Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

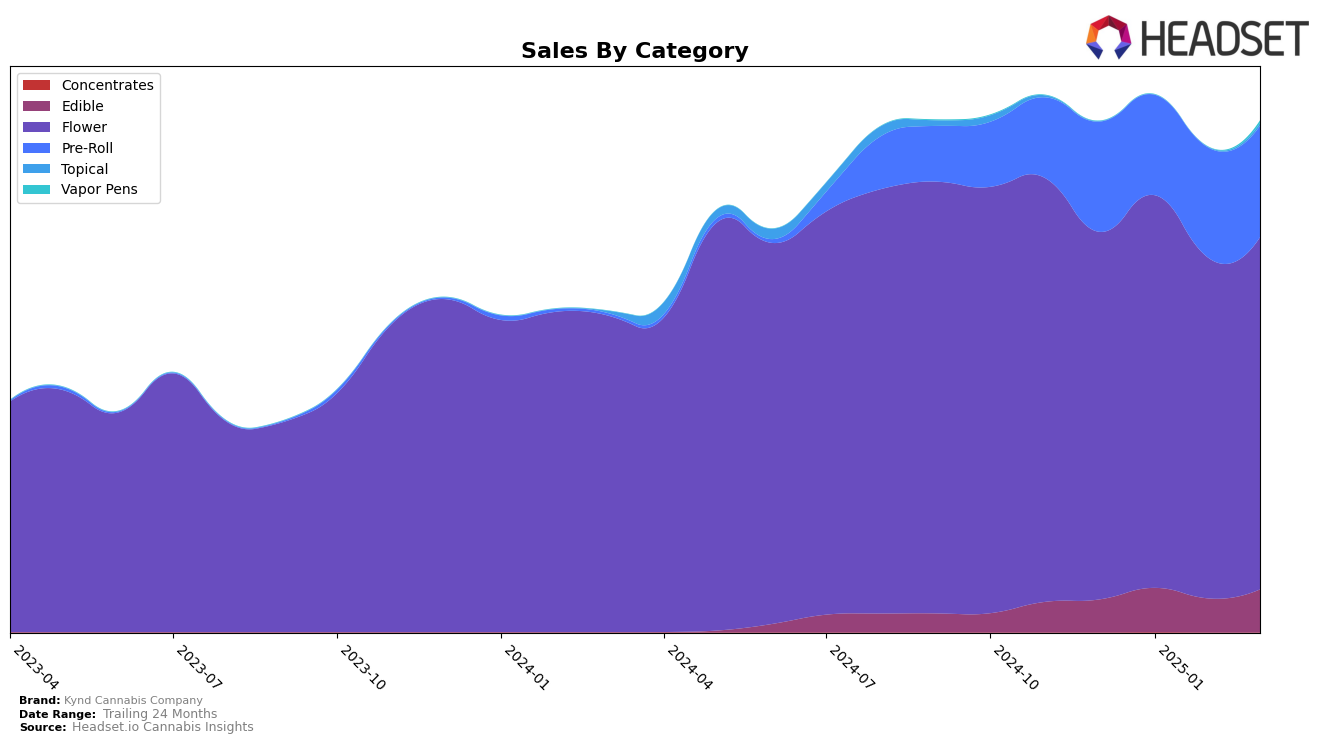

Kynd Cannabis Company's performance across various states and categories reveals interesting trends and shifts in market presence. In Massachusetts, the brand has shown a consistent presence in the Flower category, maintaining top 11 positions from December 2024 through March 2025, with a slight dip to the 10th position in March. The Pre-Roll category in Massachusetts also saw a significant upward trend, moving from the 32nd position in December 2024 to a high of 15th in February 2025, before settling at 18th in March. However, the Edible category in Massachusetts only broke into the top 30 by February 2025, indicating a slower growth trajectory compared to their Flower and Pre-Roll products.

In New Jersey, Kynd Cannabis Company experienced some fluctuations. The Edible category saw a drop from the 20th position in January 2025 to 26th in February, before a slight recovery to 25th in March. This indicates potential volatility in consumer preferences or competitive pressures. Meanwhile, their Flower category ranking improved to 26th in March 2025, a positive sign after slipping out of the top 30 in February. In Nevada, the Pre-Roll category remains strong, consistently ranking within the top 11, peaking at 6th in December 2024, and maintaining a top 10 position thereafter. This stability in Nevada contrasts with the more variable performance in Ohio, where the Flower category saw a decline from 24th in January 2025 to 30th by March, suggesting a need for strategic adjustments in that market.

Competitive Landscape

In the competitive Massachusetts flower market, Kynd Cannabis Company has shown a steady performance, maintaining a consistent rank between 9th and 11th from December 2024 to March 2025. This stability is noteworthy given the dynamic nature of the market. Notably, Glorious Cannabis Co. has been a strong competitor, consistently ranking higher than Kynd, although its sales have shown a slight downward trend. Meanwhile, Find. has fluctuated in rank, dropping to 11th in February 2025 but rebounding to 8th in March, indicating potential volatility. Eleven and Bostica have also been close competitors, with Eleven closely trailing Kynd in March 2025. Despite these challenges, Kynd's ability to climb to 9th in February 2025 suggests a positive trajectory in sales performance, positioning it well against these competitors.

Notable Products

In March 2025, N.Y. Sour Diesel (3.5g) maintained its top position in the Flower category for Kynd Cannabis Company, despite a slight dip in sales to 7227.0. Double Mintz (3.5g) climbed back to the second rank after briefly slipping to third in February, showing resilience in its performance. Sherbert Sundae (3.5g) secured the third spot, having re-entered the rankings after a hiatus in February. British Bakeoff (3.5g) experienced a drop to fourth place, reflecting a decrease from its peak second position in February. Notably, GMO x Grease Monkey Pre-Roll (1g) made its debut in the rankings at fifth place, highlighting its growing popularity among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.