Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

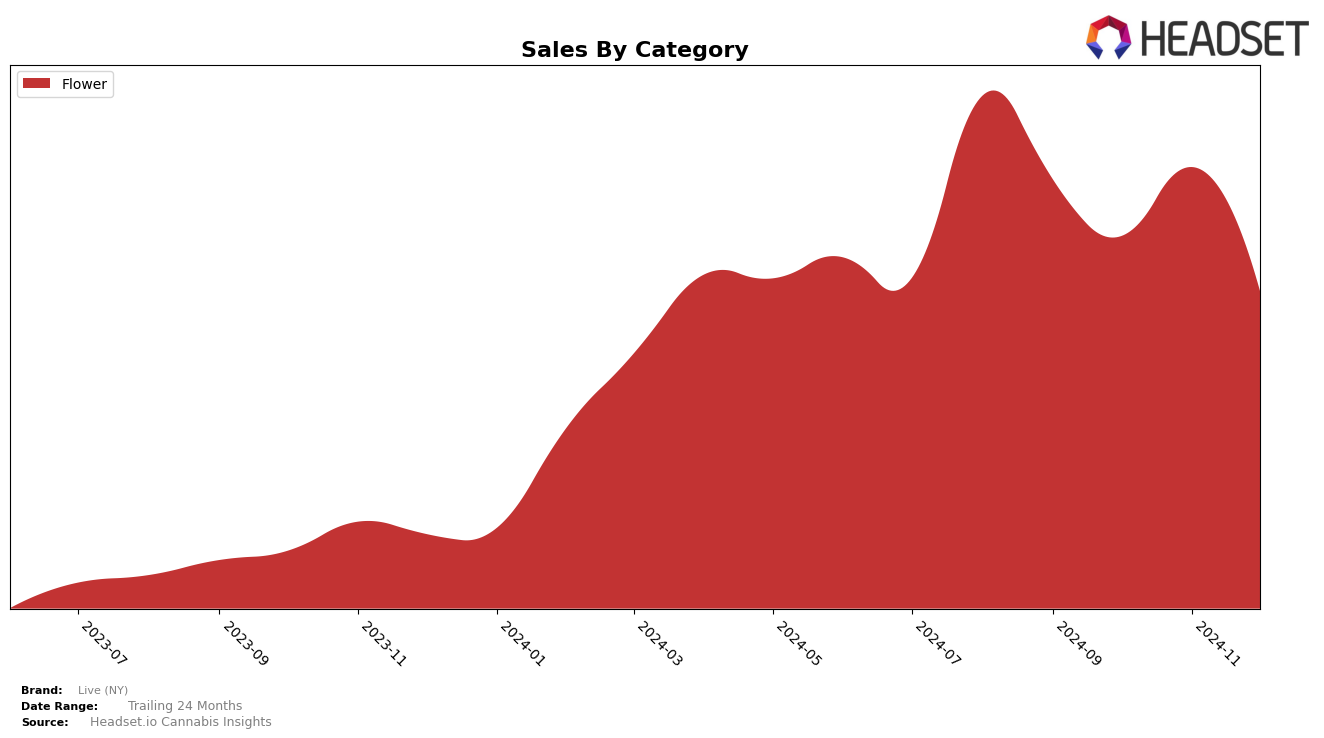

Live (NY) has demonstrated fluctuating performance in the Flower category across the state of New York. Over the last few months of 2024, the brand experienced a noticeable dip in its rankings, moving from 20th position in September to 28th by December. This decline in rank suggests a competitive landscape in the New York market, where maintaining a top position is challenging. Despite a brief recovery in November, where sales peaked, the brand's overall downward trend in December highlights potential challenges in sustaining consumer interest or facing stronger competition.

Interestingly, the brand's sales figures reflect a similar pattern, with a significant increase in November, which suggests a successful marketing or promotional strategy that month. However, the drop in both rank and sales by December indicates that these efforts might not have had a lasting impact. The absence of Live (NY) in the top 30 brands in other states or categories could imply a focus on the New York market, or it might suggest opportunities for expansion and growth beyond the current geographical and product boundaries. This strategic focus might be beneficial for the brand to consider as it plans its future moves in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Live (NY) has experienced notable fluctuations in its ranking over the last few months of 2024. Starting in September, Live (NY) held the 20th position, but by December, it had slipped to 28th. This decline in rank suggests a challenging competitive environment, particularly as brands like Ithaca Organics Cannabis Co. have shown significant upward momentum, climbing from 50th in September to 30th in December. Meanwhile, Gypsy Weed has also improved its standing, moving from 52nd to 27th, indicating a robust increase in sales performance. Despite Live (NY)'s strong sales in November, which were higher than those of Zizzle, the brand's overall downward trend in rank suggests a need for strategic adjustments to regain its competitive edge in the New York market.

Notable Products

In December 2024, the top-performing product for Live (NY) was Cake Mints (3.5g) in the Flower category, maintaining its first-place rank from November. Vanilla Frosting (3.5g) rose from fifth to second place, showing a significant increase in sales to 958 units. Vanilla Frosting (7g) dropped slightly from second to third place, while Vanilla Frosting (14g) entered the rankings at fourth place. Apple Jax (3.5g) experienced a decline, moving from second in November to fifth in December, with sales decreasing to 677 units. The shift in rankings highlights Vanilla Frosting's growing popularity, while Cake Mints solidifies its position at the top.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.