Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

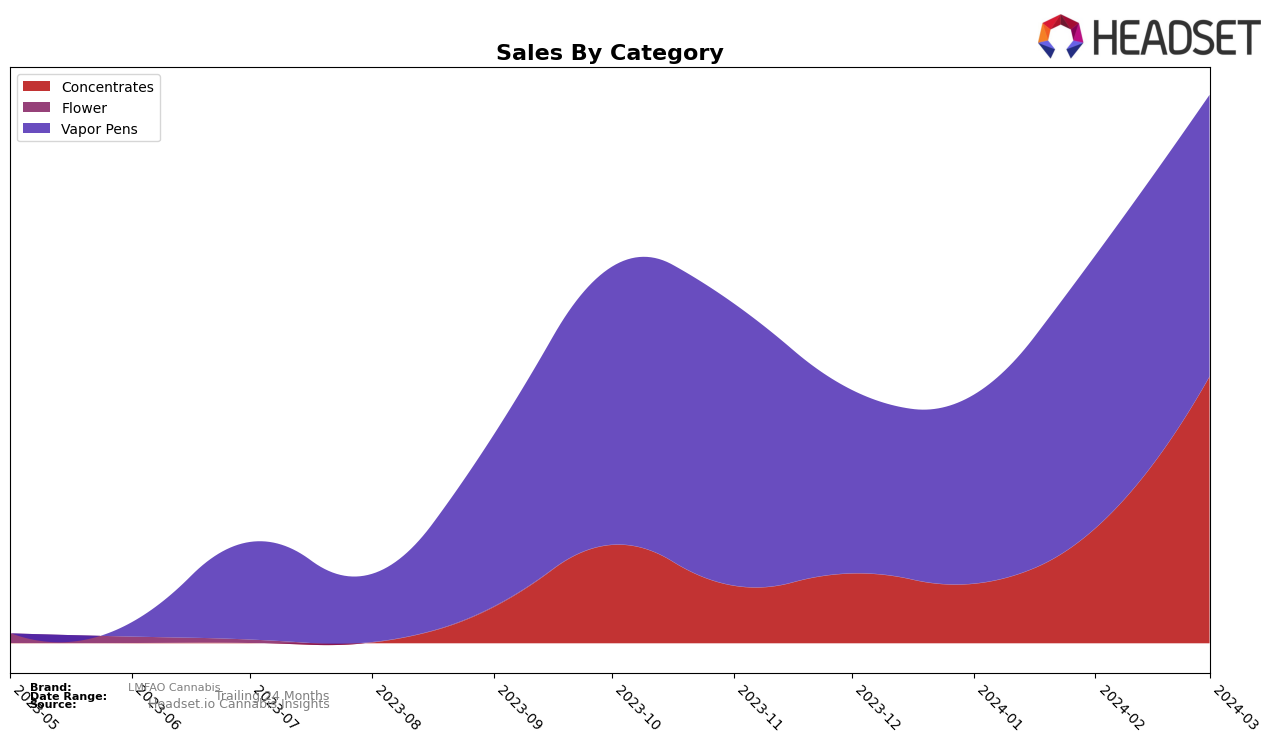

In the competitive cannabis market of California, LMFAO Cannabis has shown a notable performance across different categories, particularly in Concentrates and Vapor Pens. For Concentrates, the brand experienced a significant improvement in rankings, moving from 59th in December 2023 to 16th by March 2024. This leap in rankings is indicative of a growing consumer preference and an effective strategy in capturing market share. The sales figures support this upward trajectory, with a remarkable increase from $64,392 in December 2023 to $246,862 by March 2024, showcasing a strong consumer demand for their Concentrate products. However, the initial rank outside the top 30 earlier in the year suggests there was considerable ground to make up, which they have commendably achieved in a short span.

On the other hand, the Vapor Pens category tells a slightly different story for LMFAO Cannabis. Despite being a popular product category, the brand's rankings within this segment have seen less dramatic movement, hovering between the 74th position in December 2023 and improving slightly to the 56th position by March 2024. While this does indicate positive momentum, the change is not as pronounced as seen in the Concentrates category. Sales in the Vapor Pens category have consistently grown, from $169,872 in December 2023 to $260,841 in March 2024, suggesting a steady but slower pace of growth compared to Concentrates. This performance highlights the challenges and competitive nature of the Vapor Pens market in California, suggesting that while LMFAO Cannabis is growing, there's a different set of dynamics at play compared to their success in the Concentrates category.

Competitive Landscape

In the competitive landscape of the Vapor Pens category in California, LMFAO Cannabis has shown a notable upward trajectory in rank and sales from December 2023 to March 2024. Starting at rank 74 in December, it climbed to rank 56 by March, demonstrating a significant improvement in its market position. This rise is particularly impressive when compared to competitors such as Flav, which saw a fluctuation in rank but ended at a lower position in March than LMFAO Cannabis. Similarly, 710 Labs maintained a stable rank around the 50s but did not show the same upward momentum. Zips and Ole'4 Fingers also experienced rank fluctuations, with Zips ending slightly ahead of LMFAO Cannabis in March. Despite these competitive dynamics, LMFAO Cannabis's sales growth and rank improvement indicate a strong upward trend and resilience in a competitive market, suggesting a growing consumer preference and market share within the Vapor Pens category in California.

Notable Products

In March 2024, LMFAO Cannabis saw Fatso Wax (1g) from the Concentrates category as its top-performing product, with sales reaching 3361 units. Following closely were Blue Gummies Sugar Wax (1g) and Cherry Zonut Batter (1g), ranked second and third respectively, indicating a strong preference for Concentrates among consumers. Pave Cream Live Resin Batter (1g) secured the fourth position, while Gas Tanker Distillate Cartridge (1g) from the Vapor Pens category broke into the top five, highlighting a slight diversification in consumer choices. Notably, these rankings represent a fresh lineup as there were no previous sales data for these products from December 2023 to February 2024, suggesting a successful introduction of new products or a shift in consumer preferences. This change underscores the dynamic nature of the market and LMFAO Cannabis's ability to adapt and capture consumer interest with its latest offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.