Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

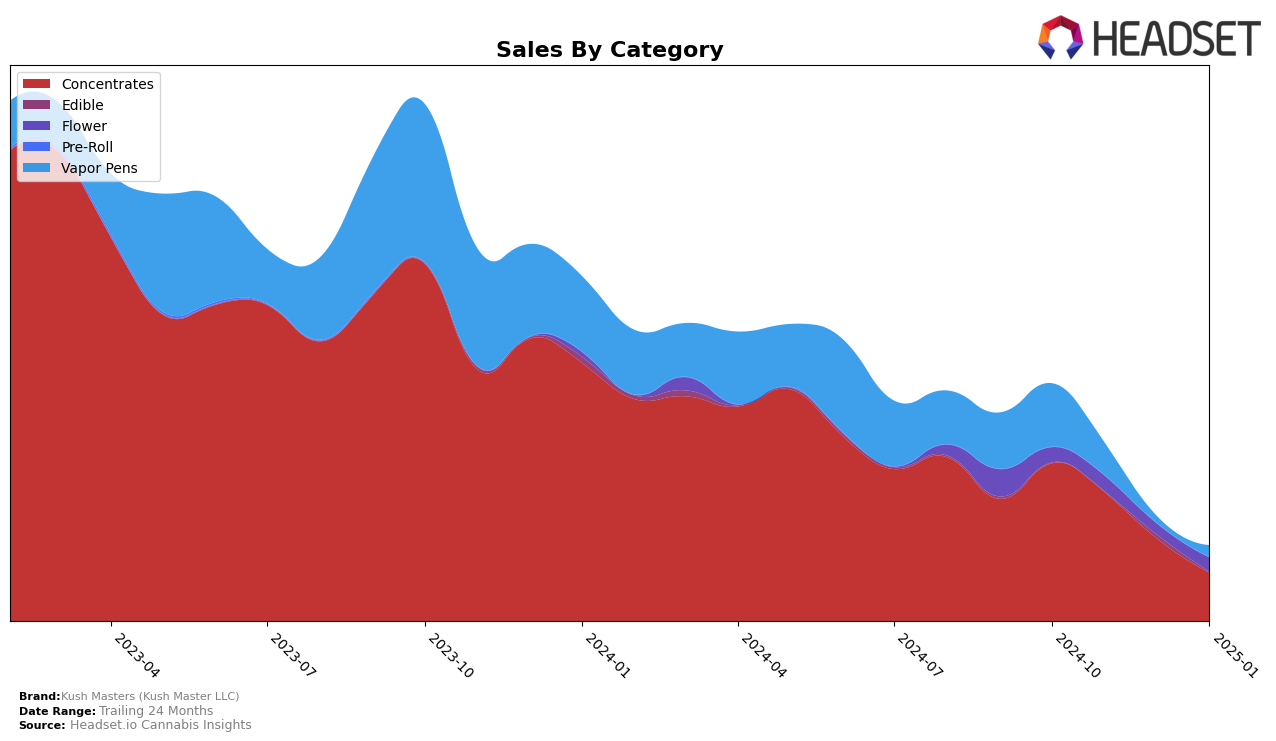

Kush Masters (Kush Master LLC) has shown varied performance across different product categories in Colorado. In the Concentrates category, the brand has experienced a noticeable decline in rankings, moving from 11th place in October 2024 to 25th by January 2025. This downward trend is accompanied by a significant drop in sales, indicating potential challenges in maintaining market share or competitive pricing. Conversely, in the Flower category, Kush Masters has managed to improve its position, climbing from 98th in October to 78th in January, suggesting a strengthening presence or a strategic pivot in this segment.

The Vapor Pens category presents a mixed picture for Kush Masters in Colorado. The brand was ranked 59th in October 2024 but saw a decline to 77th by January 2025, with a notable absence from the top 30 in December. This indicates fluctuating market dynamics or possibly supply chain issues affecting availability. Despite these challenges, the brand's resilience in the Flower category may hint at a strategic focus that could be leveraged to stabilize or grow its position in other product lines. Such insights suggest that while Kush Masters faces certain hurdles, there are areas of potential growth and opportunity within the Colorado market.

Competitive Landscape

In the competitive landscape of concentrates in Colorado, Kush Masters (Kush Master LLC) has experienced a notable decline in its market position from October 2024 to January 2025. Initially ranked 11th in October 2024, the brand saw a steady drop to 25th by January 2025. This downward trend in ranking is mirrored by a decrease in sales, indicating potential challenges in maintaining market share. In contrast, competitors such as Nuhi and Mile High Dabs have shown more stable or improving positions, with Mile High Dabs climbing from 35th to 24th in the same period. This suggests that while Kush Masters is facing headwinds, other brands are capitalizing on market opportunities, potentially drawing customers away. Understanding these dynamics and the strategies employed by rising competitors could provide valuable insights for Kush Masters to regain its competitive edge.

Notable Products

In January 2025, Death by Mimosa (Bulk) emerged as the top-performing product for Kush Masters (Kush Master LLC), reclaiming its number one rank with notable sales of 1732 units. Pillow Talk #5 (Bulk) slipped to the second position from its previous top spot in December 2024. Kush Masters Shatter Bucket (4g) made its entry into the rankings at third place, indicating a rising trend in concentrates. Both Goat Fruit Wax (1g) and Kush Mints Live Rosin (1g) shared the fourth position, suggesting a competitive landscape within the concentrates category. This shift in rankings highlights a growing consumer interest in diverse product offerings from Kush Masters.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.