Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

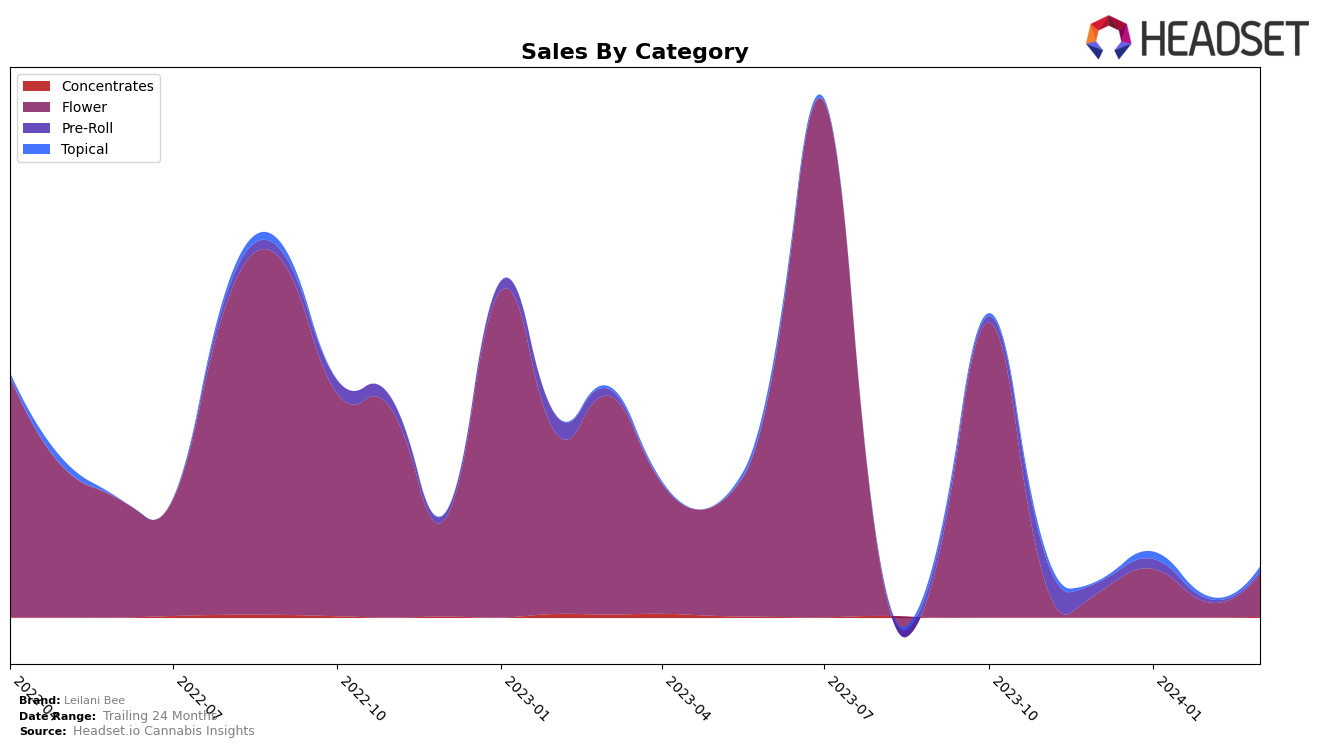

In the Topical category within Michigan, Leilani Bee has shown a fluctuating yet overall positive trajectory in its rankings over the recent months. Starting outside of the top 30 in December 2023, it made a significant leap to the 20th position by January 2024. This jump is noteworthy, considering the brand's sales more than quintupled from 344 units in December to 1,997 units in January. However, the following months saw a slight decline, with rankings dropping to 25th in February and settling at 24th in March. Despite these small setbacks, the upward movement from not being in the top 30 to maintaining a spot within it highlights a growing interest and potentially increasing market share for Leilani Bee in Michigan's topical cannabis category.

While the detailed performance of Leilani Bee across other states or provinces and categories remains unexplored in this snippet, the information provided about its performance in Michigan suggests a brand that is finding its footing and audience in a competitive market. The initial absence from the top 30 rankings in December 2023, followed by a noteworthy surge in January 2024, indicates a potentially effective strategy or campaign that significantly boosted its visibility and sales. The slight decline in rankings in the subsequent months could reflect normal market fluctuations or increased competition. Without more data across different time frames and categories, it's challenging to predict long-term trends, but the early 2024 performance in Michigan's topical category certainly paints a picture of a brand on the rise, making it one to watch for future developments.

Competitive Landscape

In the competitive landscape of the topical category in Michigan, Leilani Bee has shown a notable fluctuation in its market position from December 2023 to March 2024. Initially ranked 35th in December, it made a significant leap to 20th in January, demonstrating a strong increase in sales. However, it experienced a slight decline to 25th in February before stabilizing at 24th in March. This trajectory indicates a volatile yet overall positive trend in its market performance. Among its competitors, Lit Labs and CURE have also experienced fluctuations, with Lit Labs showing a more dramatic drop in rank from 19th in February to 25th in March, and CURE moving up to 23rd in March from lower ranks in the preceding months. Notably, Fatty's and Green DR have not consistently been in the top 20, indicating less direct competition with Leilani Bee. The data suggests that while Leilani Bee is navigating a competitive market with some volatility, it has managed to maintain an upward trajectory in rank, hinting at a resilient and potentially growing market presence amidst fierce competition.

Notable Products

In March 2024, Leilani Bee saw Crunchberry (3.5g) leading its sales with 134 units, making it the top-performing product of the month. Following closely was Crunchberry (7g) in second place, showing a notable improvement from its fifth position in February. The Why U Gelly Pre-Roll (1g) consistently performed well over the months, securing the third spot in March with 68 units sold, demonstrating stable demand. Truffle Pig (7g) also made a significant jump to the fourth rank, indicating a growing interest in this product category. Interestingly, Crunchberry (1g) entered the rankings at fifth place, highlighting the overall popularity of the Crunchberry line within Leilani Bee's offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.