Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

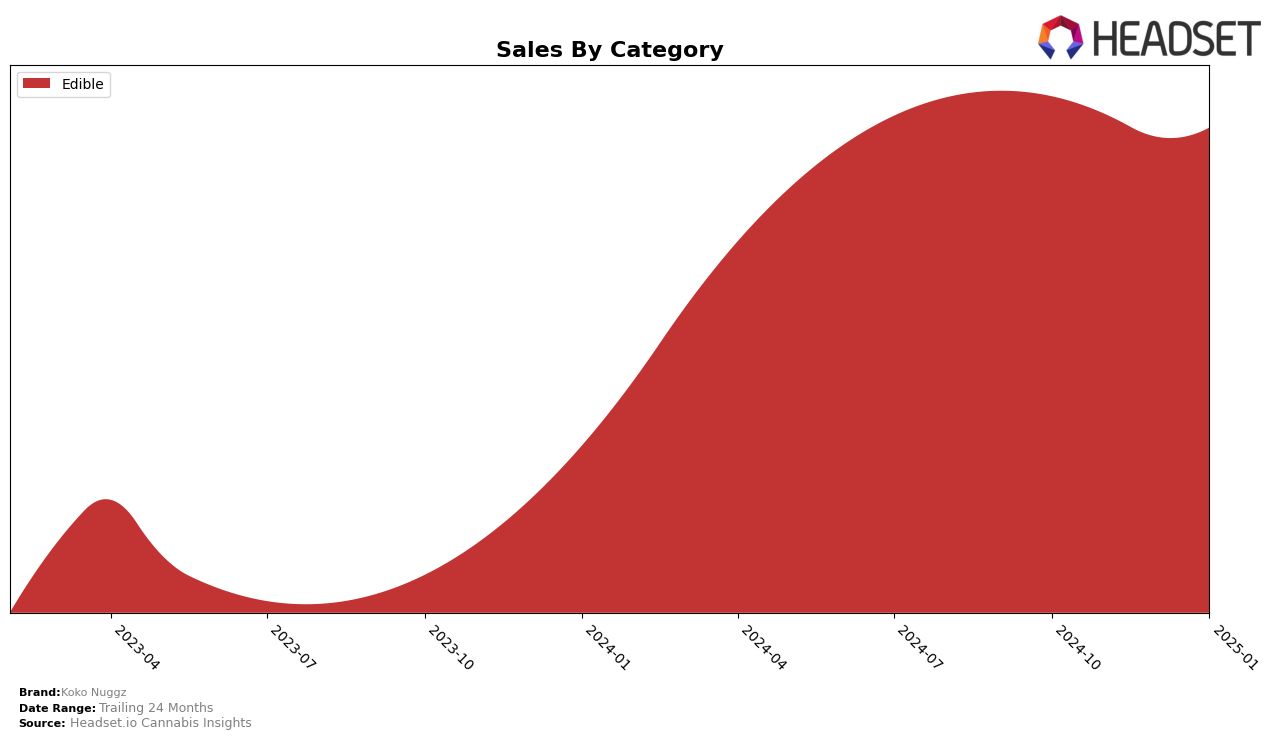

Koko Nuggz has shown a noteworthy trajectory in the Edible category in New York. Starting from outside the top 30 in October 2024, the brand made a significant leap to rank 32 in November. This upward movement continued as Koko Nuggz climbed to the 26th position in December, before slightly dropping to 27th in January 2025. Despite the minor setback in January, the brand's ability to break into the top 30 is a positive indicator of its growing presence in the competitive New York market. The sales figures also reflect a stable performance, with a slight fluctuation over the months, suggesting a consistent demand for Koko Nuggz products in the region.

While Koko Nuggz has made strides in New York, it is important to note that the brand did not feature in the top 30 rankings for October 2024, which could be seen as a challenge or an opportunity for growth. The absence from the rankings during this month highlights the competitive nature of the Edible category in New York and suggests that Koko Nuggz faced significant competition. However, the subsequent improvement in rankings indicates a positive reception and adaptation to market demands. This trend could potentially be leveraged to gain further insights into consumer preferences and enhance the brand's strategy in other states and categories.

Competitive Landscape

In the competitive landscape of the edible cannabis market in New York, Koko Nuggz has shown a fluctuating presence, with its rank improving from being outside the top 20 in October 2024 to 27th by January 2025. This improvement in rank coincides with a relatively stable sales performance, indicating a potential increase in market penetration. In contrast, Nanticoke experienced a more volatile journey, with ranks oscillating between 25th and 31st, but ultimately surpassing Koko Nuggz in January 2025. Pure Vibe maintained a consistent presence, generally ranking higher than Koko Nuggz, though its sales saw a downward trend by January 2025. Meanwhile, FINCA started strong in October 2024 but dropped to a rank similar to Koko Nuggz by January 2025, suggesting potential vulnerabilities. Lastly, The Green Lady Dispensary hovered around the same rank as Koko Nuggz, indicating a closely matched competition. These dynamics suggest that while Koko Nuggz is gaining traction, it faces stiff competition from both established and fluctuating brands, emphasizing the need for strategic marketing and product differentiation to enhance its market position.

Notable Products

In January 2025, the top-performing product for Koko Nuggz was the Churro Cocoa Covered Crispy Treats 10-Pack (100mg), which climbed to the number one rank with sales of 300 units. The White Runtz Marshmallow Cocoa Covered Cereal Treats 10-Pack (100mg) secured the second position, showing a significant rise from fourth place in December 2024. The Peanut Butter Cocoa Covered Cereal Treats 10-Pack (100mg) maintained its steady performance, consistently holding the third rank over the past three months. Red Velvet Cocoa Covered Crispy Treats 10-Pack (100mg) improved its position, moving up to fourth place from fifth in the previous month. Meanwhile, the Chocolate Chip Cocoa Covered Crispy Treats 10-Pack (100mg) experienced a drop, falling from the top position in November and December to fifth place in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.