Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

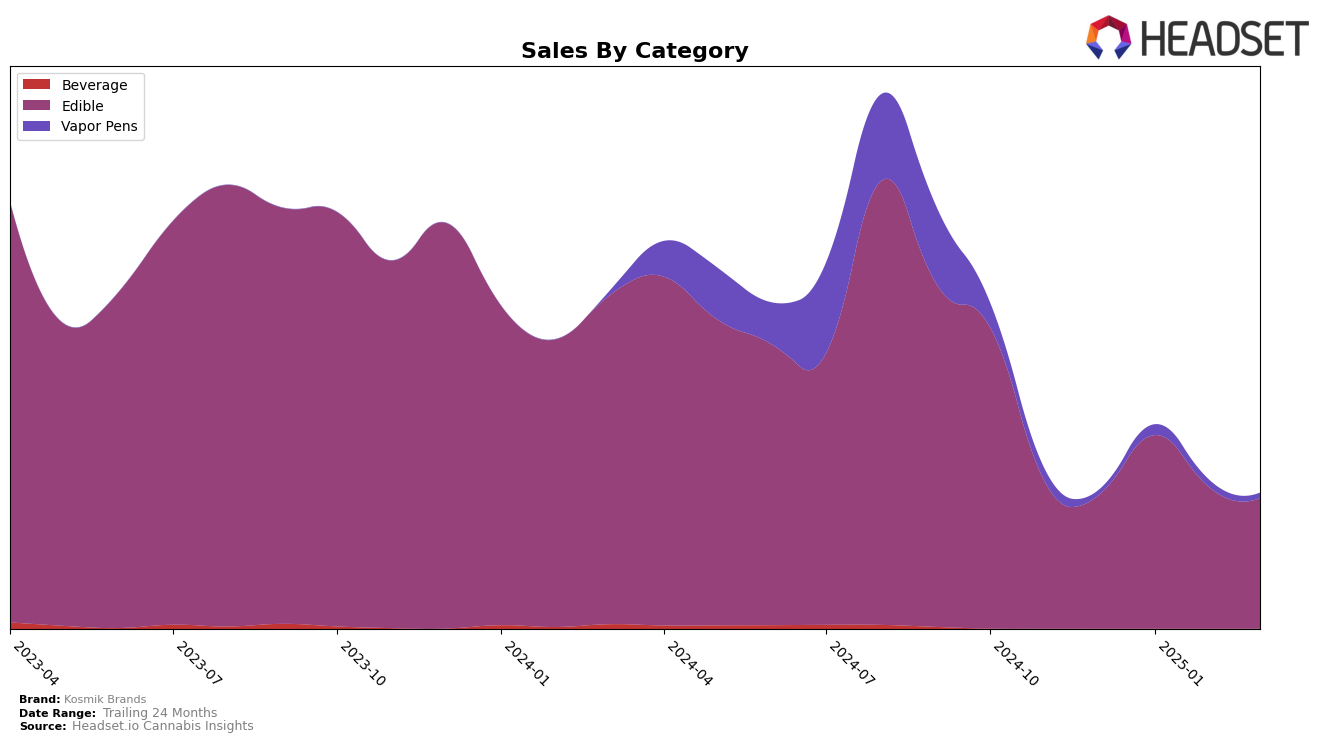

Kosmik Brands has shown notable performance in the Massachusetts market, particularly within the Edible category. While they did not break into the top 30 brands in December 2024 and January 2025, they managed to climb to the 33rd position by February, maintaining this rank through March. This upward trend is accompanied by a significant increase in sales, with a notable jump from February to March, indicating a strengthening presence in the market. However, their performance in the Vapor Pens category in Massachusetts is less impressive, as they only appeared in the rankings in January 2025 at the 87th position, suggesting potential challenges or a strategic focus elsewhere.

In Missouri, Kosmik Brands has demonstrated a more consistent performance in the Edible category. Starting at the 21st position in December 2024, the brand improved its rank to 14th in January 2025, although it experienced some fluctuations, dropping to 19th in February and returning to 21st in March. Despite these ranking changes, the sales figures reflect a strong market presence, particularly with the peak in January. The ability to maintain a top 30 position throughout the months suggests a solid foothold in the Missouri market, even as the brand experiences some volatility in its rankings.

Competitive Landscape

In the competitive landscape of the Missouri edible cannabis market, Kosmik Brands has experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Initially ranked 21st in December, Kosmik Brands improved significantly to 14th in January, indicating a strong start to the year. However, the brand's rank slipped back to 19th in February and further to 21st in March, suggesting challenges in maintaining its competitive edge. Despite these fluctuations, Kosmik Brands' sales in January were notably higher than in other months, reflecting a potential seasonal or promotional influence. In contrast, ROBHOTS and Curio Wellness consistently remained in the top 20, with Curio Wellness peaking at 12th in January, indicating stronger brand stability. Meanwhile, CODES and Plume Cannabis (MO) trailed behind, often ranking outside the top 20, which could present an opportunity for Kosmik Brands to capitalize on their weaker market positions. Overall, while Kosmik Brands shows potential, it faces stiff competition and must strategize to sustain and improve its market presence.

Notable Products

In March 2025, the top-performing product for Kosmik Brands was the THC/CBD/CBN Galaxzzz Gummies 20-Pack, which maintained its number one rank from February with notable sales of $1,318. Following closely, Blasters - Big Bang Berry Gummies 10-Pack climbed to second place, up from third in February. Black Hole - Orange Slices Gummy 10-Pack held steady in third place, consistent with its February ranking. Black Hole - Yellow Lemon Lime Gummy made an impressive debut at fourth place. Peanut Butter & Jelly Gummies 10-Pack dropped to fifth place from fourth in February, marking a decline in its ranking over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.