Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

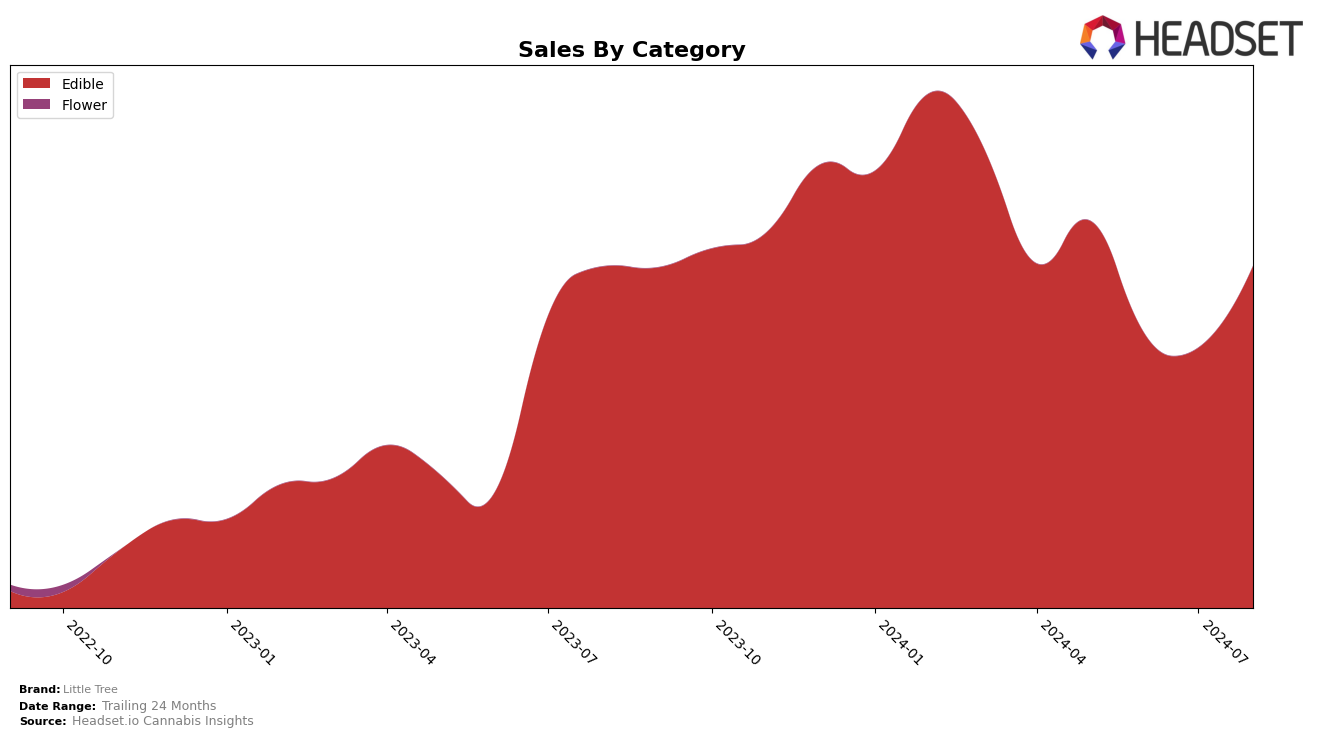

Little Tree has experienced notable fluctuations in their performance across different categories and states throughout the summer. In Michigan, their ranking in the Edible category saw a dip from 16th place in May to 25th in July, before rebounding to 18th in August. This indicates a volatile but resilient presence in the market. The brand's sales followed a similar pattern, with a significant drop from May to June, but a recovery in August, illustrating their ability to bounce back from mid-year challenges.

Interestingly, Little Tree did not appear in the top 30 brands in any other states or categories during this period, which could be seen as a limitation in their market reach or an area for potential growth. The absence from top rankings outside of Michigan may highlight a need for strategic expansion or increased marketing efforts in other regions. The brand's performance in Michigan, especially their ability to recover rankings and sales, suggests a strong local foothold that could be leveraged for broader success.

Competitive Landscape

In the competitive landscape of Michigan's edible cannabis market, Little Tree has experienced notable fluctuations in rank and sales over the past few months. Starting at rank 16 in May 2024, Little Tree saw a decline to rank 23 in June and further to rank 25 in July, before recovering to rank 18 in August. This volatility contrasts with the more stable performance of competitors like Cannalicious Labs, which improved from rank 19 in May to 15 in July before a slight dip to 16 in August, and Mischief, which climbed from rank 26 in May to 17 in August. Meanwhile, Mitten Extracts and Shattered Thoughts have shown mixed performance, with Mitten Extracts re-entering the top 20 in August at rank 19 and Shattered Thoughts maintaining a relatively stable presence around the 20th rank. These shifts highlight the competitive pressures and dynamic nature of the market, suggesting that while Little Tree has faced challenges, there is potential for recovery and growth if they can capitalize on market trends and consumer preferences.

Notable Products

In August 2024, the top-performing product for Little Tree was Red Razz Live Resin Gummies 10-Pack (200mg), with a notable sales figure of 17,642 units. This product reclaimed the top spot from Pineapple Live Resin Gummies 10-Pack (200mg), which fell to second place with consistent performance. Grape Live Resin Gummies 10-Pack (200mg) climbed to third place, showing a steady increase in sales. Cherry Gummies 10-Pack (200mg) maintained its position in fourth place, while Blue Razz Hash Rosin Gummies 10-Pack (200mg) remained in fifth place. Overall, Red Razz Live Resin Gummies showed the most significant improvement, jumping from second to first place, while the other products showed minor fluctuations in their rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.