Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

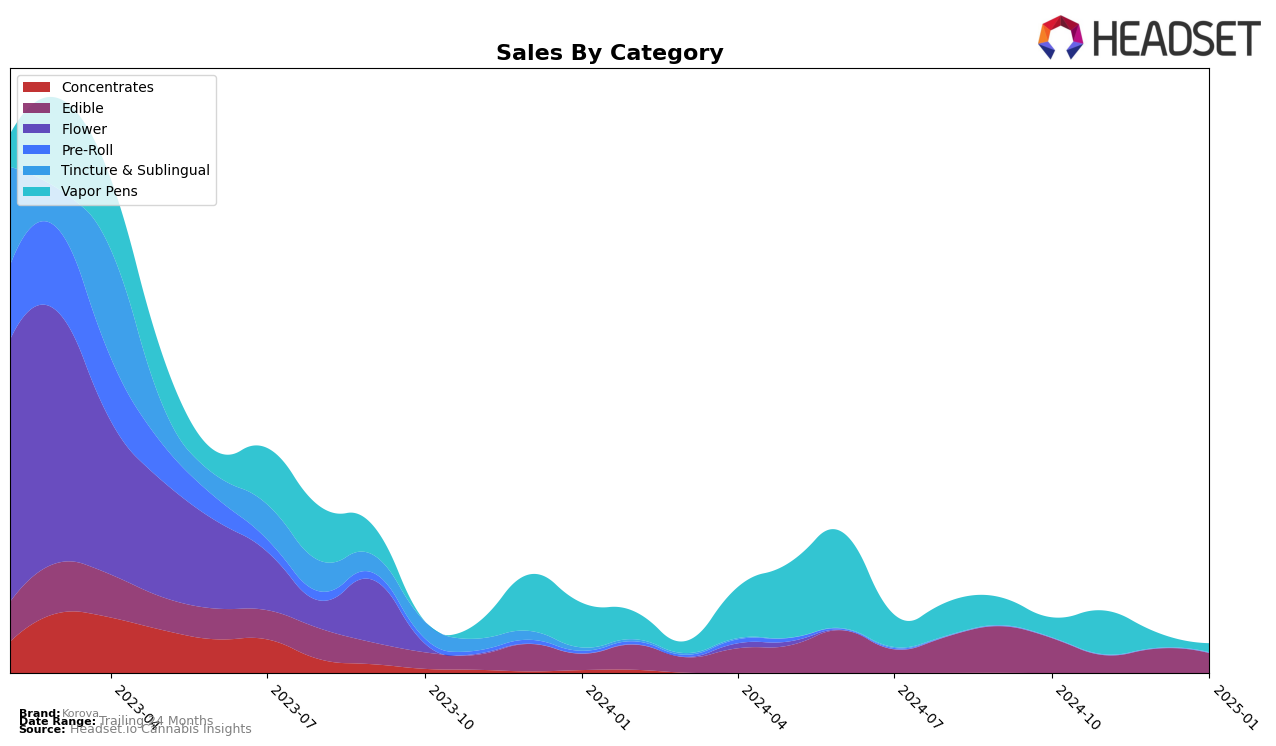

Korova's performance in the Edible category in California has seen some fluctuations over the recent months. Notably, the brand did not break into the top 30 rankings from October 2024 to January 2025, with ranks hovering around the mid-60s. This indicates a competitive market where Korova is struggling to gain a foothold among the leading brands. Despite this, there was a slight improvement from November to December, suggesting potential for growth if the brand can capitalize on any upward trends.

The sales figures for Korova in California show a significant drop from October to November, with sales nearly halving. However, there was a recovery in December, although this was followed by another decline in January. This pattern of volatility suggests that Korova's market presence in the Edible category is currently unstable, and they may need to reassess their strategy to maintain consistent growth. The absence from the top 30 rankings during these months highlights the challenge Korova faces in increasing its market share amidst strong competition.

```Competitive Landscape

In the competitive landscape of the California edible market, Korova has experienced fluctuations in its rankings and sales over the past few months. Starting from October 2024, Korova was ranked 55th, but saw a decline to 66th in November, before slightly recovering to 62nd in December, and then dropping again to 67th in January 2025. This volatility is contrasted by Care By Design, which showed a steady improvement, climbing from 59th to 50th over the same period, indicating a potential shift in consumer preference. Meanwhile, Halfpipe Cannabis re-entered the top 20 in January at 56th, after not ranking in October and December, suggesting a resurgence in popularity. While Korova's sales figures have seen a downward trend from October to January, Care By Design has shown a consistent increase, potentially impacting Korova's market share. Understanding these dynamics can provide valuable insights for strategic adjustments in marketing and product offerings.

Notable Products

In January 2025, the top-performing product for Korova was the Mimosa Distillate Disposable (1g) in the Vapor Pens category, which ascended to the number one rank despite a decrease in sales to 160 units. The Pineapple Sorbet Distillate Disposable (1g) followed closely, ranking second after holding the top position in December 2024. The Hybrid Black Bar Brownie 20-Pack (1000mg) maintained a steady third-place ranking from the previous month. Notably, the Black Bar Brownie (100mg) entered the rankings at fourth place, while the Chocolate Chip Cookie (100mg) debuted at fifth. This shift in rankings highlights a strong performance in the Vapor Pens category, with a noticeable entry of new edible products in the top five for January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.