Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

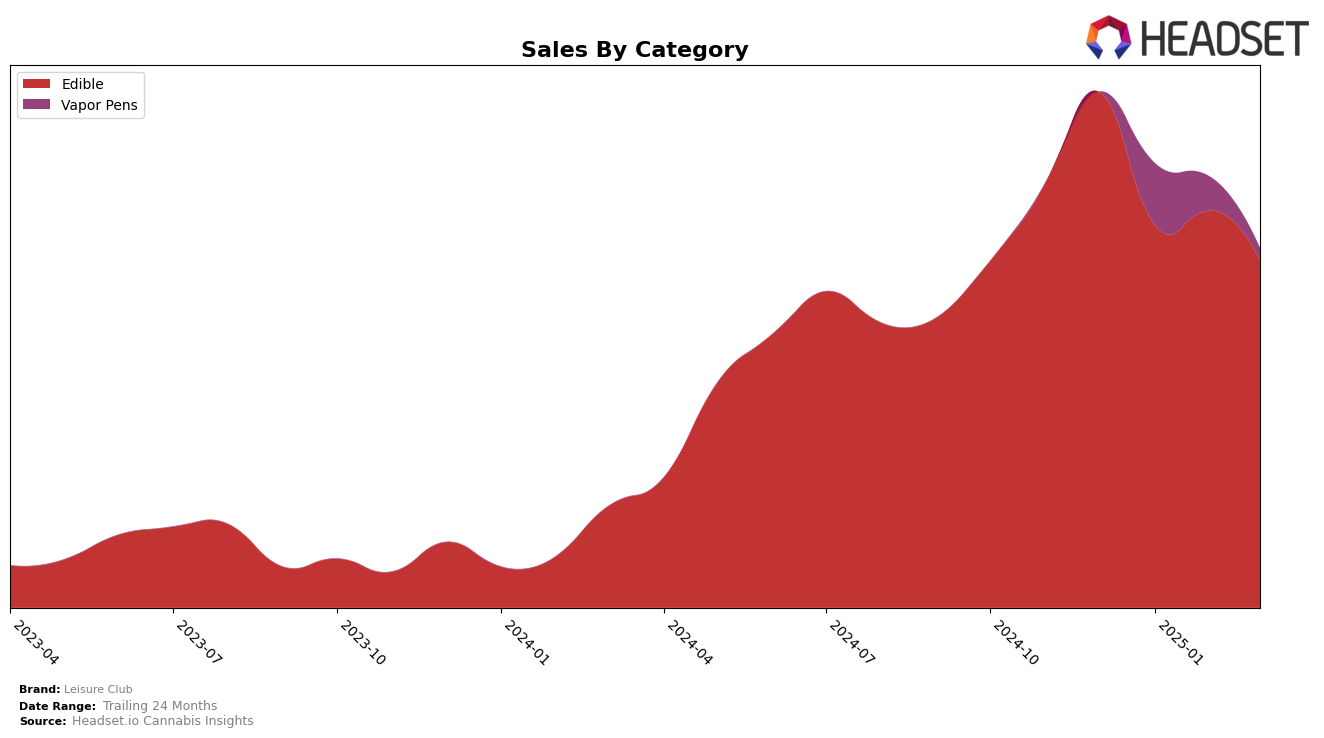

Leisure Club's performance across different categories and states/provinces demonstrates both stability and areas needing improvement. In the edible category within Alberta, Leisure Club maintained a consistent presence, ranking 8th in December 2024 and January 2025, before slightly dropping to 9th place in February and March 2025. This indicates a relatively stable market position, although a minor decline in sales was observed, with sales decreasing from 140,334 CAD in December 2024 to 104,715 CAD by March 2025. Meanwhile, in Saskatchewan, Leisure Club held steady in the 8th position for edibles from December 2024 through February 2025, but the absence of a March ranking suggests they may have fallen out of the top 30, which could be a cause for concern.

In the vapor pens category in Alberta, Leisure Club's performance highlights a different narrative. The brand did not rank within the top 30 in December 2024, which signifies a challenging market entry or competition. By January 2025, they entered the rankings at 73rd place, but by March 2025, they had dropped to 78th. This downward trend, coupled with the absence of sales data for March, suggests that they are struggling to gain a foothold in this category. The contrasting performance across categories and regions underscores the need for targeted strategies to bolster their market presence, particularly in the vapor pens category.

Competitive Landscape

In the Alberta edible market, Leisure Club has maintained a steady presence, consistently ranking 8th or 9th from December 2024 to March 2025. Despite a slight dip in sales from January to March, Leisure Club's rank remained stable, indicating a loyal customer base. Competitors such as Chowie Wowie and Olli have shown more dynamic movements, with Chowie Wowie holding a strong 6th position throughout and Olli making a significant climb from 18th to 7th. This suggests that while Leisure Club maintains a solid mid-tier position, there is increased competition from brands like Olli, which could impact Leisure Club's future market share if the trend continues. Meanwhile, San Rafael '71 experienced a decline, dropping from 10th to 12th, which might provide Leisure Club an opportunity to capitalize on shifting consumer preferences.

Notable Products

In March 2025, Leisure Club's top-performing product was Cherry Fizz Live Rosin Gummies 5-Pack (10mg), maintaining its first-place rank for four consecutive months with sales of 5525 units. Sour Peach Live Rosin Gummies 5-Pack (10mg) consistently held the second position, reflecting steady demand. Tropical Berry Live Rosin Gummies 5-Pack (10mg) and Sour Apple Live Rosin Gummies 5-Pack (10mg) also retained their third and fourth rankings, respectively, indicating stable consumer preferences. Notably, Sativa Sun Live Resin Cartridge (1g) entered the rankings in March, debuting at fifth place, suggesting a growing interest in vapor pens. This consistent ranking pattern across the top four products highlights a strong brand loyalty among consumers.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.