Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

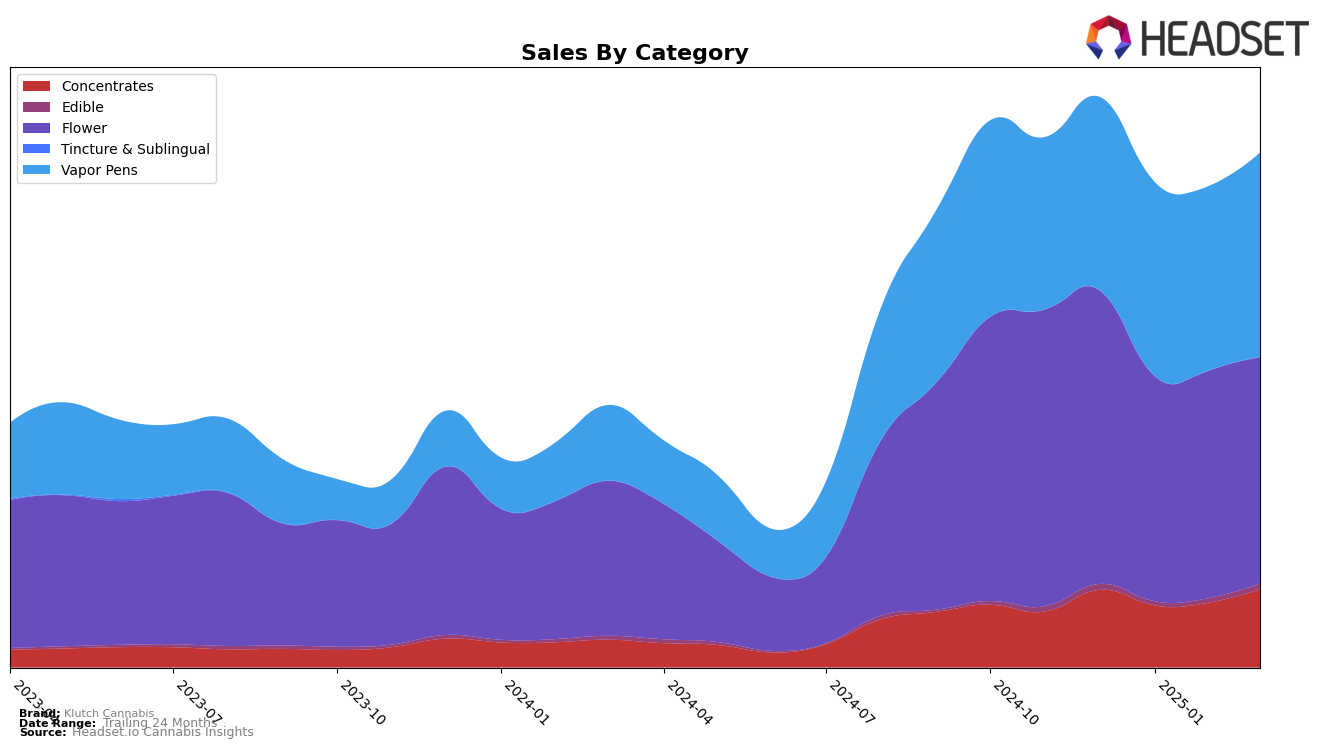

Klutch Cannabis has demonstrated a strong performance in the Ohio market, particularly in the Concentrates category where it has consistently held the top spot from December 2024 through March 2025. This sustained leadership suggests a robust demand and consumer preference for their concentrates over other brands. In the Flower category, Klutch Cannabis has maintained a steady third-place ranking over the same period, indicating a stable market presence, though there seems to be room for growth if they aim to ascend to the top. Meanwhile, their sales figures in the Vapor Pens category show a slight dip in ranking from first to second place in March 2025, which could signal increased competition or shifting consumer preferences in that segment.

Interestingly, Klutch Cannabis does not appear in the top 30 brands for any categories outside of Ohio, which could be interpreted as a potential area for expansion or a strategic focus primarily on the Ohio market. The brand's ability to maintain top positions in multiple categories within a single state suggests a strong local brand presence and consumer loyalty. However, their absence in other states' rankings might indicate either a lack of distribution or market penetration beyond Ohio, or possibly a strategic decision to concentrate efforts where they are already dominant. This could present both a challenge and an opportunity for Klutch Cannabis as they consider future growth strategies.

Competitive Landscape

In the Ohio flower market, Klutch Cannabis consistently maintained its position at rank 3 from December 2024 through March 2025, indicating a stable performance amidst a competitive landscape. Despite this consistency, Klutch Cannabis faces strong competition from Rythm, which held the top rank throughout the same period, and Riviera Creek, which secured the second position. Both competitors demonstrated robust sales figures, with Rythm showing a notable upward trend in sales, further solidifying its leading position. Meanwhile, Seed & Strain Cannabis Co. showed significant improvement, climbing from rank 12 in December 2024 to rank 5 by March 2025, indicating a potential threat to Klutch Cannabis's market share. As Klutch Cannabis continues to hold its ground, the brand must strategize to enhance its competitive edge and capture more market share in this dynamic environment.

Notable Products

In March 2025, Orange 43 (2.83g) maintained its position as the top-performing product for Klutch Cannabis, with sales reaching 32,499 units. Ice Cream Cake (2.83g) consistently held the second rank across all months, although its sales dipped compared to February. Lemon Slushee (2.83g) climbed to the third spot from its previous fourth rank in February, showing a notable increase in sales. Orange 43 Co2 Luster Pod (1g) experienced a slight drop in ranking to fourth, despite a small increase in sales from February. Ice Cream Cake Live Resin Luster Pod (1g) entered the top five for March, although it saw a decrease in sales from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.