Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

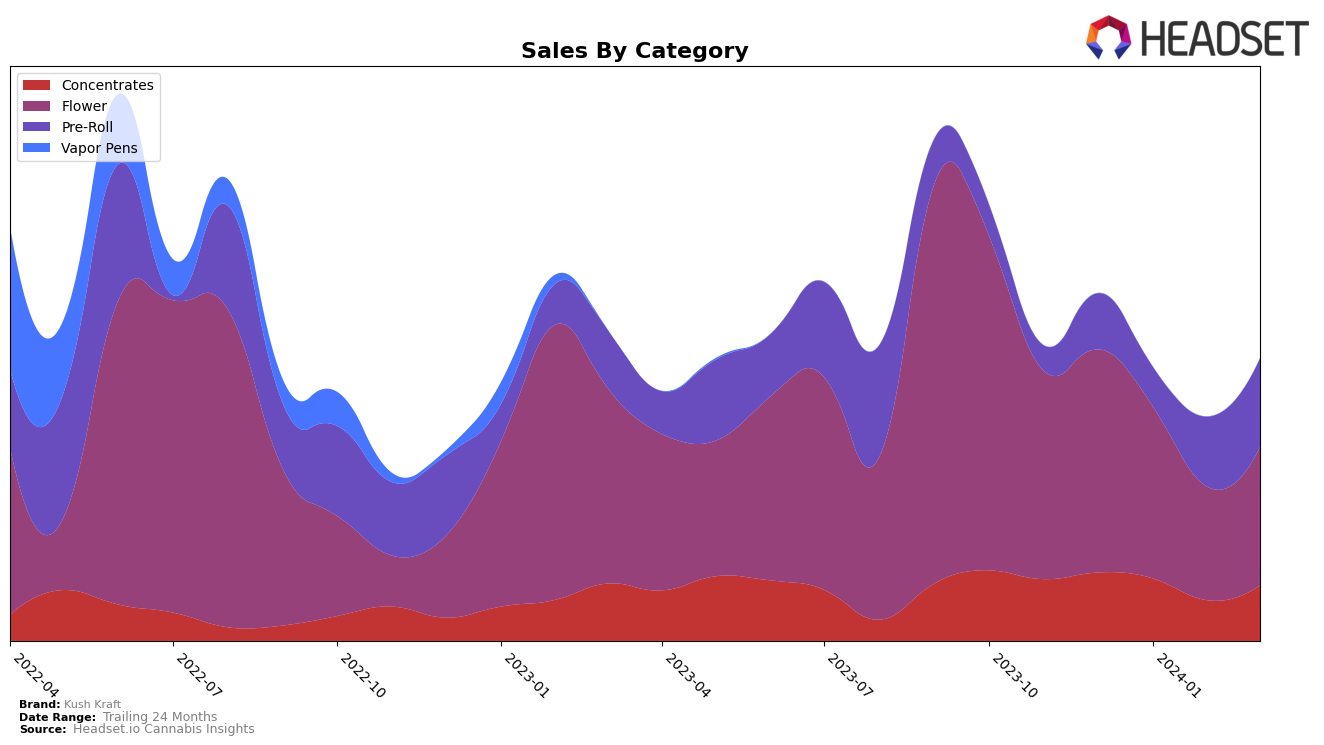

In the concentrates category, Kush Kraft has shown a diverse performance across the provinces of Ontario and Saskatchewan. In Ontario, the brand experienced a significant decline in rankings from 51st in December 2023 to 70th by February 2024, before slightly recovering to 59th in March. This trend is mirrored in their sales figures, which saw a sharp drop from December's $17,980 to just $5,468 in February, before partially rebounding in March to $9,759. Conversely, in Saskatchewan, Kush Kraft's performance in the concentrates category has been on an upward trajectory, improving from 36th in December to 20th by March, alongside a consistent increase in sales, culminating at $6,449 in March. This contrasting performance highlights the brand's potential for growth in certain markets, despite challenges in others.

For the flower category within Saskatchewan, Kush Kraft's rankings reveal a lack of presence in the top 30 brands for the months of February and March 2024, indicating a potential area of concern or strategic withdrawal from the market segment. Initially ranked 62nd in December 2023 and slightly improving to 66th in January 2024, the absence of subsequent rankings suggests a significant shift in the brand's market position or focus. Considering the sales figures began at $14,401 in December and slightly decreased to $13,903 in January, the lack of data for the following months may reflect a strategic pivot or challenges faced in maintaining market share within the highly competitive flower category. This absence from the top rankings underscores the importance of adaptability and market analysis for brands operating within the dynamic cannabis industry.

Competitive Landscape

In the competitive landscape of the concentrates category in Ontario, Kush Kraft has experienced notable fluctuations in its market position over the recent months. Initially ranked 51st in December 2023, Kush Kraft saw a slight improvement in January 2024, moving up to the 55th position, before experiencing a significant drop to the 70th rank in February 2024, and then partially recovering to the 59th position by March 2024. This volatility is particularly striking when compared to its competitors, such as Kolab, which maintained a more stable, albeit lower, ranking in the mid-50s to high 50s range during the same period. Similarly, Stigma Grow and EXKA (XK) showed less dramatic shifts in their rankings, suggesting a more consistent market performance. Notably, Pistol and Paris demonstrated a gradual decline in rank but remained ahead of Kush Kraft throughout the observed period. The significant drop in Kush Kraft's rank and sales in February 2024, followed by a partial recovery, highlights the brand's challenges and resilience in a competitive market. This fluctuation in Kush Kraft's performance, compared to the relatively steadier standings of its competitors, underscores the dynamic nature of the concentrates market in Ontario and suggests potential areas for Kush Kraft to strategize on stability and growth.

Notable Products

In March 2024, Kush Kraft's top-selling product was the Korean BBQ Pre-Roll 10-Pack (3.5g) from the Pre-Roll category, with sales reaching 724 units. The Hulkberry (7g) from the Flower category, previously leading in sales for the past three months, dropped to second place with a notable decrease in sales. Cake Face (3.5g), also in the Flower category, improved its ranking to third, showcasing a consistent upward trend in its sales figures. The Jeffrey- The Greek Infused Blunts 5-Pack (1.75g) from the Pre-Roll category maintained a strong presence in the top products, securing the fourth position. Lastly, the Mini Moons Hash 4-Pack (2g) from the Concentrates category made its debut in the top five, indicating a diversifying interest among Kush Kraft's product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.