Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

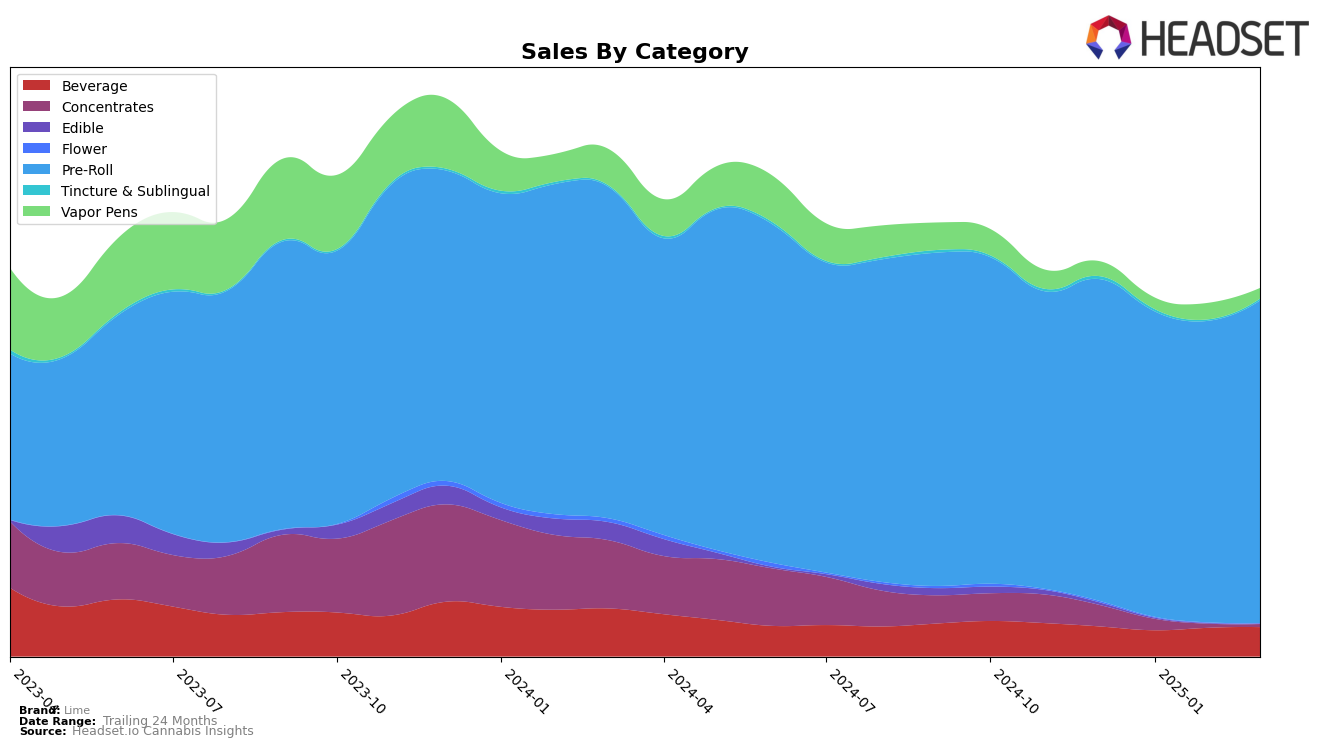

In California, Lime has shown consistent performance in the Beverage category, maintaining a steady 10th place rank from December 2024 through March 2025. This stability suggests a solid foothold in the market, despite a slight dip in sales in January 2025. Interestingly, Lime's presence in the Concentrates category has diminished, dropping from a rank of 44 in December 2024 to 66 in January 2025, and then failing to appear in the top 30 in subsequent months. This decline could indicate a shifting focus or increased competition in this category. In contrast, the Pre-Roll category tells a different story, with Lime consistently holding a top 10 position, improving slightly to 8th place in February before returning to 9th in March 2025. This suggests strong consumer loyalty and effective brand strategies in the Pre-Roll segment.

While the Beverage and Pre-Roll categories demonstrate Lime's robust market presence in California, the absence from the top 30 in the Concentrates category after January 2025 is noteworthy. This absence could be perceived as a challenge for the brand, potentially pointing to areas where Lime might need to innovate or invest more to regain its competitive edge. The Pre-Roll category, with its consistent high rankings, might offer insights into successful strategies that could be leveraged across other categories. The brand's ability to maintain a strong position in the Beverage category, despite fluctuations in sales, also highlights resilience and perhaps a loyal customer base. These dynamics across different product categories provide a snapshot of Lime's current market strategies and potential areas for growth.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in California, Lime has maintained a relatively stable position, consistently ranking around the 9th spot from December 2024 to March 2025. This stability contrasts with the more volatile rankings of competitors like Kingpen, which fluctuated between 5th and 9th place, and Quickies Prerolls, which improved significantly from 19th to 10th place over the same period. Despite a slight dip in sales in January, Lime's sales figures rebounded by March, suggesting resilience in its market position. Meanwhile, Sluggers Hit experienced a decline in rank from 5th to 8th, indicating potential opportunities for Lime to capture more market share if this trend continues. The data suggests that while Lime remains a strong contender, it faces stiff competition from brands that are either gaining momentum or experiencing fluctuations, highlighting the need for strategic marketing efforts to bolster its standing.

Notable Products

In March 2025, Lime's top-performing product was the Hybrid Blend Pre-Roll (1g), maintaining its first-place ranking for three consecutive months with sales of 3,852 units. The Indica Blend Pre-Roll (1g) consistently held the second position from December 2024 through March 2025, with a slight dip in sales to 3,502 units. Notably, the Lil Limes - Maui Wowie Live Resin Hash Infused Pre-Roll 5-Pack (3g) entered the rankings at third place with impressive sales, followed closely by the Gushers Infused Pre-Roll (1.75g) in fourth. The Premium Sativa Pre-Roll (1g) dropped to fifth place from its previous fourth-place ranking in January 2025. Overall, Lime's pre-rolls continue to dominate the sales charts, with stable rankings and strong sales figures across the board.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.