Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

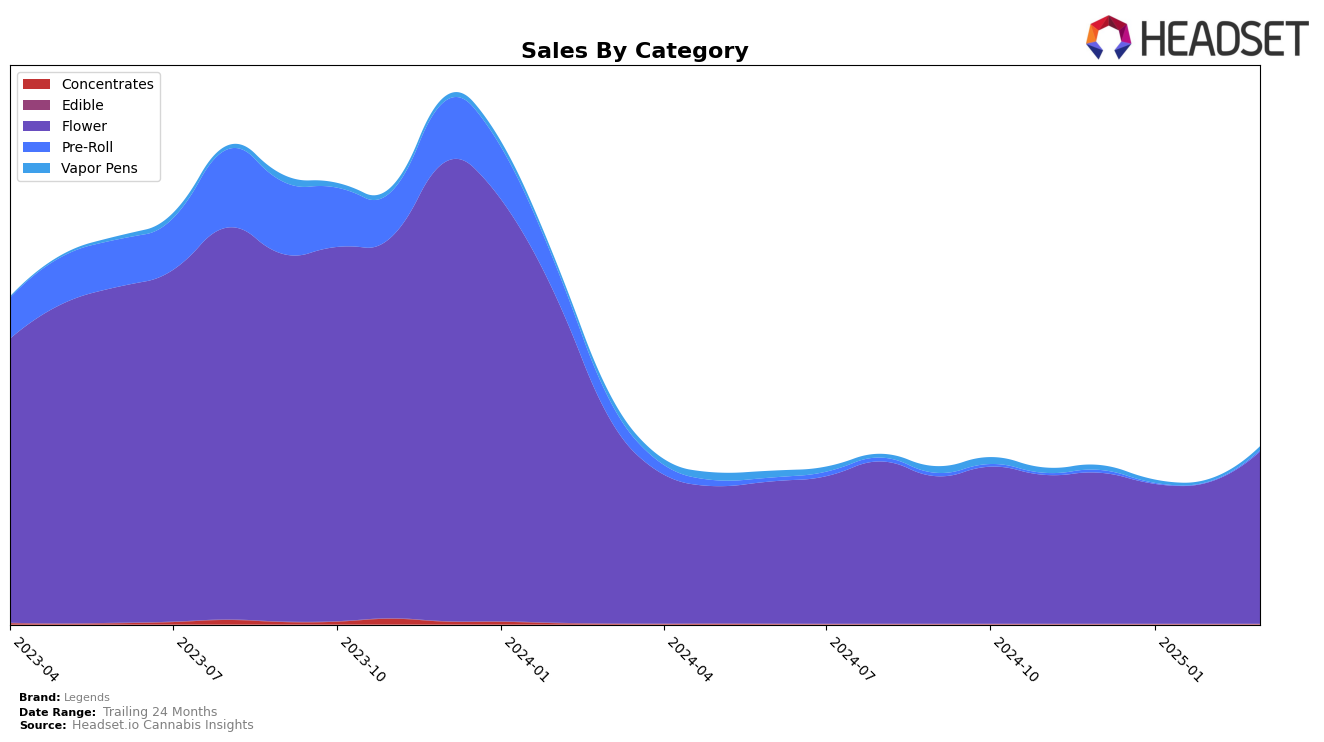

In the Arizona market, Legends has shown a consistent upward trend in the Flower category, moving from not being ranked in December 2024 to 55th place by March 2025. This steady climb suggests a growing acceptance and popularity of their products within the state. Similarly, in Illinois, Legends made a significant leap from being outside the top 30 to securing the 50th position by March 2025. This rapid ascent is indicative of a strong market penetration strategy or a shift in consumer preferences towards their offerings. However, the absence of ranking data for the Vapor Pens category in Oregon after December 2024 suggests that Legends is either not focusing on this category or facing stiff competition that has kept them out of the top 30.

In the Washington market, Legends has maintained a strong and consistent position, holding the 2nd rank in the Flower category from December 2024 through March 2025. This stable performance highlights the brand's strong foothold and consumer loyalty in the region. Despite fluctuations in sales figures, which are common in the industry, maintaining such a high rank indicates robust brand recognition and product quality. The performance across different states and categories reflects Legends' strategic focus and market adaptability, although there are areas, such as in Oregon's Vapor Pens, where further insights into their strategy or competitive landscape would be beneficial for a more comprehensive understanding.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Legends has maintained a consistent rank at number two from December 2024 through March 2025. Despite this stability, Legends faces stiff competition from Phat Panda, which has dominated the top position throughout the same period. Legends' sales figures have shown a positive trend, with a notable increase in March 2025, indicating a potential strengthening of its market position. Meanwhile, Artizen Cannabis and Redbird (formerly The Virginia Company) have fluctuated in their rankings, with Redbird showing a significant improvement in March 2025. These dynamics suggest that while Legends holds a strong position, the brand must continue to innovate and adapt to maintain its rank amidst competitors who are also vying for market share.

Notable Products

In March 2025, Washington Apple (3.5g) maintained its position as the top-selling product for Legends, with an impressive sales figure of 4271 units. Blue Dream (3.5g) climbed to the second position from third in February, showing a significant increase in popularity. Washington Apple (14g) rose to third place, up from fourth in February, demonstrating consistent demand. Washington Apple (7g) dropped from second to fourth place, indicating a slight decline in sales momentum. Super Boof (3.5g) held steady in fifth place, maintaining its rank from the previous month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.