Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

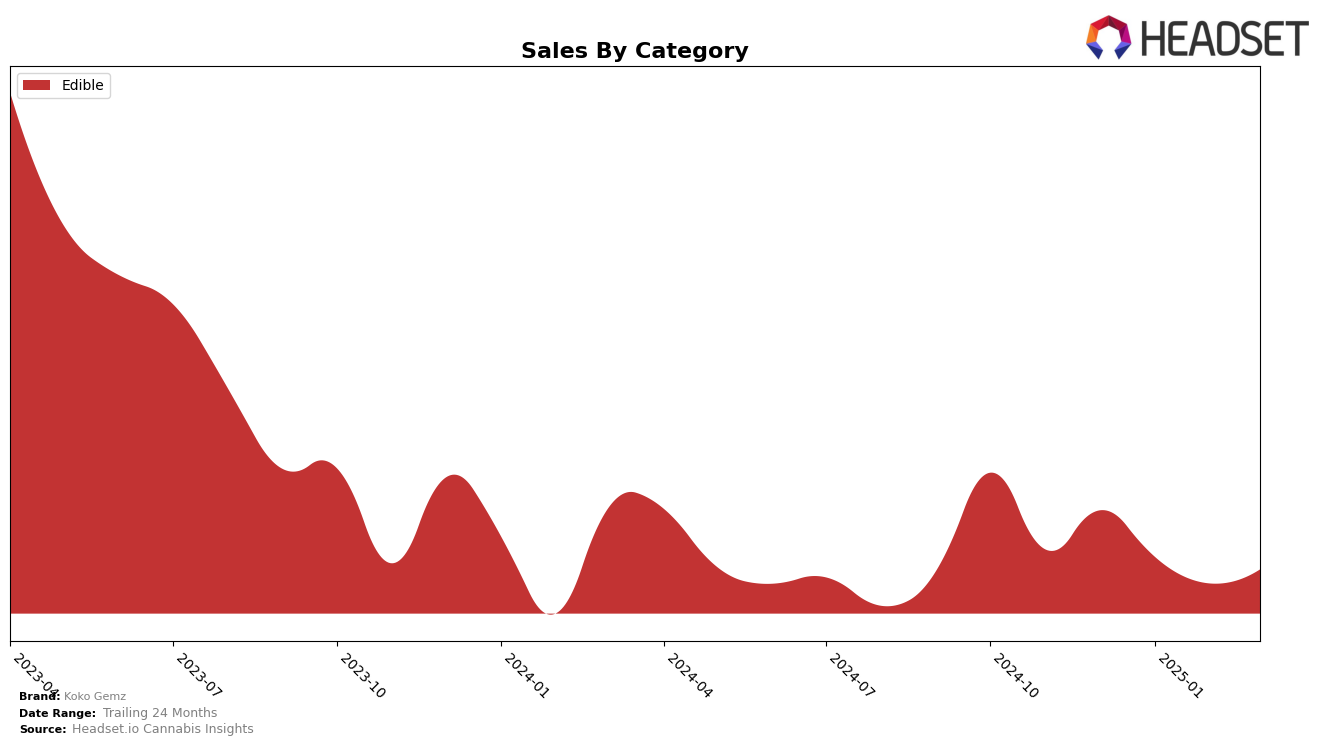

In the state of Massachusetts, Koko Gemz has been making strides in the Edible category, although they have yet to break into the top 30 rankings. Their rankings in December 2024 and January 2025 were 69th and 66th, respectively, indicating a slight upward movement. While this suggests some positive momentum, the brand has not sustained this into February and March 2025, as they are not present in the top 30 list. This absence might suggest a need for strategic adjustments to maintain and improve their market position in Massachusetts.

Conversely, Koko Gemz has shown a more consistent performance in the Washington Edible market. They have maintained a steady presence within the top 25 from December 2024 through March 2025, with rankings of 25th, 23rd, 23rd, and 24th, respectively. This stability highlights their established presence and potential customer loyalty in Washington. Notably, while their sales saw a dip in January 2025, they rebounded in February, indicating resilience and adaptability in a competitive market. This consistent ranking in Washington could serve as a model for their strategy in other states.

Competitive Landscape

In the competitive landscape of the Washington edible cannabis market, Koko Gemz has shown a dynamic performance from December 2024 to March 2025. Initially ranked 25th in December, Koko Gemz improved its position to 23rd in January and February, before slightly dropping to 24th in March. This fluctuation in rank reflects a competitive environment where brands like Swell Edibles consistently maintain higher ranks, holding the 21st and 22nd positions throughout the period. Despite the competition, Koko Gemz's sales figures indicate a resilient performance, with a notable increase in February, although not enough to surpass Hi-Burst, which consistently ranks just above Koko Gemz. The data suggests that while Koko Gemz is a strong contender, it faces stiff competition from brands like June's Sweets & Savories and Agro Couture, which are closely trailing in rank and sales, indicating a need for strategic marketing efforts to enhance its market position.

Notable Products

In March 2025, the Milk Chocolate Bite 10-Pack (100mg) reclaimed its position as the top-performing product for Koko Gemz, with sales reaching 895 units. Following closely, the Cookies N' Cream Chocolate Bites 10-Pack (100mg) held the second spot, slipping from its previous first-place rank in January and February. The Mint Dark Chocolate 10-Pack (100mg) improved its position to third place, showing a consistent rise from fifth in January. Milk Chocolate With Sea Salt Truffles Bites 10-Pack (100mg THC, 1.98oz) maintained a stable performance, ranking fourth, which is a slight drop from its third-place position in January and February. The Peanut Butter Milk Chocolate 10-Pack (100mg) made its debut in fifth place, showing promising potential for future months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.