Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

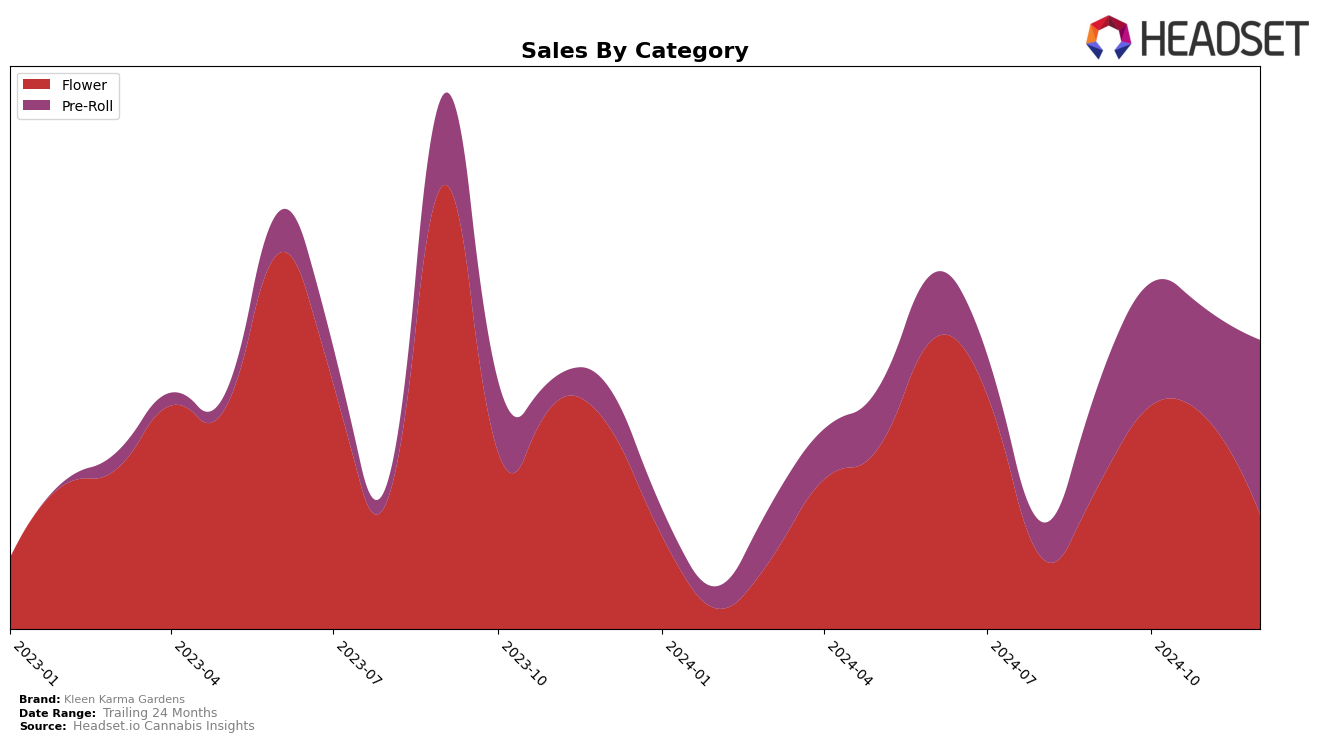

Kleen Karma Gardens has shown varied performance across its product categories in Oregon. In the Flower category, the brand experienced a notable fluctuation in its rankings, starting from 75th place in September 2024 and reaching 47th in October, before sliding back to 72nd by December. This movement indicates a volatile market presence that might be influenced by seasonal trends or competitive pressures. Despite a significant spike in sales in October, the brand struggled to maintain its momentum, which could suggest challenges in sustaining consumer interest or supply chain issues.

Conversely, in the Pre-Roll category, Kleen Karma Gardens demonstrated a more consistent upward trajectory. It improved from 43rd place in September to a commendable 28th by December. This steady rise in rankings, paired with an increase in sales, highlights a strengthening position in the pre-roll segment, which may be attributed to successful marketing strategies or product innovations. The absence of a top-30 ranking in the Flower category during these months suggests room for growth and a potential area to focus efforts on enhancing brand visibility and competitiveness.

Competitive Landscape

In the competitive landscape of the Oregon pre-roll category, Kleen Karma Gardens has shown a notable upward trajectory in its rankings over the last few months of 2024. Starting from a rank of 43 in September, Kleen Karma Gardens improved to 28 by December, indicating a significant climb amidst strong competition. This positive trend in rank is mirrored by a substantial increase in sales, particularly in December, where sales peaked, suggesting successful market penetration and consumer acceptance. Compared to competitors like Grown Rogue and Smokes / The Grow, which saw fluctuating ranks and a decline in sales towards the end of the year, Kleen Karma Gardens' consistent improvement is noteworthy. Meanwhile, Emerald Extracts experienced a significant jump in December, but their overall sales were lower than Kleen Karma Gardens, indicating that while they may have had a strong finish, they did not maintain consistent sales throughout the period. Similarly, National Cannabis Co. closely follows Kleen Karma Gardens in rank and sales, suggesting a tight competition. Overall, Kleen Karma Gardens' strategic advancements have positioned it favorably against its competitors in the Oregon pre-roll market.

Notable Products

In December 2024, the top-performing product from Kleen Karma Gardens was the Apple MAC Gelato Pre-Roll 2-Pack (2g), which climbed to the number one rank with impressive sales of 3349 units. This product showed consistent improvement, rising from third place in September to second in both October and November before reaching the top spot. The Super Boof Pre-Roll 2-Pack (2g) maintained a strong presence, holding the second position in December after leading in the previous months. Death Star Pre-Roll 2-Pack (2g) made a notable re-entry into the rankings, securing third place after being unranked in October and November. Lastly, Blueberry #4 Pre-Roll 2-Pack (2g) ranked fourth, showing a resurgence from its third-place position in October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.