Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

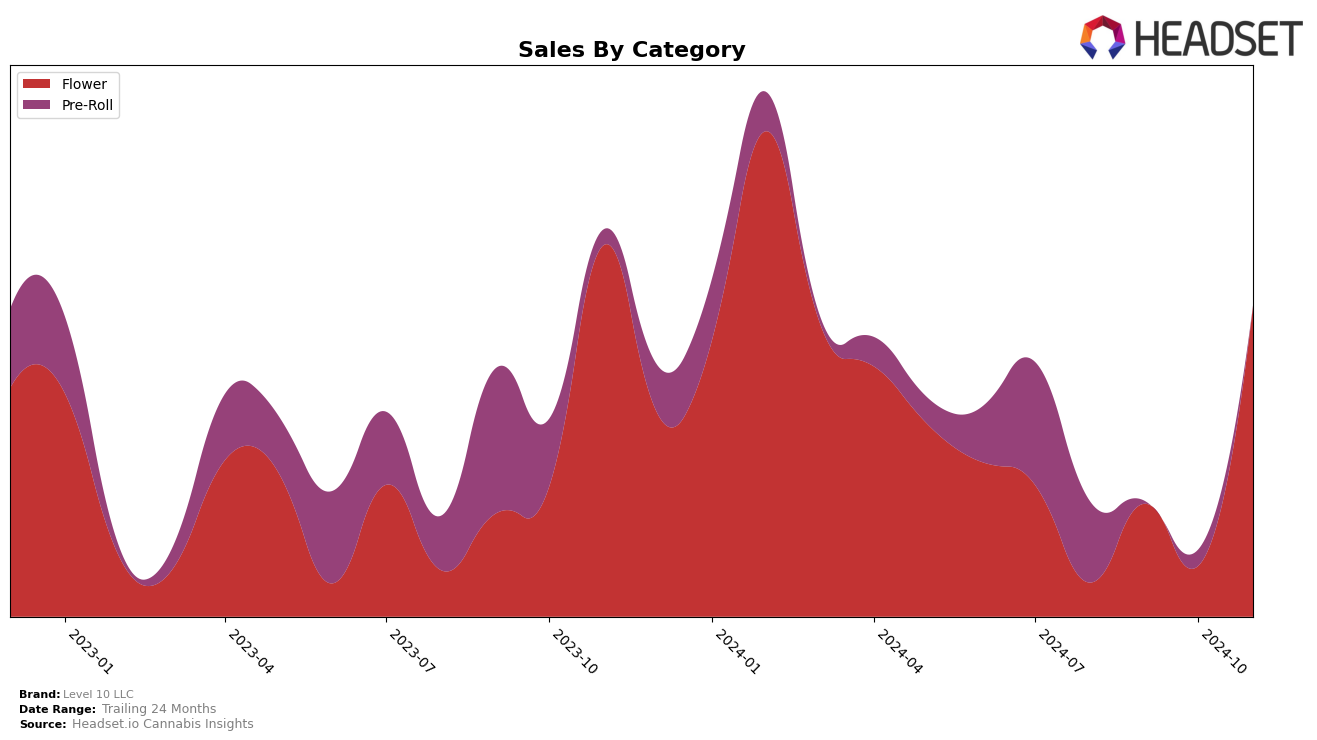

Level 10 LLC has shown notable performance shifts across different categories and states, particularly in Colorado. In the Flower category, the brand has made a significant leap from not being in the top 30 in previous months to securing the 29th position by November 2024. This indicates a strong upward trend and suggests effective strategies or market changes that have positively impacted their standing. On the other hand, their performance in the Pre-Roll category has been more volatile, with rankings fluctuating between 41st and 57th over the months. Despite this, they have managed to maintain a presence close to the top 50, which could be seen as a stable foothold in a competitive market.

While Level 10 LLC's Flower category experienced a dramatic improvement in rankings, their sales figures also reflect this upward trajectory, with a substantial increase recorded in November 2024. This could imply successful product launches or increased consumer demand. In contrast, the Pre-Roll category did not see a similar boost, with sales figures showing a slight decline from August to November. The absence from the top 30 in both categories during several months highlights areas for potential growth and market penetration. The fluctuations in rankings and sales across these categories provide a glimpse into the brand's current market dynamics and potential areas for strategic focus.

Competitive Landscape

In the competitive landscape of the flower category in Colorado, Level 10 LLC has shown a remarkable improvement in its market position, particularly from October to November 2024. Initially ranked at 83rd in August, Level 10 LLC climbed to 29th by November, indicating a significant upward trajectory. This improvement is noteworthy when compared to competitors such as Natty Rems, which maintained a relatively stable rank, fluctuating between 26th and 43rd, and Rocky Mountain High, which experienced a decline from 25th to 37th. Despite the competition, Level 10 LLC's sales surged in November, surpassing brands like Rocky Mountain High, which saw a decrease in sales. Additionally, Clarity Gardens and Melody Genetics also saw fluctuations in their rankings, but neither matched the rapid ascent of Level 10 LLC. This data suggests that Level 10 LLC is gaining traction and increasing its market share, potentially due to strategic marketing efforts or product innovations that resonate with consumers in Colorado.

Notable Products

In November 2024, the top-performing product for Level 10 LLC was Trop Cherries Small Buds (Bulk) in the Flower category, securing the first rank with sales of 6816. Mac Small Buds (Bulk) followed closely in second place, demonstrating a strong performance with a slight increase in rank compared to previous months. Georgia Pie Small (Bulk) and High Fructose Corn Syrup (Bulk) occupied the third and fourth positions, respectively, both maintaining consistent sales figures. Notably, Georgia Pie (Bulk) experienced a drop from fourth place in September to fifth in November, indicating a shift in consumer preference within the category. Overall, the rankings reflect a stable demand for small bud products, with minor fluctuations in sales performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.