close the gap with higher-ranked competitors.

Notable Products

In March 2025, the top-performing product for Kinloch Wellness was the Serene™- CBD Green Apple Gummy 30-Pack, maintaining its first-place ranking consistently since December 2024, with sales reaching 838 units. The Refresh - CBD:CBG 1:1 Mango Gummies 4-Pack climbed to second place, up from third in February 2025, showing a notable increase in sales. The CBN:CBD Softgels 4-Pack dropped to third place, despite previously holding the second position in the prior months. The Refresh - CBD:CBG 1:1 Mango Gummies 15-Pack maintained its fourth-place rank, while the CBZ™ CBN:CBD Pomegranate Berry Gummy 4-Pack entered the top five for the first time. Overall, the Edible category dominated the rankings, with significant shifts in product popularity and sales figures.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.