Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

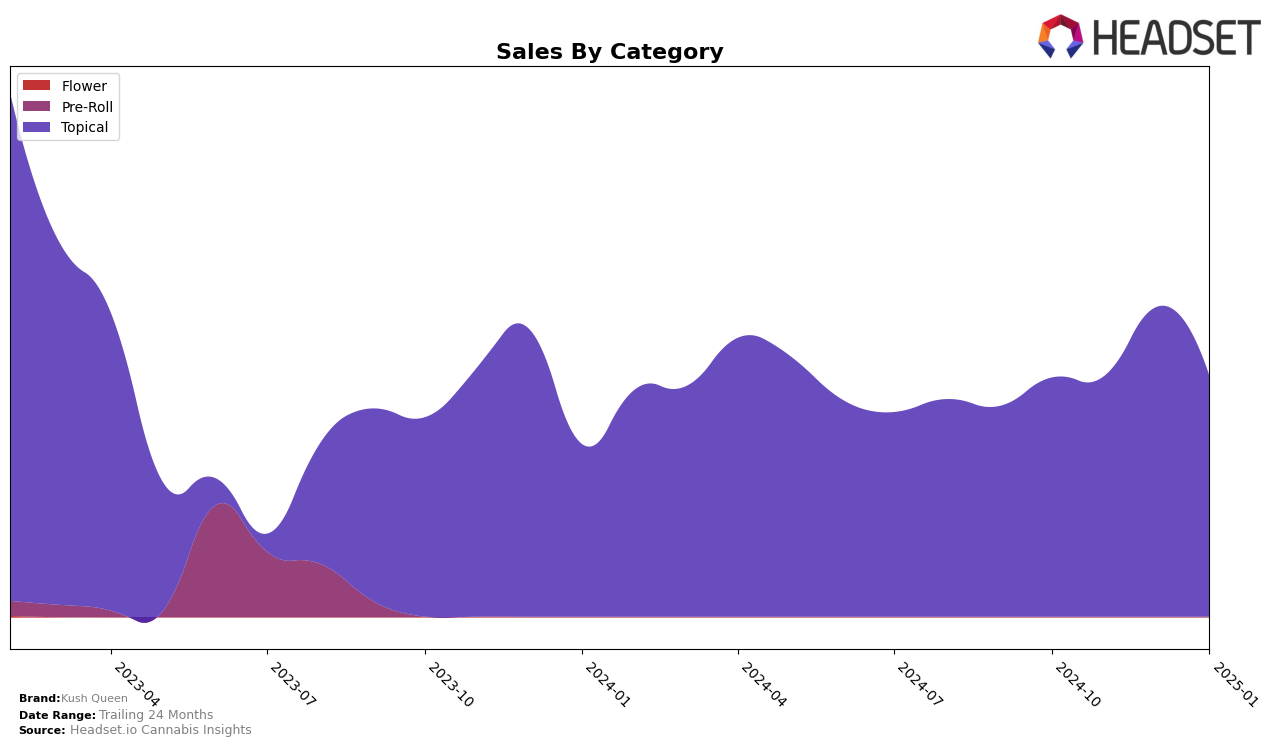

Kush Queen has shown a consistent performance in the California market within the Topical category. The brand maintained its position at 8th place in both October and November of 2024, before climbing to 7th place in December and maintaining that rank in January 2025. This upward movement in rankings indicates a strengthening presence in the market, particularly notable as the brand's sales saw a significant increase in December before stabilizing in January. Such stability in a competitive market like California suggests a robust consumer base and effective market strategies.

While Kush Queen's performance in California is commendable, it is important to note that the brand's visibility in other states or provinces is not highlighted, as it did not make it into the top 30 brands in those regions. This could be seen as a challenge or an opportunity for the brand to expand its reach and adapt its strategies to penetrate other markets. For those interested in the specifics of Kush Queen's performance and strategies in other regions or categories, further detailed data analysis would be necessary to uncover potential growth areas and competitive dynamics.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Kush Queen has demonstrated a steady performance with a consistent improvement in rank from October 2024 to January 2025, moving from 8th to 7th place. This upward trend is notable, especially when compared to competitors like High Desert Pure, which maintained a stable 9th position, and Liquid Flower, which experienced a decline from 6th to 8th place over the same period. Despite the competitive pressure from brands like Care By Design and Sweet ReLeaf (CA), which consistently ranked higher, Kush Queen's sales saw a significant boost in December 2024, indicating a potential for further growth. This suggests that while Kush Queen is currently trailing behind some of its competitors in terms of rank, its sales trajectory is promising, positioning it as a brand to watch in the coming months.

Notable Products

In January 2025, the top-performing product for Kush Queen was the CBD/THC 1:1 Relax Bath Bomb (25mg CBD, 25mg THC, 8oz), maintaining its number one rank with sales of 878 units. The CBD/THC 1:1 Relieve Bath Bomb (25mg CBD, 25mg THC, 8oz) consistently held the second position across the months, although its sales saw a decrease from December 2024. The CBD/THC 1:1 Sleep Bath Bomb (25mg CBD, 25mg THC) remained third, with stable sales figures compared to the previous month. The CBD/THC 1:1 Awaken Bath Bomb (25mg CBD, 25mg THC) also retained its fourth-place ranking, with a slight decline in sales from December. Lastly, the CBD/THC 1:1 Shield Bath Bomb (25mg CBD, 25mg THC) continued to hold the fifth position, experiencing a decrease in sales over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.