Feb-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

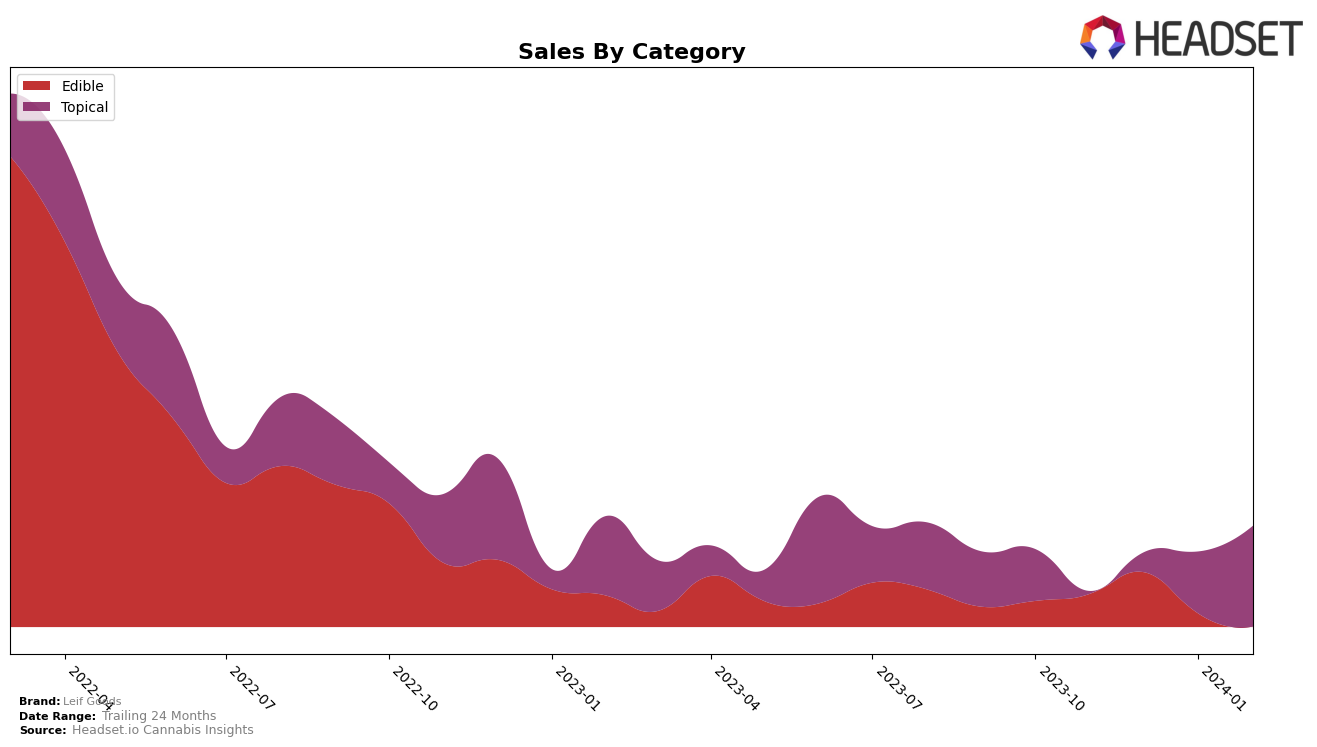

In the edible category, Leif Goods showed a fluctuating performance in the Oregon market over the observed period. Starting at rank 74 in November 2023, the brand managed to improve its position to rank 62 in December 2023, indicating a positive reception to its products during the holiday season, as reflected by a significant sales jump from 898 to 1484 units. However, this upward trend did not sustain into the new year, with the brand dropping to rank 71 in January 2024 and not making it into the top 20 in February 2024. This inconsistency in ranking highlights potential challenges in maintaining consumer interest or dealing with increased competition within the edible category.

Conversely, Leif Goods demonstrated remarkable growth in the topical category within the Oregon market. The brand was not ranked in the top 20 in November 2023, but it made a significant leap to rank 16 in December 2023 and further climbed to rank 10 in both January and February 2024. This impressive ascent is underscored by a substantial increase in sales, from 524 units in December 2023 to 2741 units in February 2024. The consistent top 10 ranking in the early months of 2024 suggests that Leif Goods has successfully captured and maintained a strong foothold in the topical category, showcasing the brand's ability to adapt and thrive in specific segments of the cannabis market.

Competitive Landscape

In the competitive landscape of the topical cannabis market in Oregon, Leif Goods has shown a notable upward trajectory in terms of rank and sales, starting from not being in the top 20 in November 2023, to securing the 10th position by February 2024. This growth is significant when compared to its competitors, such as Green Revolution, which saw a decline from 11th to not being in the top 20, and Buddies, which also experienced a drop in rank from 10th to 12th in the same period. On the other hand, Empower and Angel (OR) have maintained a relatively stable presence in the top 10, though not without fluctuations in their rankings. Leif Goods' significant rise in sales, from not being in the top 20 to achieving higher sales than competitors like Buddies by February 2024, indicates a strong market presence and consumer preference that could challenge the positions of established brands like Empower and Angel (OR) in the near future.

Notable Products

In February 2024, Physic Nude Balm (440mg THC,120mg CBD, 50g, 1.8oz) from Leif Goods topped the sales chart in the Topical category, maintaining its number one position from January with a notable increase in sales to 60.0 units. The CBD:THC 1:1 Mint Hibiscus Chocolate Bar, previously a strong contender in the Edible category, did not make the sales chart this month, indicating a significant shift in consumer preference or availability. CBD:THC Nude Balms Away (12mg CBD, 44mg CBD 0.18oz) also in the Topical category, showed a fluctuating presence in the sales ranking but did not appear in the top rankings for February. Junk - Tiger Blood x Cran Cherry x Cordyceps Functional Magic Gummies 10-Pack (100mg), once leading sales in the Edible category in November and December 2023, witnessed a decline, dropping off the top sales chart by February 2024. These shifts highlight changing consumer interests and possibly inventory adjustments within Leif Goods' product offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.