Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

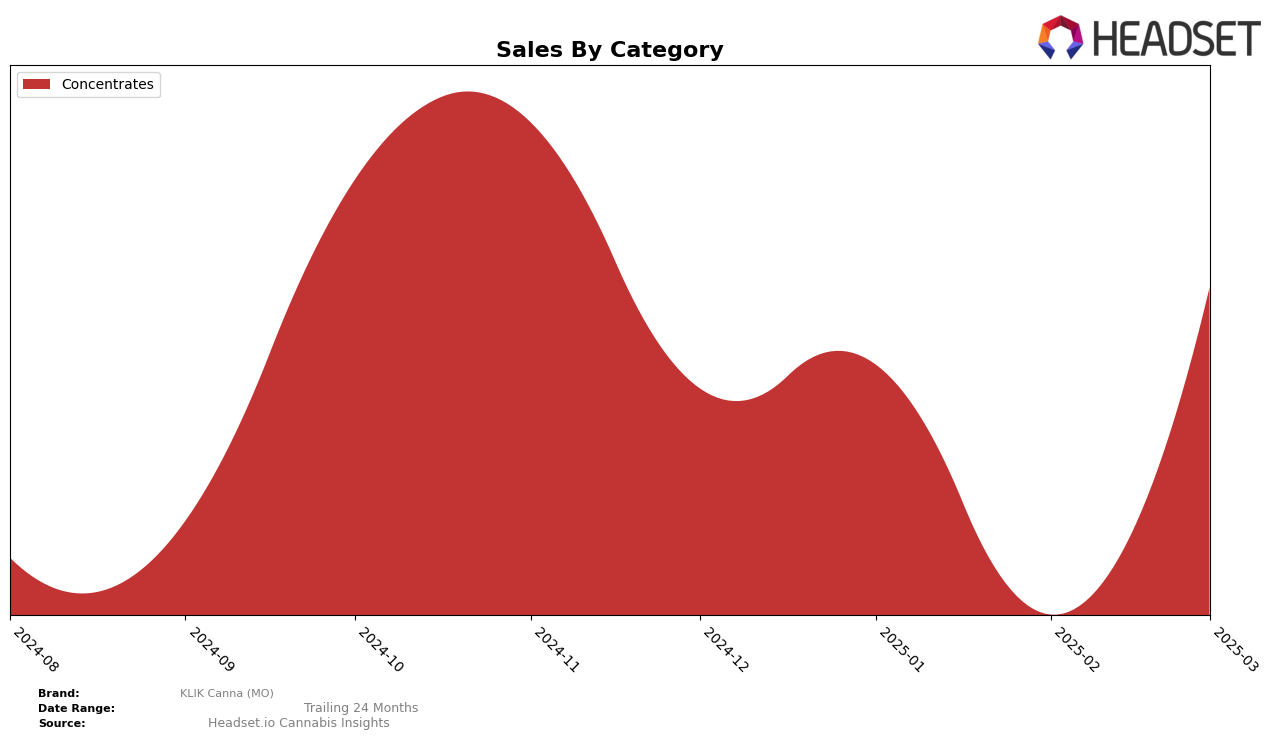

KLIK Canna (MO) has shown a consistent presence in the New Jersey concentrates market over the past few months. The brand maintained its position within the top 11 rankings from December 2024 to March 2025, with a slight dip in February where it held steady at the 11th spot. Despite the fluctuation in rankings, KLIK Canna (MO) experienced a notable increase in sales from February to March, suggesting a potential rebound or successful marketing strategy during that period. This consistent ranking in a competitive market like New Jersey reflects a steady demand for their products.

While KLIK Canna (MO) has managed to keep a foothold in the New Jersey concentrates category, the absence of rankings in other states or categories highlights areas for potential growth or concern. The lack of presence in the top 30 in other regions could suggest a focus on maintaining and growing their market share in New Jersey, possibly due to strategic reasons or market conditions. This selective market performance could be a calculated approach or an area that requires further exploration to understand the brand's overall strategy and market dynamics.

Competitive Landscape

In the competitive landscape of the New Jersey concentrates market, KLIK Canna (MO) has shown resilience despite fluctuating ranks. From December 2024 to March 2025, KLIK Canna (MO) maintained a consistent presence in the top 20, with ranks ranging from 10th to 11th. This stability is notable, especially when compared to competitors like Black Label Brand, which improved its rank from 12th to 8th, and ONYX (NJ), which consistently ranked higher. Despite a dip in sales in February 2025, KLIK Canna (MO) rebounded in March, indicating a potential upward trend. Meanwhile, Avexia and HAZE experienced declines in both rank and sales, suggesting that KLIK Canna (MO) could capitalize on their downward momentum to capture more market share.

Notable Products

In March 2025, the top-performing product for KLIK Canna (MO) was Yum Yum RSO (1g) in the Concentrates category, climbing to the number one spot with a notable sales figure of 828. Philly Special RSO (1g) followed closely in the second position, showing a strong performance with sales of 727. Banana Muffin RSO Syringe (1g) entered the rankings for the first time, securing the third spot. Strawberry Cough RSO (1g) maintained a consistent presence, ranking fourth, while Ice Cream Candy RSO (1g) experienced a drop to fifth place from its previous top positions in December and January. The changes in rankings highlight a dynamic shift in consumer preferences within the Concentrates category over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.