Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

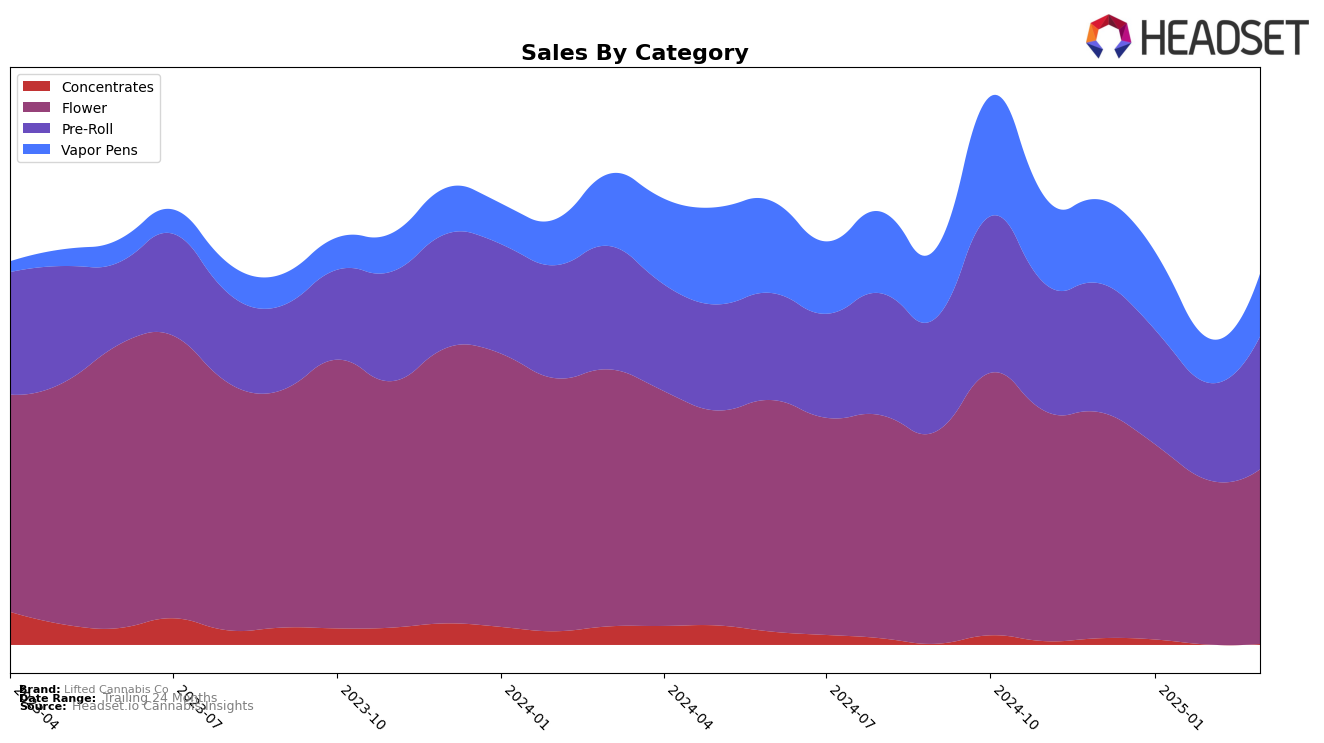

Lifted Cannabis Co has shown varied performance across different product categories in the state of Washington. In the Concentrates category, the brand saw a slight improvement in its ranking from December 2024 to January 2025, moving from 27th to 24th place. However, it slipped out of the top 30 in February 2025, only to regain a spot at 30th in March 2025. This fluctuation in ranking is mirrored by a decline in sales during this period, indicating a potential challenge in maintaining a strong foothold in this category. Meanwhile, Lifted Cannabis Co's performance in the Vapor Pens category also reflects some volatility, with rankings oscillating between 21st and 29th place over the four months, suggesting that the brand is facing stiff competition.

Conversely, Lifted Cannabis Co has maintained a relatively strong position in the Flower and Pre-Roll categories in Washington. The brand consistently held a top-five ranking in Flower, although it experienced a slight decline from 3rd to 5th place by March 2025. Despite this, sales in the Pre-Roll category showed a positive trend, with the brand climbing back to the 5th position in March 2025 after a temporary dip to 7th place earlier in the year. This demonstrates Lifted Cannabis Co's resilience and ability to capitalize on consumer demand in these categories, even as overall sales figures saw some fluctuations. Such trends highlight the importance of strategic focus and adaptation in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Washington, Lifted Cannabis Co has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially holding a strong rank of 3rd, Lifted Cannabis Co saw a slight decline to 5th by March 2025. This shift is particularly significant when compared to competitors like Artizen Cannabis, which maintained a consistent presence in the top 5, and WA Grower, which briefly climbed to 3rd in February before dropping to 6th in March. Meanwhile, Redbird (formerly The Virginia Company) demonstrated a strong recovery from 8th in February to 4th in March, indicating a potential threat to Lifted Cannabis Co's market share. Despite these competitive pressures, Lifted Cannabis Co's sales remained robust, although they experienced a downward trend over the months, suggesting a need for strategic adjustments to regain and maintain a higher rank in this dynamic market.

Notable Products

In March 2025, the top-performing product for Lifted Cannabis Co was the Sugar Stix- Wedding Cake THCa Infused Pre-Roll (1g), which took the first place with impressive sales of $6,783. The Wedding Cake (3.5g) Flower, previously holding the top spot, moved to second place. The Coffee Creamer Pre-Roll (1g) maintained a steady presence, ranking third, while the Wedding Cake Pre-Roll (1g) debuted in fourth place. Notably, the SugarStix - Permanent Marker Infused Pre-Roll (1g) entered the rankings at fifth place. This month saw a significant reshuffling, with the Sugar Stix- Wedding Cake THCa Infused Pre-Roll climbing from a second place in February to the top spot in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.