Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

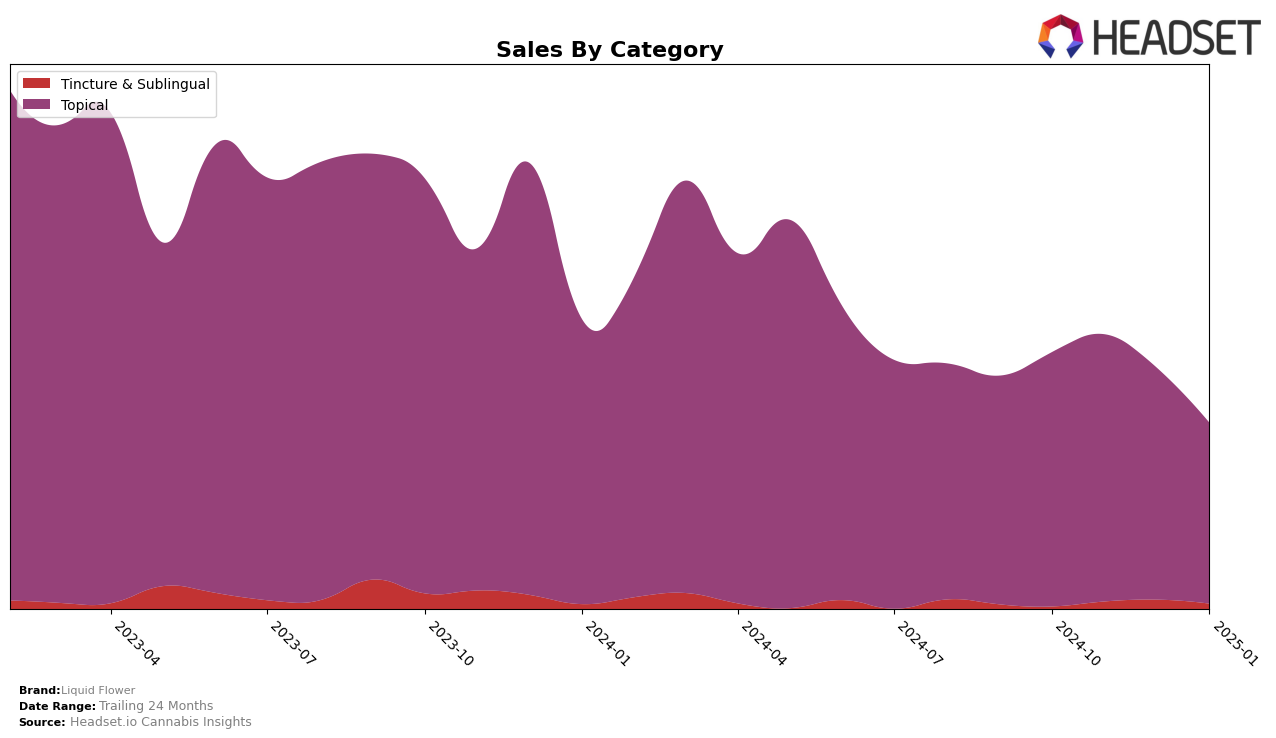

Liquid Flower has demonstrated a consistent presence in the topical category within California, maintaining a position within the top 10 brands over the past few months. Starting at rank 7 in October 2024, the brand improved slightly to rank 6 in November 2024 before settling back to rank 8 in both December 2024 and January 2025. Despite this minor fluctuation in ranking, it's noteworthy that Liquid Flower has managed to remain a significant player in the market, suggesting a steady consumer base and product appeal. However, the sales figures show a downward trend from November 2024 to January 2025, which could indicate seasonal variations or increased competition affecting their market share.

Interestingly, Liquid Flower's absence from the top 30 in other states or categories could be interpreted in multiple ways. It might highlight the brand's strategic focus on the California market, where it has established a strong foothold, or it could suggest potential areas for expansion if the brand aims to diversify its market presence. The lack of rankings in other regions could also point to the challenges of scaling operations or adapting products to different consumer preferences. Such insights could be crucial for stakeholders looking to understand the brand's performance dynamics and potential growth opportunities.

Competitive Landscape

In the competitive landscape of the California topical cannabis market, Liquid Flower has experienced notable fluctuations in its ranking and sales performance over the past few months. From October 2024 to January 2025, Liquid Flower's rank shifted from 7th to 6th, before settling back to 8th place. This movement indicates a competitive struggle amidst strong contenders. For instance, Care By Design consistently maintained a higher rank, holding steady at 5th and 6th positions, suggesting a robust market presence. Meanwhile, Kush Queen showed a positive trajectory, improving its rank from 8th to 7th, which may have contributed to the pressure on Liquid Flower. Despite these challenges, Liquid Flower's sales figures reveal resilience, with a peak in November 2024, although a decline was observed by January 2025. This competitive analysis highlights the dynamic nature of the market and underscores the importance for Liquid Flower to strategize effectively to regain and sustain higher rankings.

Notable Products

In January 2025, the top-performing product for Liquid Flower was the Deep Relief Topical (38mg THC, 1mg CBG, 4.5mg CBD, 5ml), maintaining its first-place rank from the previous months with sales reaching 414 units. The Deep Relief Balm (40mg CBD, 40mg CBDa, 400mg THC, 400mg THCa, 59ml, 2oz) held steady in second place, although its sales decreased to 308 units. The CBD/THC Original Topical Relief Balm (20mg CBD, 180mg THC, 59ml) rose to third place from a consistent fourth in the previous months, showing a notable increase in sales to 180 units. The Deep Relief Stick (17mg CBD, 93mg THCa, 88mg THC, 15ml) dropped to fourth place, experiencing a decline in sales to 127 units. A new entry, Deep Relief Balm (250mg THC, 2oz), debuted at fifth place with sales of 62 units, indicating potential growth in the coming months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.